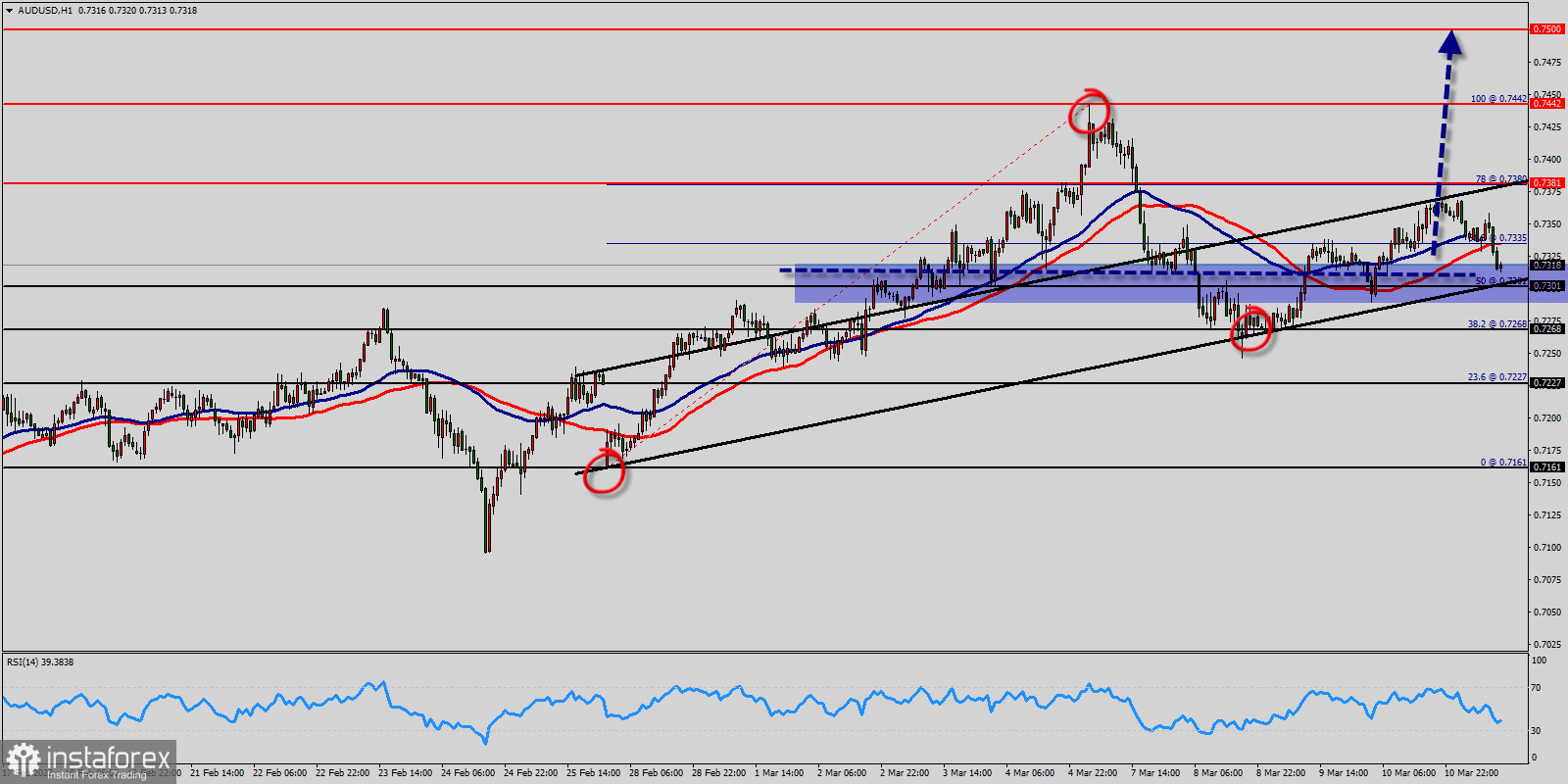

The Australian dollar shows a positive session against the US dollar today, the currency pair is rising north of the widely watched 100 -day simple moving average, currently trading around the spot of 0.7381.

As long as 0.7310 resistance turned support holds, larger up trend from 0.7310 is still expected to continue.

On the upside, if the trend fails to break of 50% Fibonacci of at the price of 0.7310 will show a strong bullish move in coming hours.

The increase from 0.7310 is expected to continue as long as 0.7310 support holds. Son the AUD/USD pair will raise the chance of long term up trend resumption and target a retest on 0.7380.

RSI (14) has made a recent bullish exit which is in line with the bullish exit we're seeing in price, for that the AUD/USD pair has climbed along a steep, upward-sloping support channel since 2 weeks, the pair rose at an even more ambitious incline.

The trend is still bullish as long as the price of 0.7301 is not broken. Thereupon, it would be wise to buy above the price of at 0.7301 with the primary target at 0.7381.

Then, the AUD/USD pair will continue towards the second target at 0.7442 (a new target is around 0.7442 - double top - last bullish wave ).

Alternative scenario :

The breakdown of 0.72 68 will allow the pair to go further down to the prices of 0.7227 and 0.7161 next week.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română