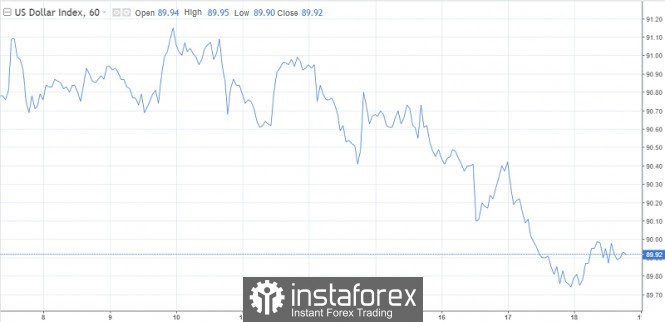

Markets periodically show neutrality or signs of an incipient downside movement, but risk appetite remains strong. At the end of the week, stock prices continue to rise, while safe assets such as the US dollar and the Japanese yen are declining in value. Although at the beginning of trading on Friday, the greenback made attempts to recover in relation to a basket of six main competitors. So far, nothing has come of it. The USD index fell to new annual lows and continues to consolidate there. It was pushed to lower levels not only by falling demand for safe haven but also by weak macroeconomic data from the US. A portion of the statistics, which was published on Thursday, increased the pressure on the dollar.

Markets are waiting day after day on a new package of support measures for the economy. A milestone event can happen at the end of this week or the beginning of the next. Georgia's elections and control of the Senate are powerful motivators. In addition, Mitch McConnell and Nancy Pelosi urge lawmakers not to leave Washington. Although $900 billion is not the number that many, including market players, would like to see, it is better than being complete without support. In addition, from the allocated amount, it is planned to direct more funds to pay unemployment benefits, subsidize rent, and funds for paying salaries for businesses.

The information background contributes to the further downward dynamics of the dollar. The USD index is targeting 88.2.

Risky sentiment is fueled by growing confidence in a trade deal between the EU and the UK. Despite the contradictory statements on both sides, and especially the pessimism of Boris Johnson, the bet is on a favorable Brexit scenario.

The meeting of the Bank of England went almost unnoticed for the pound. There is no point in changing or declaring a couple of weeks before the Brexit deadline. Pound traders today are focused on retail sales. The November lockdown was expected to result in a 4.2% price cut. Nevertheless, the indicator was not so pessimistic. Retail, of course, sank, but by a smaller amount by 3.8%.

The pound lost its earlier gains, and now there is a struggle for the 1.35 mark. Its further dynamics will depend on the Brexit rhetoric. When can we expect a deal, maybe by Christmas or earlier?

European Union chief negotiator Michel Barnier, on Friday, warned that only a few hours were left before a possible Brexit trade deal was reached and he had nothing good to say about it. The road to an agreement is "very narrow," Barnier said. The pound wavered on this information.

"The latest comments raise some doubts in the markets, but the majority still consider the deal very likely," analysts comment on the situation.

According to the Smarkets betting exchange, the chances of making a deal dropped to 70%, while at the beginning of the week they reached 80%. At the same time, last week at a separate stage they were less than 50%.

Most market strategists are leaning towards the fact that the deal will be announced at the very last minute. It does not matter at all what statements or comments will precede this moment. Immediately after the announcement of the deal, the GBP / USD pair, given the general weakness of the dollar, will try to rise to 1.4000, or even the high of the beginning of 2018 at 1.4300. It is unlikely that it will be possible to stay at these marks. In the medium to long term, the ceiling for the pound could be much lower. The fact is that Great Britain has similar structural problems with the United States, we are talking about a huge foreign trade deficit. But here we must admit that the starting point of the pound is much lower than that of the dollar.

If we go back to the present, then from a technical point of view, after a long torment, the pound has taken the resistance level of 1.333. However, even this mark is very fragile, since sterling is highly dependent on the news background for the trade.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română