The US Fed kept the target rate at the level of 0-0.25% and preserved their current parameters on monetary policy. Thus, the regulator will continue to buy back at least $ 80 billion a month in treasuries and $ 40 billion a month in mortgage-backed securities. It is expected to continue until significant further progress is made in meeting the Committee's targets for maximum employment and price stability.

As we can see, the phrase about significant further progress is new, which actually indicates the absence of any time constraints. The expected shift in bond purchases to the long side did not occur. In general, the Fed's decision coincided with market expectations, and the dollar is getting reasons to further decline.

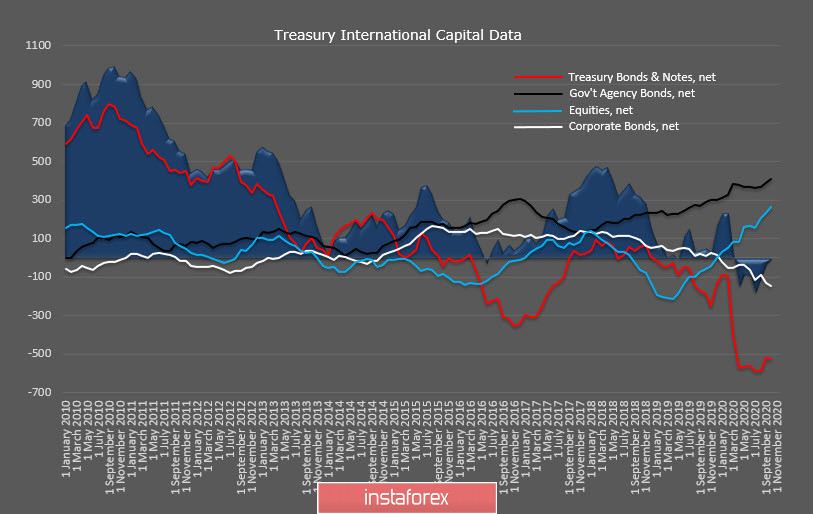

On another note, there are rumors that the negotiations in Congress about the new stimulus package is almost complete. It is not surprising, since the markets have been waiting for this for too long. Otherwise, the US economy will be in a situation of acute shortage of resources for further recovery. The Treasury report on the movement of foreign capital shows that there is no reversal in the demand for treasures, that is, foreign investors do not want to finance the government's debt; therefore, the money must be taken from domestic sources. At the same time, demand for stocks is growing, which indirectly indicates confidence that the new stimulus package will support stock markets.

The US dollar looks weak, and it is unreasonable to reverse for strengthening. The probability of a Christmas rally is getting high, so the trend towards the dollar's further weakening is most likely.

USD/CAD

The Canadian dollar seems to be quite average compared to other G10 currencies, which staged a small rally yesterday after the results of the Fed's meeting was announced. The CAD's behavior contradicts the general market mood, especially given the rise in oil prices and the strengthening of stock markets.

Without any clearly negative news on the Canadian dollar, its relative weakness may be related to the comments of Mr. Macklem, Head of Bank of Canada, who said that he notes Canadian dollar's significant growth, which affects the competitiveness of exporters. He also did not say anything new, so there is no reason to expect that the Bank of Canada will try to adjust the exchange rate through intervention. But the market chose to hedge, which led to profit-taking.

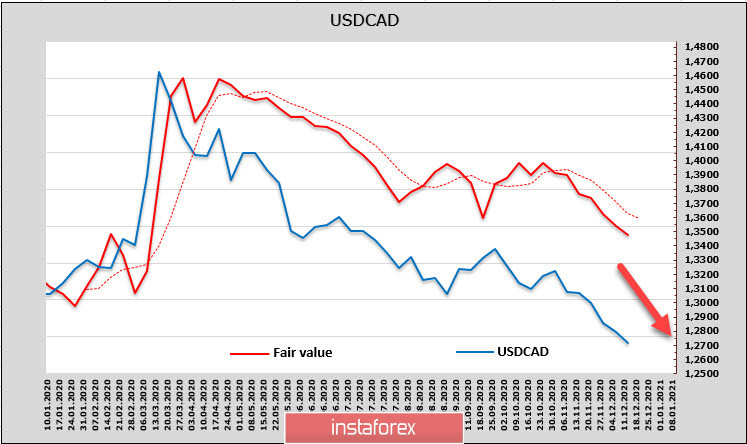

Meanwhile, capital movements show no signs of a reversal. The target price is still looking below and the trend remains moderately bearish.

A strong decline without correction in the USD/CAD pair causes some concerns, which increases the risk of a pullback. Nevertheless, the impulse remains strong, and any growth should be used to sell from more favorable levels. The target is still 1.2522. Now, we expect the Canadian dollar to join the rally that has begun.

USD/JPY

The general decline in tension, connected with a number of reasons (the nearing agreement on new stimuli in the US, the growing oil prices, and the beginning of universal vaccination), objectively reduce the demand for protective assets, but the yen continues to trade with a strengthening trend.

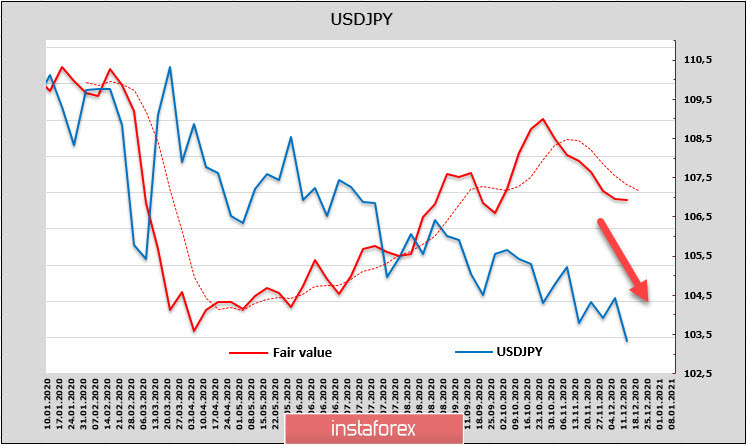

The target price is higher than the spot price, but continues to decline; on CME, the bullish advantage in futures is quite confident. Therefore, the current direction is more of a downward than an upward one.

In part, the growing demand for the yen is due to the lack of confidence in the pace of recovery of the Japanese economy. TANKAN quarterly indices showed a very weak pullback after three consecutive quarters of a strong decline. At the same time, industrial production indices were in the "red zone" for the year. In November, imports and exports declined, which was surprising, since a slight increase in imports and a slight upward pullback in exports was predicted.

Jibun Bank's analysis of Japan's manufacturing activity is disappointing – Japan's private sector continued to struggle in December as PMI data indicate further decrease in business activity. New orders also declined amid a further decline in new export orders

Traditionally, economic problems lead to the yen's growth, so the base scenario is still the downward movement of USD/JPY pair. We expect it to decline to the support level of 103.19 in the near future, and continue to the level of 101.20. The medium-term target is 0.9890/9910.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română