The British pound continues to hit highs, breaking above the 1.3600 mark amid reports that the UK and the European Union are heading for a final battle over fishing rights. Officials predict the trade talks would reach a climax by the end of this week. Today, the pound's bullish run initiated on Tuesday continues amid investor optimism over a post-Brexit trade deal. The fact that the parties are discussing the key issue of fisheries suggests that a compromise on the issue of equal competitive conditions for business has been found and all major differences have been resolved.

Against this background, the pound sterling is in strong demand, ignoring the results of today's meeting of the Bank of England. The current monetary policy of the British regulator depends directly on the post-Brexit trade deal.

British Prime Minister Boris Johnson announced today that Christmas recess would begin on Thursday but Parliament could be recalled next week to approve a trade deal. "Parliament has long shown it can move at pace and the country would expect nothing less," Johnson said in a statement.

However, the situation is still uncertain. European Commission President Ursula von der Leyen warned that the long-running disagreement on how to manage post-Brexit fishing rights could still scupper the "narrow path" to a deal. Failure to find a compromise would lead to a no-deal Brexit. "Very difficult" negotiations on fishing rights could still sink the chances of a Brexit deal, the European Commission said. "In all honesty, it sometimes feels that we will not be able to resolve this question," she added. Nevertheless, her tone was mostly optimistic, which holds out hope for a last-minute compromise.

Prime Minister Boris Johnson softened his pessimistic rhetoric about the chances of a deal as well. Asked at a press conference Wednesday if he still stood by his Sunday claim that the "most likely" result is no deal, he demurred. According to recent reports, the discussions on fisheries will probably take some days before there can be talk of agreement.

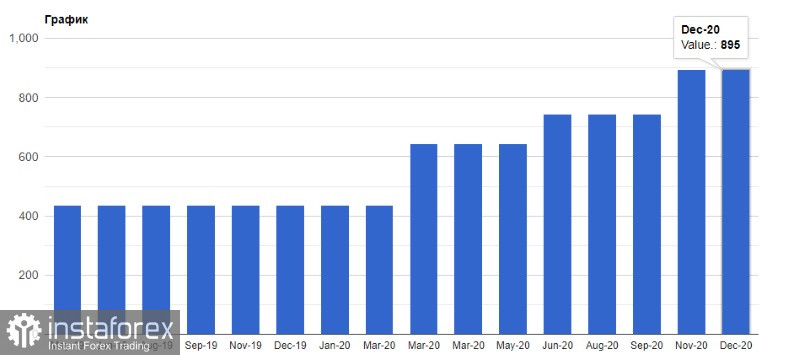

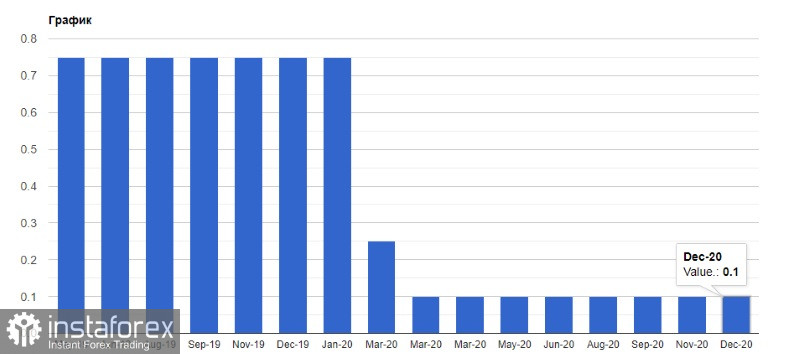

As I noted above, the British pound ignored the outcome of today's meeting of the Bank of England. The regulator left its key interest rate unchanged at 0.1%. The BoE's nine monetary policymakers voted 9-0 to keep the rate on hold. Besides, the committee members voted unanimously to leave its bond-buying programme at 875 billion pounds. The size of its corporate bond purchase program also remained unchanged at 20 billion pounds.

According to the minutes, the vaccination program is likely to reduce the downside risks to the economy, but the current lockdown will put pressure on economic activity in Q4 2020 and Q1 2021.

From a technical point of view, the pound/dollar's further direction will completely depend on the level of 1.3605, where the pair has recently stopped its bullish run. Positive news on Brexit will certainly support the pound sterling. In this case, the price will most likely hit new local highs near the levels of 1.3650 and 1.3700. At the moment, there are no preconditions for the pair's decline. However, if UK-EU trade talks fail at the last moment, the British pound is expected to collapse and reach the levels of 1.3470 and 1.3350.

USD: The US dollar remained under pressure against the European currency following the news that the Congressional leaders and their staffs continued working out the details of a nearly $900 billion coronavirus relief plan. The draft of the proposal includes $600 in payments for individuals, $300-per-week in supplemental unemployment insurance payments. In addition, the package includes $17 billion in aid for airlines. Senate Majority Leader Mitch McConnell, House Speaker Nancy Pelosi, Senate Democratic leader Chuck Schumer and House Republican leader Kevin McCarthy have been directly involved in the negotiations, raising prospects for a package that can quickly pass the House and Senate.

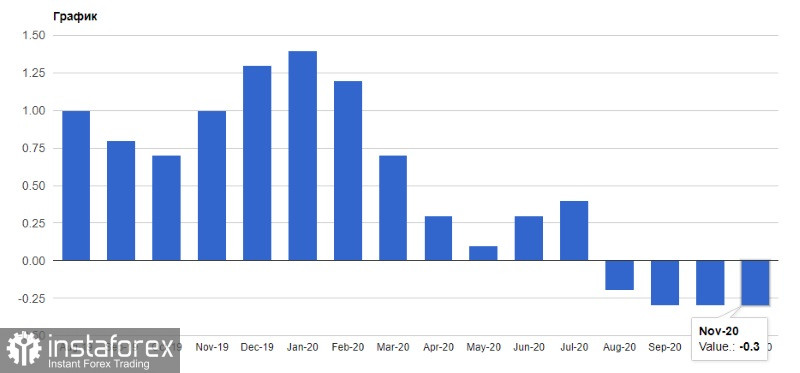

As for today's macroeconomic calendar, traders should pay attention to the data on inflation in the euro area, which declined in November, as expected. According to Eurostat, the EU's statistical agency, on a month-on-month basis, consumer prices in the euro area fell by 0.3% in November. A year earlier, in November 2019, annual inflation in the euro area was 1%. Annual inflation in the European Union slowed down to 0.2% in November against 0.3% in October.

The data on business confidence among manufacturers in France had no impact on the market. According to the National Bureau of Statistics, amid improved business confidence, the sentiment index rose to 93 in December from 92 in November. Economists predicted that the figure would amount to 92.

In addition, the countries of the European Union are going to carry out a coronavirus vaccination campaign in the period from December 27 to December 29. The European Medicines Agency is expected to hold a meeting on December 21 to give temporary authorization for the Pfizer/BioNTech vaccine's use in the EU.

From a technical point of view, the euro/dollar pair has broken through the resistance level of 1.2210, but this fact has not yet provoked new major purchases of the European currency. However, as long as the price is above this range, the pair is likely to move in an upward trend with a view to hitting its highs of 1.2270 and 1.2340. In case the price goes below the support level of 1.2210, the pair is expected to make a correction towards the lows of 1.2160 and 1.2110.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română