Crypto Industry News:

Paolo Ardoino, chief technology officer at Tether, believes that the growing advancement around central bank digital currencies around the world will not really affect the role of private stablecoins.

Ardoino shared his opinion in a Twitter thread about the growing discussion around CBDC and their role in the current payment system. He said CBDC will only replace the age-old centralized payment networks as SWIFT and use private blockchains to execute most transactions.

He then explained that CBDC is not about digitizing fiat currency as it has already done considering that most modern transactions are digital. The main goal of CBDC is to use private blockchains as a modern and cost-controlled technological infrastructure in which most bank transfers and credit / debit card transactions will be settled through CBDC.

CTO Tether said private stablecoins like USDT will remain relevant even in the era of government-issued digital currencies. These would give users the option of interchain transfer and would be available on a number of blockchains of their choice.

Ardoino's response comes as a result of a growing debate over whether CBDC will reduce the role of the private stablecoin sector. The discussion gathered pace in the United States after calls from several lawmakers to regulate the market.

Technical Market Outlook

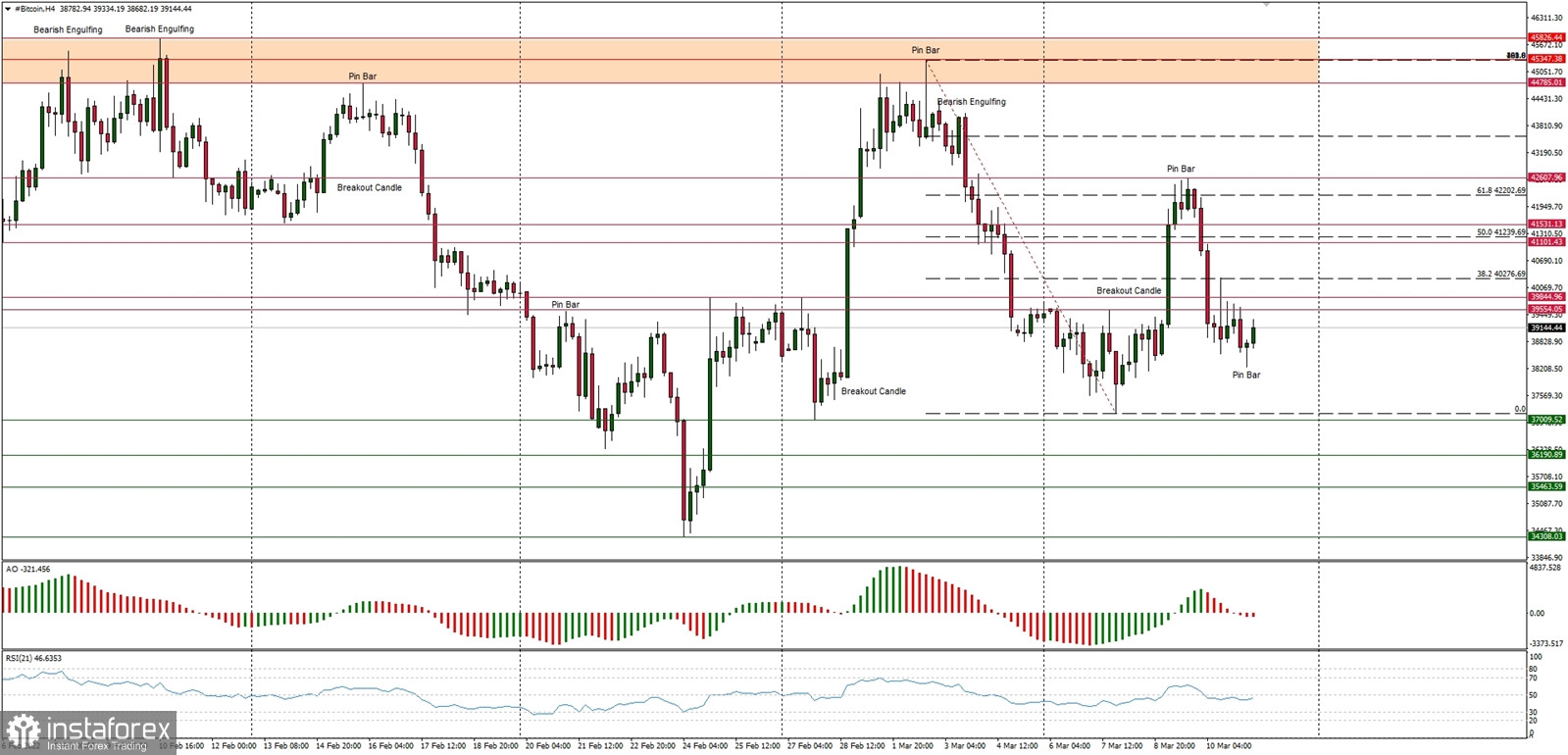

After the BTC/USD rally was capped at the 61% Fibonacci retracement of the last wave down the market returned below $40k again and is currently trying to bounce from the local lows made at the level of $38,232. The nearest technical support is seen at the level of $37,009. Only a sustained breakout above the supply zone located between the levels of $44,875 - $45,826 would change the outlook to more bullish in the near term. The volatility has decreased as the market participants await the decisive breakout in either direction.

Weekly Pivot Points:

WR3 - $50,991

WR2 - $48,083

WR1 - $42,916

Weekly Pivot - $40,144

WS1 - $35,041

WS2 - $32,033

WS3 - $26,666

Trading Outlook:

The market still keeps trying to bounce after over the 60% retracement made since the ATH at the level of $68,998 was made. The level of $45,427 is the key technical resistance for bulls, but the game changing technical supply zone is seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend, otherwise the bearish pressure might push down the BTC towards the level of $29,254.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română