The dollar index continues to trade near the lows for 2.5 years, gradually approaching the round mark of 90. Sellers keep hoping for a breakout of this level, especially since the developing events in the market favor this.

If we turn to the technical picture, several tests of the 90.5 mark ended with a breakdown of the range. There is a possibility of resuming sales on the dollar index. It is also worth noting that today's downward movement brought the price to a new low. This means that in the future it is possible to test the level of 89.7 and only then there will be a correction to 90.5.

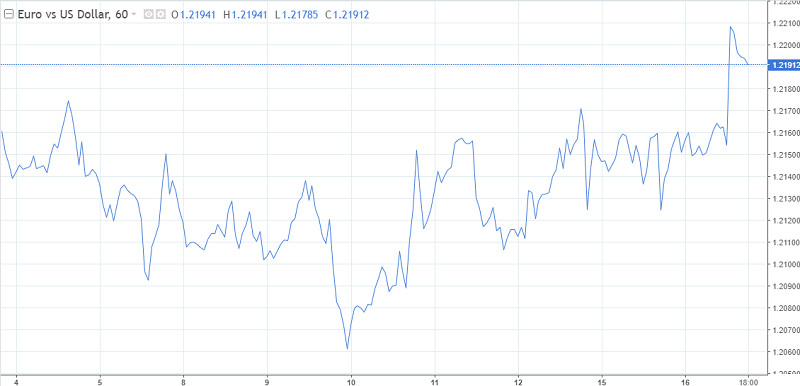

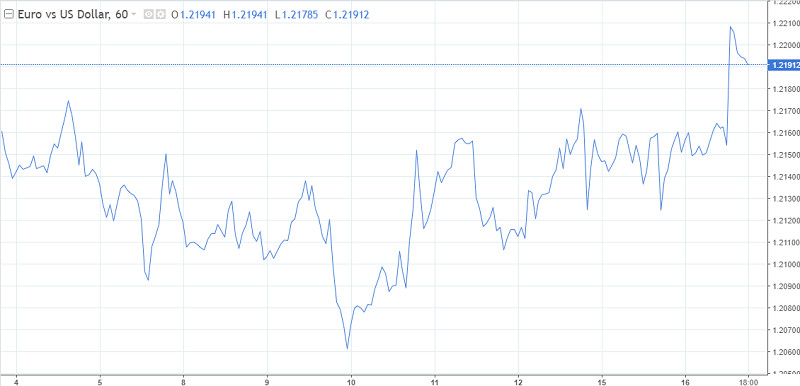

Today, a surge of optimism in risky assets was facilitated by sharply positive data from Europe. France reported an increase in business confidence, investors did not expect such positive preliminary data. This was followed by a strong report on Germany. As a result, the pair made an impulsive jump, breaking the level of 1.22.

The gradual decline in the dollar is also supported by optimism about new incentives for the US economy and the start of the mass vaccination. In this scenario, markets are not interested in defensive assets like the dollar.

The key event of the day will be the announcement of the results of the Fed meeting. It is unlikely that the markets will take any rash actions. Perhaps they will wait for Jerome Powell's statements. Since senior Fed officials have said more than once this year that the interest rate will not be changed for the next three years, investors will turn their attention to comments on the treasury purchase program. This information may be of little interest to the foreign exchange market.

In terms of incentives, other major regulators - the ECB and the Bank of Australia - have recently announced an increase in this package. It is possible that the Fed will follow the same path, as the second wave of the pandemic is in full swing, and Congress is still feeding the economy with only promises.

Such news for the EUR/USD pair will become a clear signal for the continuation of the upward trend. Today, the euro has already broken through the level of 1.22, now it will have the opportunity to gain a foothold above it.

The pound has its own history, but it also has something in common with the euro. The weakening dollar is helping both currencies. Today, the pound has overcome the psychologically important level of 1.35 against the dollar. The growth was boosted by news of further progress in the Brexit negotiations. EC president Ursula von der Leyen praised the chances of a deal between the UK and the European Union.

Positive macroeconomic publications can also count on the continuation of the upward trend. Average earnings in the country increased to a maximum in the last 7 months. This means that inflation will rise, and the Bank of England will not have to think about cutting interest rates in the near future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română