EUR/USD

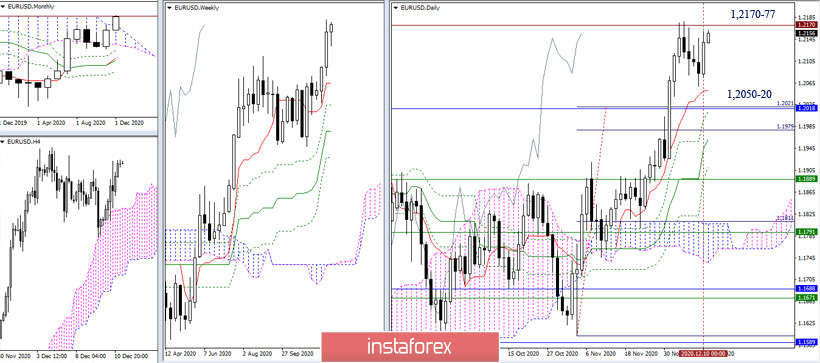

The bulls were the daily priority yesterday, which reached a significant recovery of positions and raised the issue of the completion of the downward correction at the end of the trading week. The upward trend in the higher time frames will resume if the high (1.2177) will be updated and the price will consolidate above it. Today, the nearest significant support levels maintained their location at 1.2050 (daily Tenkan) and 1.2020 (upper limit of the monthly cloud).

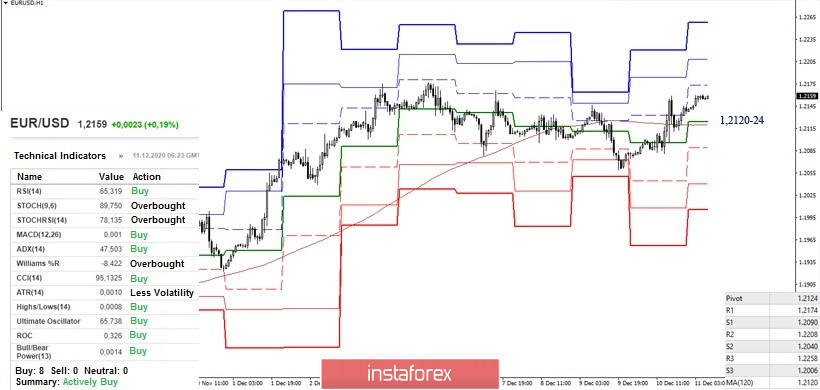

The advantage in the smaller time frames is in the side again of the bulls, who managed to regain the key levels – 1.2120-24 (central daily pivot level + weekly long-term trend) and are now in a horizontal position, thus supporting uncertainty. The resistances of the classic pivot levels, which are the pivot points for the continuation of the upward movement, are located at 1.2174 - 1.2208 - 1.2258 today.

However, in case of a decline and loss of 1.2120-24, the balance of forces on one-hour time frame will change in favor of the bulls. In this regard, the support of the classic pivot levels (1.2090 - 1.2040 - 1.2006) will become relevant again.

GBP/USD

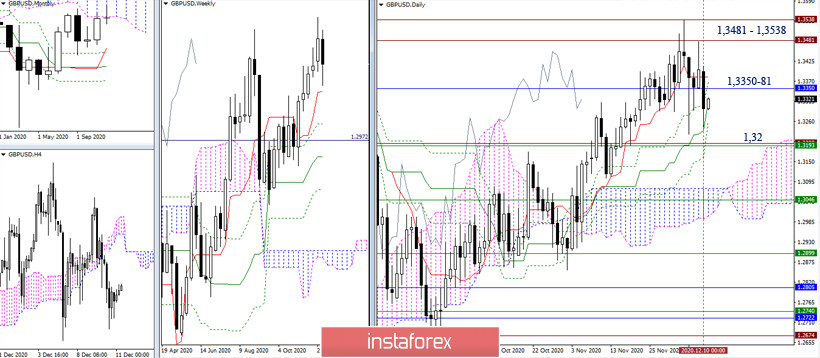

Yesterday, bearish traders declined to the daily mid-term trend, but could not surpass Monday's result. The daily Kijun has moved forward and is now supporting the pound at 1.3314. As a result, the pair must first eliminate the daily Ichimoku gold cross in order to continue to decline and retest the historical level (1.32) and the weekly Tenkan (1.3196). A consolidation above the current midpoint 1.3350-81 (lower limit of the monthly cloud + daily short-term trend) will return some of the advantages to the bulls' side, whose task will be to test the strength of the previous high extremes (1.3481 - 1.3538).

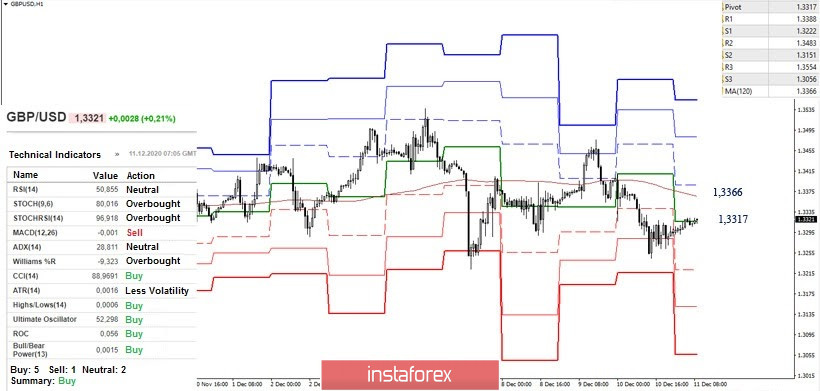

The key level zone of 1.3317 (central pivot level of the day) and 1.3366 (weekly long-term trend) is being tested again in the smaller time frames. After completing this retest and updating yesterday's low, the pivot points for the continuation of the decline will be the support of the classic pivot levels (1.3222 - 1.3151 - 1.3056). However, if the bears fail to retest it, the key levels (1.3317-66) will return to the bulls' side. This will allow the pair to return to the attraction zone of important levels of the higher time frames (1.3350-81). Now, the further development of the situation will depend on the result of interaction with this uncertainty area. The resistances of the classic pivot levels are located today at 1.3388 - 1.3483 - 1.3554.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română