During the Asian session today, key data on the growth of the labor market in Australia was published. Despite the fairly strong numbers that came out in the green zone, the reaction of the Australian Dollar was relatively mild. The AUD/USD pair only approached the boundaries of the 76th figure but did not test this price level. The deterrent was China, which continues to wage a cold war with Canberra. However, in my opinion, this fact should not confuse traders. The upward trend is still in force and today, the currency received an important trump card which will still play a role in the foreseeable future.

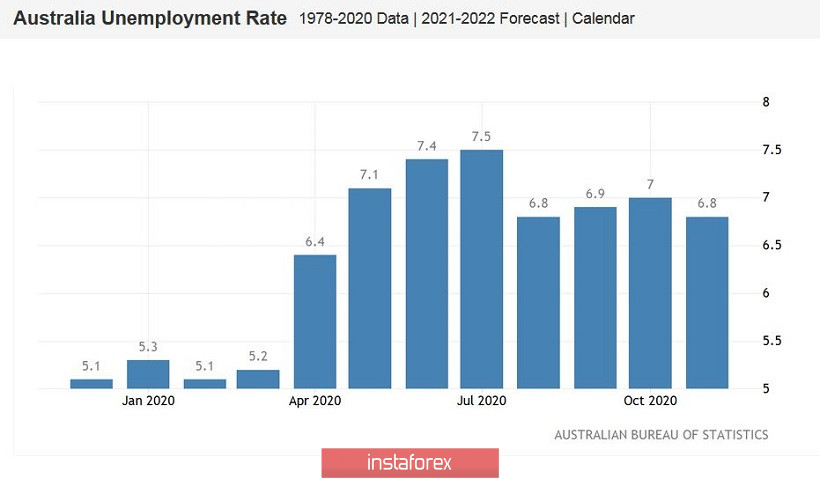

So, let's turn to the numbers. The preliminary forecast was quite cautious as experts assumed that unemployment in November will remain at 7% which is at the level seen in October. Aside from this, they predicted that there will be growth in the number of employed people by 40 thousand– due to the growth of the part-time employment component (which is a negative factor). But the real numbers were much better than the predicted values. First, the unemployment rate dropped to 6.8%. The last time the indicator was at this level was in August, after which it showed an increase for two months against the background of the second wave of Coronavirus in the country and the corresponding quarantine restrictions. In November, Australia completely came out of quarantine. After this, the labor market began to gain momentum.

This fact is confirmed by another indicator which is the increase in the number of employees. Instead of the predicted 40,000 increase, the indicator jumped to 90,000. This increased happened most importantly by increasing the full employment component. As you know, full-time positions offer a higher level of salary and a higher level of social security compared to temporary part-time jobs. This factor affects the dynamics of wage growth and indirectly affects the dynamics of inflationary growth. According to today's data release, the full-time component increased by 84,000 and the part-time component by 6,000. It is also worth noting that in the green zone, there was an indicator of the share of the economically active population. From the previous value of 65.8%, it rose to 66.1%. These are the best results since August last year.

Today's release is important not only in the context of the short and medium term growth prospects of the AUD/USD pair, but also in the long-term. At the last meeting of the year, members of the Central Bank expressed concern that labor market indicators are recovering at an uneven pace. According to the calculations of the Central Bank's economists, even at such an optimistic pace, the country will need years for unemployment tol go back to the pre-crisis level which is in the range of 4.5-5.2%. Also, RBA members were concerned about the growth of part-time employment. The Reserve Bank of Australia has indicated that if the labor market does not show signs of a sustained recovery in the foreseeable future, the regulator will consider expanding the stimulus program.

In the context of such events, the data published today are quite important. It can be assumed that if such dynamics continue, the regulator will not rush to expand QE in the foreseeable future.

Despite a fairly positive data, the Australian Dollar paired with the US Dollar only came to the borders of the 76th figure but did not attempt to make an impulse movement on this target. The fact is that China acts as a kind of anchor for the AUD/USD pair. Yesterday, the country officially announced an embargo on coal imports from Australia. It is worth noting that such a decision is not unexpected. Back in early October, steel mills in China received an official verbal notice to stop importing Australian coal which led to a drop in the price of marine coking coal. According to sources, Australia has been replaced by Mongolia as the leading supplier of coking coal to China. Yesterday, Beijing announced the embargo on an official level. Coal is Australia's third-largest export commodity so shares in Australian clean coal exporters fell sharply.

However, the foreign exchange market reacted to the latest news quite calmly. This fact only prevented AUD/USD buyers from conquering the 76th figure with an impulse growth. Despite all the anti-Australian decisions, Beijing has not banned iron ore. This raw material product is strategically important for the Australian economy so its absence from the Chinese black list is perceived as a positive fundamental factor. Moreover, China is increasing its ore imports (including from Australia) and the cost of a ton of this raw material has already exceeded the $150 mark.

Thus, the upward trend of the AUD/USD pair is still in force. From a technical point of view, the pair, on all higher timeframes (from H4 and above), is on the upper line of the Bollinger Bands Indicator. This tells us that priority is on the upward movement of the pair. On the H4 to W1 timeframes, except for the monthly chart, the Ichimoku Indicator has formed a bullish signal when the price is above all the indicator lines. This also includes the Kumo cloud. This signal indicates bullish sentiment. The strongest resistance level is at 0.7620. This is the upper line of the Bollinger Bands on the monthly chart. It is important for buyers to overcome this target in order to gain a foothold within the 76th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română