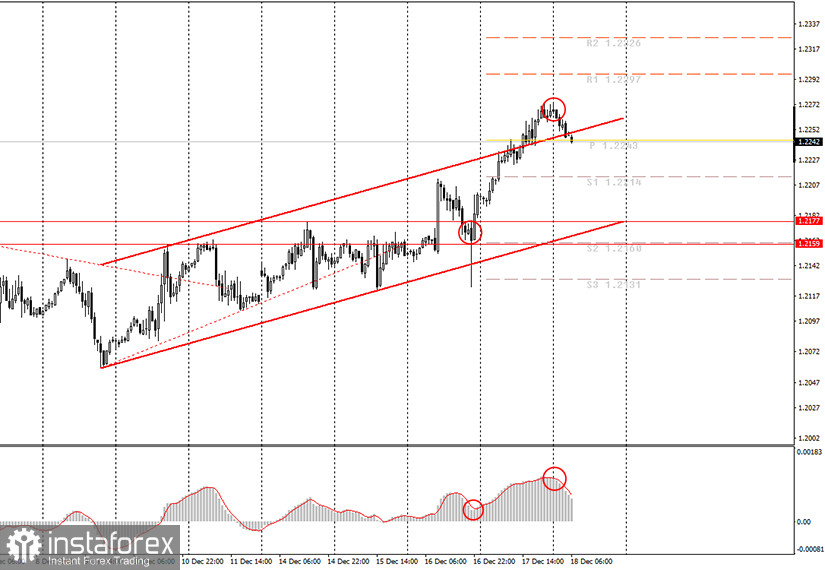

Hourly chart of the EUR/USD pair

Yesterday, the EUR/USD pair continued to trade in exactly the same way it did at the beginning of the week. That is, it continued its upward movement. We have already repeatedly raised the question of why the euro is rising (and with it the pound), or rather, why is the dollar falling? We have repeatedly tried to understand this issue, but the most likely answer can only be speculative growth. Simply put, the euro grows simply because it is being bought, and the dollar is getting cheaper simply because it is being sold. Traders are not paying attention to fundamental news or macroeconomic reports right now. They just buy pounds and euros. This results in both currencies being overbought and also inflates a bubble (oil rising to $140 per barrel). Sooner or later, the bubble will burst. But at the same time, it can inflate as much as necessary. The last signal, which was at the disposal of novice traders - a buy signal, is encircled in the first circle. It was possible to keep it open up to the 1.2267 level, where the MACD has already turned down. The rising channel kept the upward trend in action, so the trade should have been bullish. Even if novice traders left open deals near target levels, it is still good, since there is profit.

The European Union published its inflation report for November. As analysts expected, the consumer price index remained unchanged in annual terms -0.3% and slowed down to -0.3% in monthly terms. And so one of the most important indicators of the state of any economy in the EU is negative and this is bad (yes, oddly enough, negative inflation is bad for the economy). However, the euro did not pay any attention to this report. Meanwhile, the US released a report on initial claims for unemployment benefits, which has been growing for several consecutive days, warning of a possible increase in the unemployment rate. Their total number was 885,000. The number of repeated ones continues to fall - 5.5 million.

There are no major releases scheduled for today in the EU and the US. However, markets continue to virtually ignore all macroeconomic data anyway, so what's the difference? We do not even have any important topics that could create a background for the dollar and the euro. The US is discussing a package of new stimulus measures in Congress, but what is the point of talking about it now if it has been discussed back in August?

Possible scenarios for December 18:

1) Long positions are still relevant at the moment, as an upward trend is visible. However, at the moment, the pair has begun to correct, so you need to wait until the correction has ended, the MACD indicator will discharge to the zero level and only after that should you wait for a new buy signal if the price remains inside the upward channel.

2) Trading for a fall looks absolutely inappropriate now, since the upward trend is clearly visible. Thus, sellers need to wait for either the upward trend to end, or a downward trend to appear, and only then should you consider the possibilities of opening short deals. The most likely signal will be when the price settles below the current rising channel.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română