4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CSI: 6.8628

For the EUR/USD pair, the first half of the fourth trading day of the week passed again in calm trading and movements. The pair's quotes showed a desire to continue falling, which suggested that traders were pessimistic about the EU summit and the ECB meeting. On Thursday, the fall of the euro currency stopped, and then the markets began to wait for the results of the ECB meeting. However, from our point of view, the EU summit was the most important event. At least, that was the case on Thursday morning. It was the problems with the budget and the recovery fund that threatened to turn into additional economic problems for the EU, but in practice, everything was resolved quickly and easily.

On Thursday morning, it just became known from sources close to the highest European diplomatic circles that Poland and Hungary agreed not to block the fund and the budget. So that's easy and simple. We don't know what happened behind closed doors, however, there is no doubt that Angela Merkel, as Chancellor of the German presidency of the EU, held talks with Polish Prime Minister Mateusz Morawiecki and Hungarian Prime Minister Viktor Orban. Most likely, after these negotiations, Warsaw and Budapest decided to withdraw their veto. Probably, Germany threatened to distribute funds from the recovery fund among the 25 EU countries, without the participation of Poland and Hungary, and these countries were saved before the onslaught. However, according to the information provided, the mechanism for observing the rule of law will still be finalized at the summit. It is reported that the leaders of the EU countries during the summit will try to take into account the comments and suggestions of Poland and Hungary, and a clear scheme for implementing this mechanism will be prescribed, with all the conditions and time frames. Thus, at the moment, we can assume that there is one less problem for the EU.

However, a riot is brewing in Poland after it became known about the possible concessions of Mateusz Morawiecki in Brussels. However, this is the problem of Poland, not the whole EU. However, the party "Solidarity Poland", which is part of the coalition, is going to seek the resignation of Prime Minister Morawiecki, if he agrees to a new "mechanism for observing the rule of law". However, the politicians of the Morawiecki party expected such development and assure that "no one sold Poland", and "all the conditions of Poland will be taken into account by the EU member states". It should also be noted that top EU officials also expect that the budget crisis will be overcome. The head of the European Council Charles Michel wrote in an open letter: "I am confident that we will be able to negotiate an agreement that will allow both rapid approvals of the multi-year framework budget and the recovery fund."

Thus, the economy returns to the first place. And here everything is not as rosy as it could be. By and large, all the main questions now relate to how much the European economy will shrink in the fourth quarter. No one doubts that there will be no growth in this quarter. So far, the official forecasts of many analytical agencies predict losses from 2% to 3%. Of course, this is not -11.7% in the second quarter, however, it is still a new drop in the European economy due to the second "wave" of COVID-2019 and the repeated "lockdown". It would be interesting to compare these forecasts with the forecasts for the fourth quarter of the US economy. However, there is no such data yet. We can assume that the US GDP in the fourth quarter will feel much better than the European one since there was no "lockdown" in the United States. However, we have been writing about this for several weeks, and the European currency does not react to this extremely important data. After all, this is one of the most banal laws: if a country's economy shrinks, its currency falls because no one wants to invest money in an economy that is not growing. However, the euro currency is still near the maximum values since April 2018, that is, for 2.5 years. And we still wonder how the euro got to these price levels in just six months? We still believe that the euro is extremely overbought and has been so for more than a few months. The upward trend is very strong, however, the corrections are very weak. Thus, we still expect a new downward trend. At the same time, we recommend waiting for the formation of technical confirmations of this hypothesis and only then start trading on the downside.

Well, the European Central Bank did not surprise the markets at all. The regulator left rates unchanged: the key rate at 0.0%, the deposit rate at -0.5%, and the credit rate at 0.25%. In an accompanying statement, the regulator said that rates will remain at record lows until inflation is around 2.0% y/y. Given that the current inflation rate in the EU is -0.4%, it will take a long time to wait. In addition, the Board of Governors headed by Christine Lagarde decided to increase the PEPP program by 500 billion euros, and its term – by 9 months. Thus, this program with a total volume of 1.85 trillion euros will be valid at least until the end of March 2022. This was also not a surprise for traders. At the same time, the ECB raised its GDP forecasts for 2020 to -7.3% against -8% previously, but at the same time lowered its GDP forecast for 2021 to 3.9%.

It should be noted that the euro resumed its upward movement in the second half of the day. However, we have long been used to such "feints" of the currency market. In 2020, there is less logic in the currency market than ever. Therefore, it is necessary to conduct a much more thorough analysis and take into account a much larger number of factors. However, now according to the "linear regression channels" system, all trend indicators are again directed upwards, so we continue to wait for the continuation of the upward movement. Although it is absolutely illogical, from a fundamental point of view.

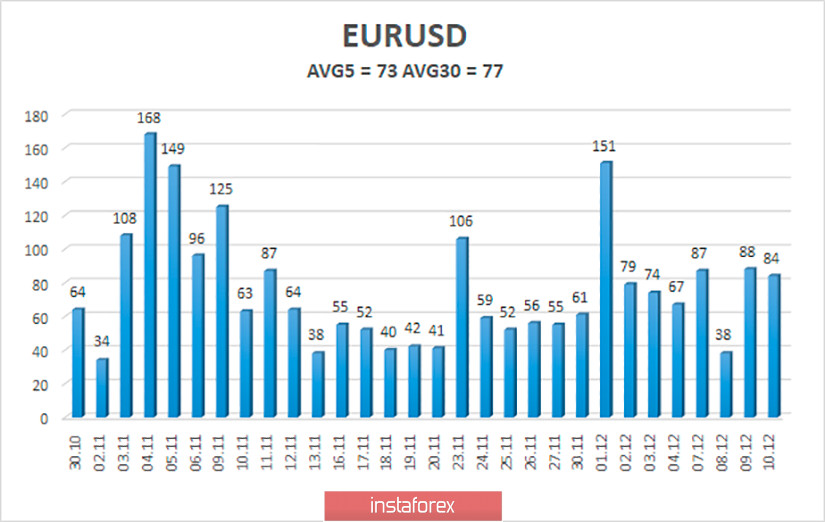

The volatility of the euro/dollar currency pair as of December 11 is 73 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.2050 and 1.2196. A reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement.

Nearest support levels:

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading recommendations:

The EUR/USD pair continues to adjust and overcome the moving average. Thus, today it is recommended to stay in sell orders with targets of 1.2024 and 1.1994 until the Heiken Ashi indicator turns up. It is recommended to consider buy orders if the pair is fixed back above the moving average, with targets of 1.2136 and 1.2207.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română