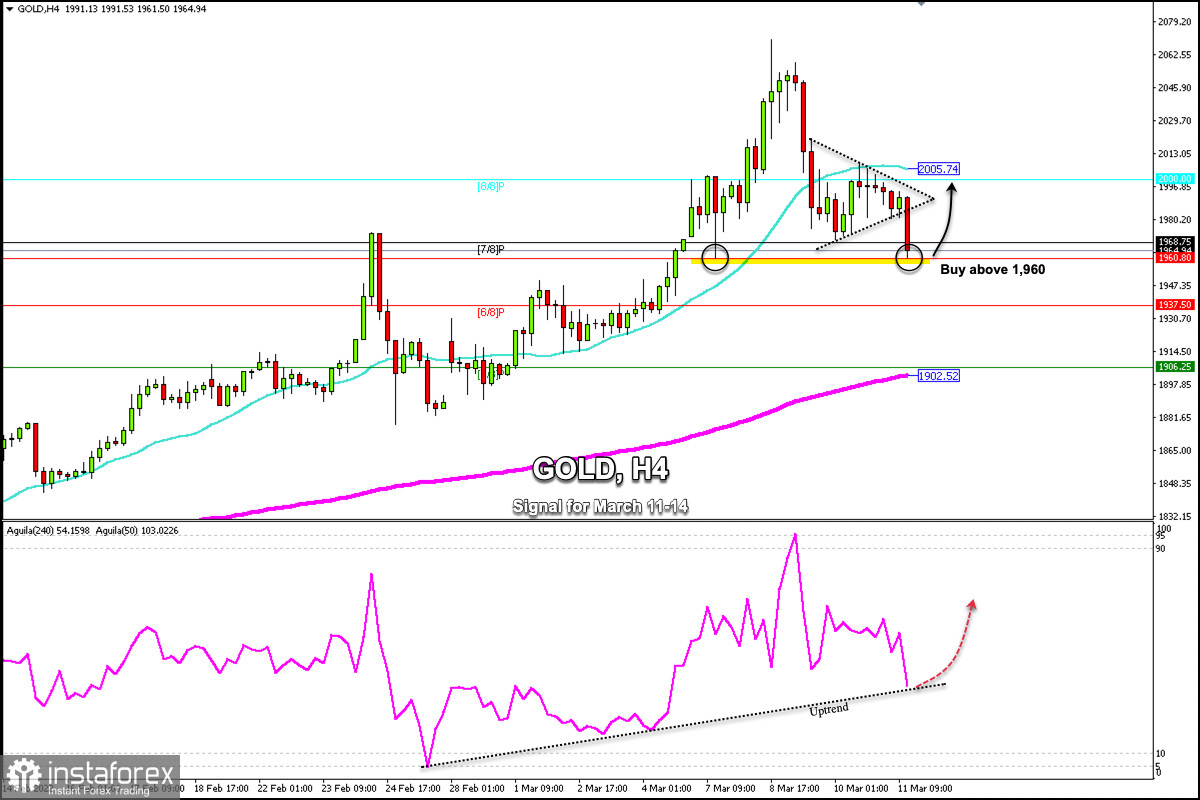

Early in the American session, gold reached the support level of 1,960. This level coincides with the low of March 7. If the price consolidates above this level in the next few hours, it could confirm the formation of a double bottom pattern.

Hopes of finding a path that would lead both countries to a peaceful solution caused a sharp pullback in gold and it is now hovering around 1,960. A break and consolidation below this level could accelerate the decline towards the support 6/8 Murray at 1,937.

However, the talks held in Turkey did not achieve any progress and, once again, investors could take refuge in gold seeking protection against the possible global recession that the war would generate.

In the European session, gold broke out the symmetrical triangle pattern and found support around 7/8 Murray and 1,960. This technical correction in gold is likely to give the bulls a chance for a positive move in the coming days.

Given that gold was trading at extremely overbought levels, this correction was expected in the last few hours and could also be part of profit-taking by investors. Another factor that is eroding the strength of gold is the slight increase in demand for risky assets. Wall Street indices are trading in the green which affects the strength of gold.

In the medium term, gold should continue its rise if the situation in Ukraine worsens or if inflation gets out of control.

Investors have their eye on the expected interest rate hike for part of FED next week as it could dampen the strength of gold, only if the interest rate increase is about 50bp.

Our trading plan is to wait for a bounce around 1,960 to buy, with targets at 1,985 and the level SMA 21 at 2,005. The eagle indicator has touched the support level of the uptrend channel which could favor a recovery in gold.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română