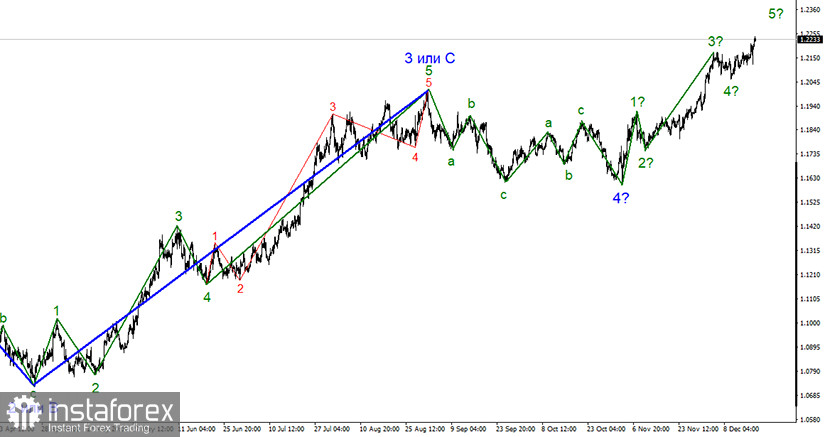

The wave analysis of the EUR/USD pair indicates the formation of an upward trend. If the pair is able to hit the high of the wave, it is likely to resume the upward momentum. Thus, the upward trend, which started on March 20, has developed in five-waves. Even with these complications, the wave that signals the upward trend is nearing its end.

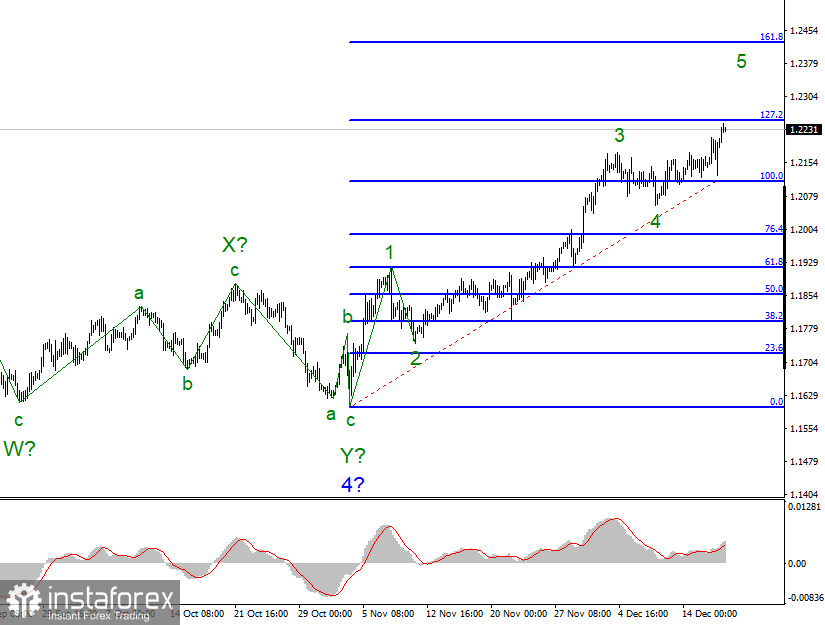

The smaller wave formation also indicates the continuation of the uptrend which is clearly shown in waves 4 and 5. Thus, the US dollar has already increased to the Fibonacci level of 127.2%. If it breaks this level, it is likely to rise markedly in the fifth wave with target levels located near the Fibonacci 161.8% level.

The news affecting the euro/dollar pair in recent days has been quite interesting, e.g. the final victory of Joe Biden in the presidential election (the electoral college vote affirmed Biden's victory) and the last meeting of the Fed in 2020. The results were announced late last night. During the day, there were other vital reports such as the PMI index in the euro area. The figure turned out to be much better than analysts' expectations. The euro added gains amid such strong data. However, the single currency enjoys high demand even without encouraging macroeconomic statistics. The US economic calendar also contained some important reports. Retail sales in November declined by 1.1%. The retail sales control group lost 0.5%, and retail sales excluding car sales decreased by 0.9%. The US dollar managed to grow modestly ahead of the data release. Therefore, investors mostly ignored the reports as the trajectory of both currencies remained unaffected. The Federal Reserve upgraded its economic outlook for GDP and unemployment for 2020 and 2021. The Fed Board of Governors once again notes how the pandemic has affected the economy and its recovery. The regulator mentioned that it is important to support the labor market and improve inflation. The rates will remain low for a long time until the labor market and inflation reach their target levels. To revitalize the economy, the Fed will continue to increase its holdings of Treasury securities by $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month

General conclusions and recommendation:

The euro-dollar pair is likely to resume an upward movement despite the complexity of the ascending set of waves. It is recommended to think twice before opening long deals on the pair. So far, there are no signals about the end of the upward movement. Thus, it is still possible to open long deals on the pair for each new MACD with targets located near the levels of 1.2250 and 1.2428, which is equal to 127.2% and 161.8% according to Fibonacci. Remembered that the probability of completing the construction of the upward trend is now very high. If the pair fails to break the 1.2250 level, it may retreat sharply from the recent highs.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română