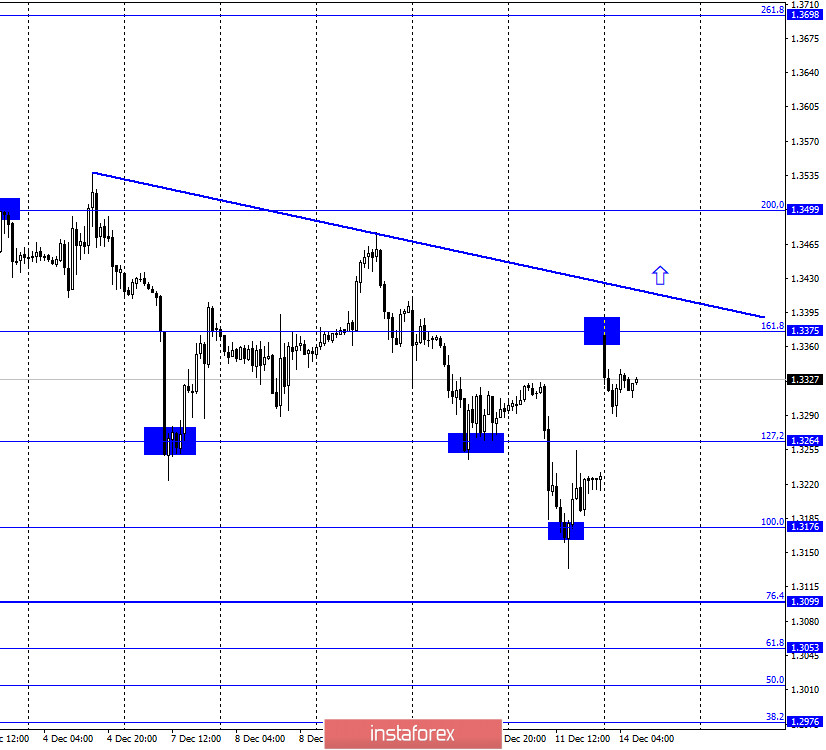

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair fell by the end of last week to the corrective level of 100.0% (1.3176). The rebound of quotes from this level allowed us to perform a reversal in favor of the British and start the growth process, which continued tonight to the Fibo level of 161.8% (1.3375). This level was followed by a rebound, which allows us to expect a new drop in quotes in the direction of 1.3264 and 1.3176. There is also a descending trend line nearby, which characterizes the current mood of traders as "bearish". The end of the past week brought exactly the news that traders were waiting for. London and Brussels continued negotiations until Sunday, as planned, and on December 13, Ursula von der Leyen and Boris Johnson made a joint statement, from which it follows that there is still no significant progress in the negotiations, and the parties decided to continue them as long as there are at least a slim chance of signing a deal. This means that Michel Barnier and David Frost will now work until at least December 31 or so. It will not be surprising if the negotiations are eventually extended to 2021. A few months ago, this option looked fantastic, but now, when Brexit is only a little more than 2 weeks away, this is a very real prospect. The main thing to understand is that neither the UK nor the EU want a "No Deal" Brexit. Therefore, it is in their interest to continue trying to negotiate. Although, of course, if an agreement is not reached in the last days of the outgoing year, then the negotiations may be over.

