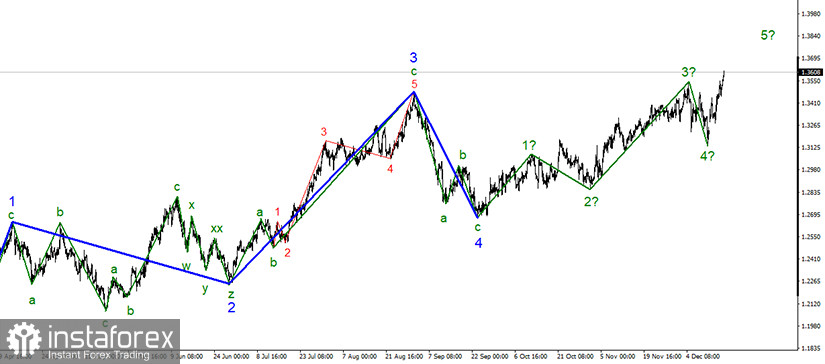

A successful attempt to break through the high of the previous wave brought significant changes to the entire wave layout. Now the part of the trend, which started to form on September 23, has finally turned into a five-wave pattern. At the moment, the 5 in 5 wave continues its formation. If this is true, then the pair is about to finish its uptrend. At the same time, if the demand for the US currency stays subdued, the wave structure may become more complex.

On a smaller time frame, we can clearly see three corrective waves in the proposed 4 wave of the upward section of the trend. Three waves have been formed within the 5 wave structure, so at least 2 more waves should be built. If the current wave marking is correct, then the price will continue to rise approaching the 38 area after a slight pullback from the previous high.

It is already December 17, but both the UK and EU negotiators have not made any statement yet. The trade negotiations continue, and we occasionally receive the news that the parties are close to finding a consensus. However, this kind of news has been repeated over time. Then, some UK or EU officials state that substantial differences remain. This means that the parties do not want to reveal the fact that there is either some progress or there is no progress at all. Nevertheless, market participants still hope for a trade deal. The logic is simple here: if negotiations continue, then the parties are still moving forward. If there is no progress, then why would the talks continue? I am less optimistic about this. At the same time, the wave layout has already changed its structure. Besides, only two weeks are left before the New Year and the end of the transition period. Therefore, we should wait and see what happens next.

The Bank of England left its monetary policy unchanged during its meeting on Thursday. All nine members of the monetary committee voted to keep the key rate at the current level. Thus, if the regulator decides to introduce negative rates, it will happen in 2021. This decision will largely depend on the outcome of the trade talks. Also, the UK regulator notes that the successful trial of several vaccines and the launch of vaccination programs in some countries reduce economic risks. At the same time, the regulator believes that the prospects for the UK economy remain highly uncertain. It is still too early to claim victory over the coronavirus pandemic. Thus, neither the Fed nor the Bank of England has made any crucial decisions by the end of 2020.

Conclusion and trading tips

The GBP/USD pair resumed the development of the uptrend. Thus, I recommend buying the instrument after every buy signal of the MACD indicator with the targets located near the levels of 1.3647 and 1.3788, which correspond to 127.2% and 161.8% Fibonacci. At the same time, even within a new wave pattern, the ascending section of the trend is about to complete soon.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română