The British pound is moving in an uptrend amid rumors that a Brexit trade deal will be reached in a matter of days. Yesterday, the pair advanced by 1.2% - about 170 pips.

It is still unclear whether London and Brussels will eventually sign a trade agreement. According to the latest statement made by Michel Barnier, the sides may reach a trade deal already this week but only if they manage to tackle the fishing rights issue. He also warned that there were risks that the negotiations could drag on until December 31.

Even if the outcome is positive, the ratification of the deal will take time.

In case the terms of the deal are accepted by both parties, the British Parliament can ratify the agreement within 24 hours. However, the process can drag on for weeks in Europe.

Steps to ratify a deal in the eurozone:

Step 1: Because of its political importance, any agreement will first be considered by the 27 EU leaders. They are expected to arrange a meeting once the deal is signed.

Step 2: the EU lawyers decide whether any clause of the agreement needs to be approved by national and regional parliaments. This will be the case if any clause of the agreement concerns the national sovereignty of the EU member-states. However, officials do not expect this to delay the implementation of any agreement.

Step 3: The European Parliament has the right of veto. Its committees will scrutinize the text before all 705 members of the Assembly vote in its favor. Depending on when the deal is signed, this could happen in a special session within the week that starts on December 28.

Step 4: After the EU Parliament has given its consent, the European Council that represents the member-states, gives its final approval. At this point, it should be just a formality. The deal will be signed without a discussion.

As clear from the above, the ratification process is time-consuming. However, yesterday, British Prime Minister Boris Johnson promised lawmakers to vote on the deal at Christmas. It is unclear why he is so confident that the deal will be signed by December 25. Perhaps, traders are speculating on this.

Therefore, one should monitor news about Brexit, as the pound does not react to statistics.

Yesterday, the pair remained flat in the 13300/1.3350 range. After that, it started moving upward.

The market dynamics continued to grow. Yesterday, the pair's volatility increased by 185 pips, which is 50% higher than the average level.

December volatility is likely to reach its highest level in 2020.

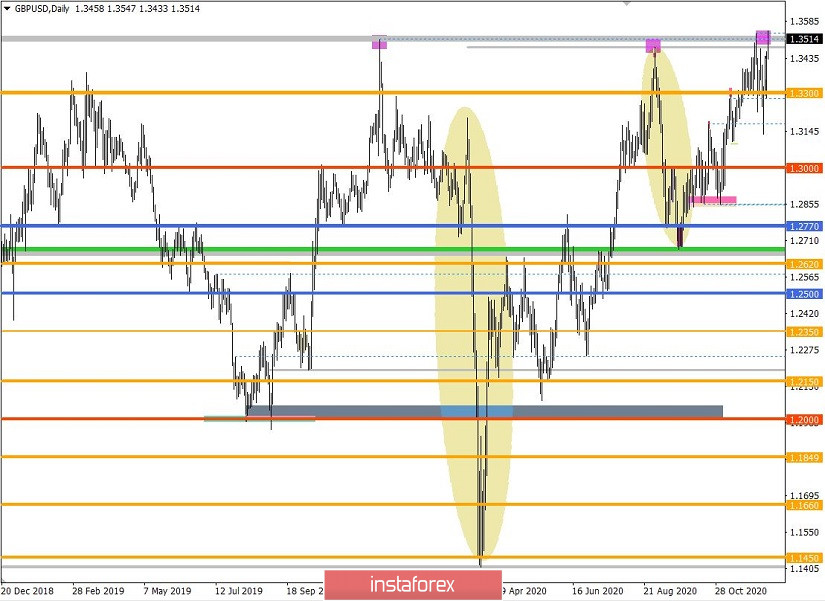

According to the daily chart, the pair is moving in an uptrend in the mid-term. Its local high is at 1.3537, recorded on December 4. Taking into account the recent strengthening of the pound sterling, the quote managed to recoup almost all its losses after a corrective move to 1.3134 from 1.3537.

In terms of the economic calendar, the inflation rate in the UK accelerated to 0.8% from 0.7%. Meanwhile, consumer prices fell to 0.3%. Interestingly, the pound did not even react to this data and the divergence of expectations.

The United Kingdom delivered its preliminary business activity report at 12:30 (GMT+3). The services PMI rose to 49.9 from 47.6. The manufacturing PMI increased from 55.6 to 57.3.

In the second half of the day, the United States will deliver similar reports. The services PMI is expected to sink to 55.6 from 58.4, while the PMI in the manufacturing sector should decline to 55.0 versus 56.7. As a result, the greenback may be brought under pressure.

17:45 (GMT+3) – December services and manufacturing PMI reports in US

The main event of the day will be the FOMC meeting. The regulator is expected to keep the interest rate at the level of 0-0.25%.

Market players will primarily be interested in the amount of quantitative easing and for how long the regulator will keep its current monetary policy.

Meanwhile, one should not forget about the trade talks between London and Brussels. Any information about the trade deal may bring the pound sterling under pressure.

Information background:

President of the European Commission Ursula von der Leyen, addressing the European Parliament on December 16, said that trade negotiations were going on around the clock. However, it remained unclear whether the parties would reach an agreement.

At the same time, Ursula von der Leyen said that the fundamental differences remained on fisheries and the level playing field to ensure fair competition.

Analyzing the current trading chart, one can see that optimism about trade negotiations is pushing the pound sterling upward. Thus, the price broke through the local high of 1.3476, reached on December 9, and the high of 1.3537 of the medium-term trend.

Such impressive price changes are associated with the information flow related to Brexit.

Some good news about Brexit is likely to lead to the strengthening of the pound sterling.

Some bad news about Brexit may lead to the weakening of the pound sterling.

You can find information about Brexit in the Analytics section on our website, as well as directly from the media. For example, Bloomberg, the Wall Street Journal, Reuters.

One should remember that the trend may change any time, leading to the closure of long positions and a technical pullback.

Indicator analysis

The analysis of different time frames shows that the technical indicators do not unanimously give a buy signal due to a rapid upward movement and a new local high.

Weekly volatility / Volatility measurement: Month; Quarter; Year

The volatility measurement reflects the average daily fluctuations, calculated per Month / Quarter / Year.

(On December 16, it was measure taking into account the publication time of the article)

The current dynamics is only 66 pips.

Key levels

Resistance zones: 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support zones: 1.3400 *; 1.3300 **; 1.3000 ***; 1.2840 / 1.2860 / 1.2885; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957).

* Periodic level

** Range level

*** Psychological level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română