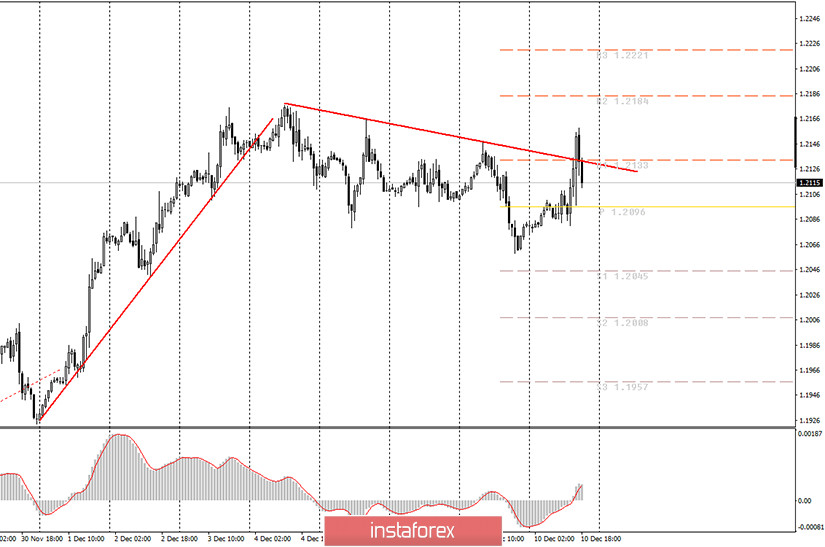

Hourly chart of the EUR/USD pair

The EUR/USD pair was moving towards the downward trend line on Thursday. Therefore, the upward movement was interpreted as corrective. The trend line was broken by the end of the day, but by that time the price had gone up by about 70 points. Therefore, of course, it was no longer worth entering with new long deals at the end of the movement. The most interesting thing is that right after breaking this line, a downward pullback began. And now it is not clear whether this retracement within the framework of a new upward trend or a breakdown of the trend line was false. In any case, there is such a technical picture for the euro that it is impossible to say for sure where the pair will go next. The euro/dollar pair began to move rather indistinctly following the pound/dollar. The movement that started on December 3 could even be interpreted as a flat, despite a small downward slope, but the trend line was quite convincing and its breakdown allows us to expect a new round of upward movement. Therefore, the current situation is confusing.

Novice traders witnessed a fairly strong fundamental background on Thursday. First, the results of the ECB meeting. They announced that the PEPP program was expanded by 500 billion euros and extended by nine months. This is a bearish factor for the euro, as it means easing of monetary policy. Simply put, the EU economy is not coping with the negative consequences of the pandemic and it had to provide additional assistance. At the same time, the rates remained the same. Secondly, the US inflation report did not turn out to be weaker than the forecast values, which could support the dollar. Thirdly, the number of applications for US unemployment benefits began to grow again and significantly exceeded the forecasted values, so the strengthening of the dollar was limited. One way or another, today's trading again cannot be called logical.

No news or macroeconomic reports scheduled for Friday. There will be a report on US consumer confidence, but it is not important. Thus, there will be no fundamental background tomorrow, and the pair will move purely on technique. Unfortunately, technique does not say much now. You need to wait at least for the morning before you can understand whether a new upward trend is now forming, which is also unlikely to be long-term, or whether the breakout was false and the downward movement will resume.

Possible scenarios for December 11:

1) Long positions have become relevant at the moment, since the downtrend line has been broken. However, the price has already gone up about 70 points, so it should now retreat. Also, a breakout of the trend line can be false. In such a situation, you need to wait for the morning and for additional signals. For long deals on the pair, you need to wait for a correction and a buy signal from the MACD. At least.

2) Trading down can also be relevant on Friday if the breakout turns out to be false. Formally, you can try to open short positions right now (if the MACD indicator turns down in the next few hours), but we also recommend that you wait until the morning comes in order to make sure that this assumption is true.You can look for a sell signal from the MACD in the morning, if quotes do not go above the trend line by that time.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română