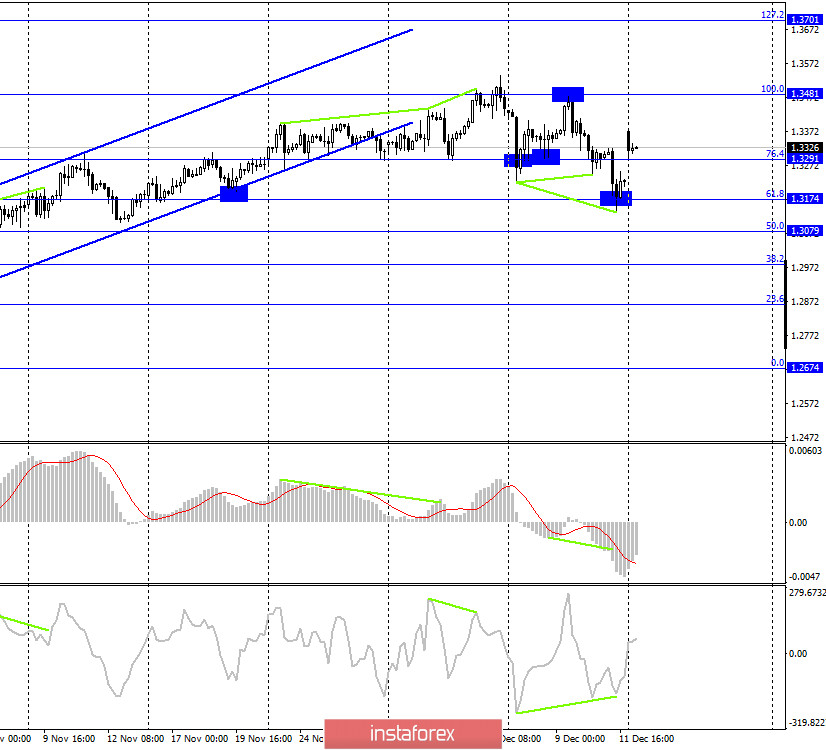

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a rebound from the corrective level of 61.8% (1.3174), a reversal in favor of the British and a consolidation above the Fibo level of 76.4% (1.3291). Thus, the growth process can now continue in the direction of the corrective level of 100.0% (1.3481). The bullish divergence of the CCI indicator also worked in favor of the beginning of the pair's growth. But the potential of bull traders is still constrained by the trend line on the hourly chart.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the corrective level of 100.0% (1.3513). And this rebound remains the most important and clear signal on all charts. If the rebound is not false (and so far it does not look false), then the British pound is waiting for a significant drop.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

On Friday in the UK, Bank of England Governor Andrew Bailey made a speech in which he said that the regulator is doing everything possible to reduce the risks of a possible Brexit "No Deal". There was no more news.

The economic calendar for the US and the UK:

On December 14, the calendars of economic events in the UK and USA is completely empty, so the background information will be absent that day.

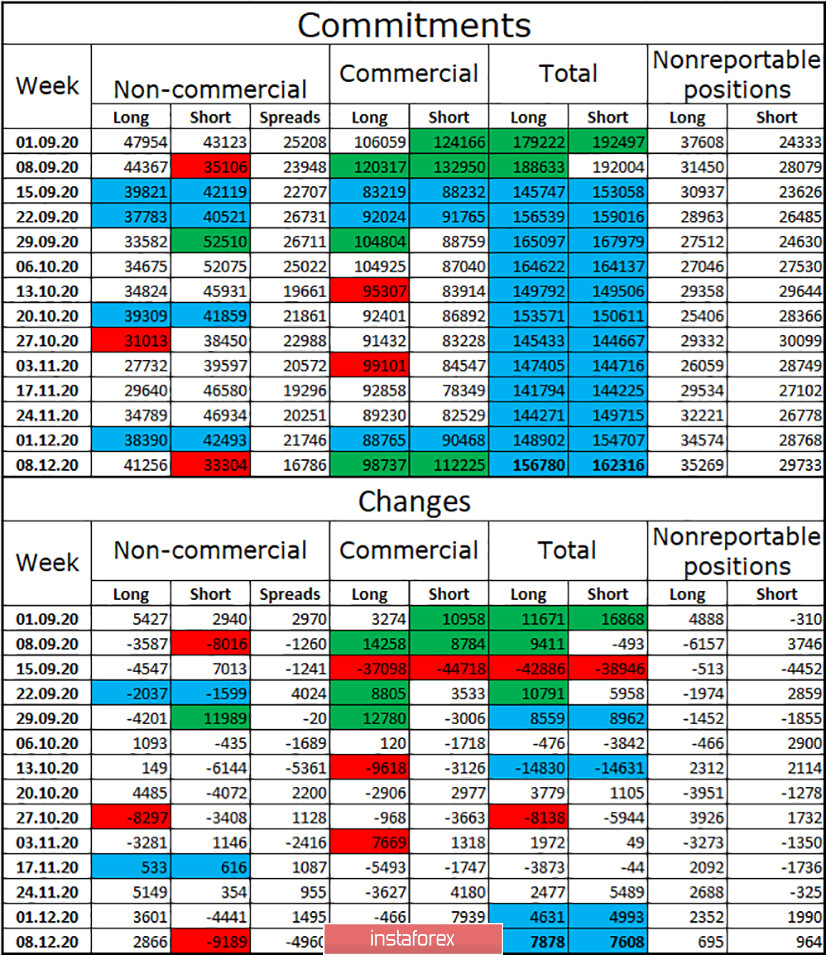

COT (Commitments of Traders) report:

The latest COT report showed a new increase in the number of long contracts held by speculators. This time, their total number increased by 2,866 contracts, while the number of short contracts decreased by 9,189 units. Thus, the mood of speculators has become much more "bullish" and is becoming so for the third week in a row. Given this fact, the growth of the British dollar is quite understandable, although the information background is not entirely on the side of the British currency. However, given that speculators have again taken up quite large purchases of the pound, we can assume its new growth. In this regard, I recommend that you carefully monitor the level of 1.3513 on the daily chart. Closing above it will confirm the intention of traders to re-open long contracts. The total number of open long and short contracts for all groups of traders remains approximately the same.

GBP/USD forecast and recommendations for traders:

At this time, I recommend that you be extremely careful with opening any deals on the British. The pair continues to move very raggedly and often changes direction. I recommend making new purchases of the British dollar if it is fixed above the trend line on the hourly chart with the target level of 200.0% (1.3499). I recommend selling the British dollar with targets of 1.3264 and 1.3176 if a new rebound is made from the level of 161.8% or the trend line on the hourly chart.

Terms:

"Non-commercial" - large market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română