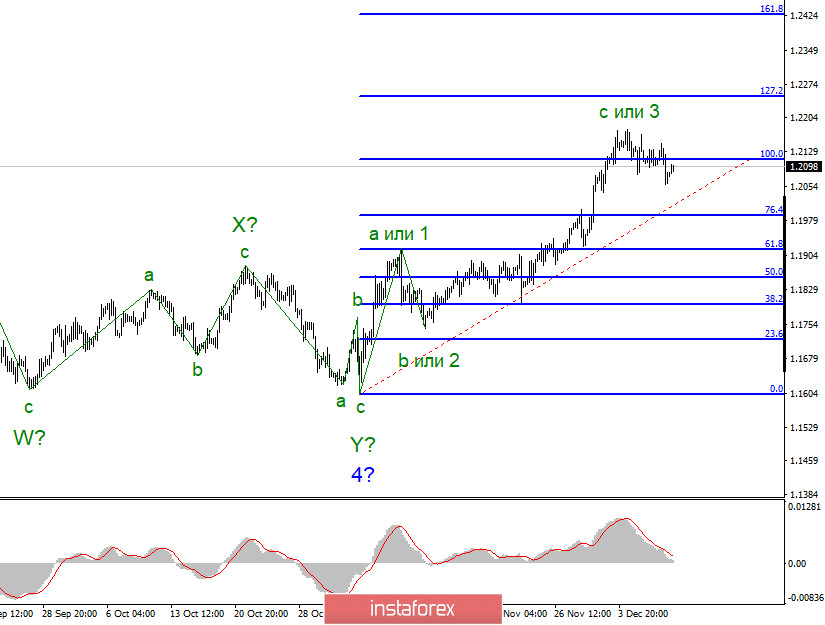

The wave pattern for the EUR/USD pair still indicates the formation of the upward trend. The upward wave C is still forming. It made a successful attempt to break through the high of the wave 3 or C. The current ascending section of the trend may turn into a five-wave structure as the formation of new three waves has been completed. In this case, the entire wave pattern may become complex. Nevertheless, all this may indicate the upcoming downward reversal.

The wave pattern in a lower time frame also indicates that the formation of the next three-wave section of the trend continues. Alternatively, the wave pattern of the trend section that has started on November 4, is transforming into a five-wave structure. At the same time, the trend may be completed by the formation of the wave C, followed by the formation of new three descending waves.

Today, two important events will take place in Europe. They can have a strong influence on the EUR/USD pair. The key one is the ECB meeting. It is closely related to the monetary policy of the ECB, which can severely affect the exchange rate. In order to keep the demand for the euro on a high level, the European Central Bank should refrain from easing its monetary policy. Only in this case, markets will continue to buy the euro. The European Central Bank is expected to announce the expansion of the Pandemic Emergency Purchase Programme (PEPP). This means that the eurozone's economy cannot cope with the negative effects of the coronavirus pandemic and the financial crisis. Terefore, it requires new cash injections. Money injections will increase the supply of the euro in the foreign exchange market, leading to a decrease in its value. On top of that, a lot will depend on what Christine Lagarde has to say to the markets. Her latest speech was extremely poor. The Head of the European Central Bank spoke about high risks of the coronavirus pandemic and the economic problems in Europe driven by the new lockdown introduced in November. Moreover, she sounded sceptical about the vaccine against COVID-19. She pointed out that the effect of vaccination would not be seen as early as in six months and that the economy should somehow survive during this period of time. In general, if her rhetoric remains unchanged, the euro is unlikely to strengthen.

Another crucial event today is the European Union summit. In the course of the summit, its members will try to persuade Poland and Hungary to overturn their veto on the recovery fund and the 2021-2027 budget. The possible outcome of the summit is unclear. However, if this issue is unsolved, it can cause new economic and ideological challenges for the European Union. Additionally, the United States will deliver its inflation report today. In case the indicator drops again, the demand for the greenback may decrease. Currently, it is on a very low level anyway.

General conclusion and recommendations:

The euro/dollar pair is currently trading in a three-wave upward trend. However, it is also possible that the bullish movement has already come to an end. Thus, I recommend that you be extremely careful when buying the instrument and consider opening short positions. Despite the fact that the wave 5 is currently being formed, it will be completed soon. Nevertheless, it is still possible to buy the pair following each of the new MACD buy signals with the targets set near 1.2250, which corresponds to the 127.2% Fibonacci extension level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română