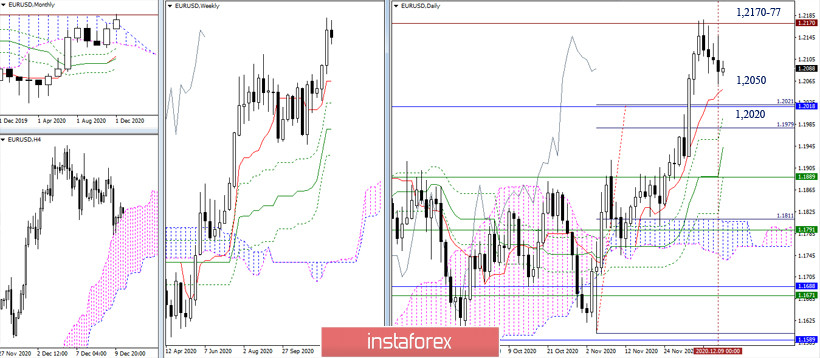

EUR/USD

Bears were able to deeper the downward correction over the previous day. Now, the daily short-term trend has moved to reach the price chart again. As a result, today's nearest support can be noted at 1.2050 (daily Tenkan) and 1.2020 (upper limit of the monthly cloud + 100% level of the daily target). The historical border and the current high extreme (1.2170-77) remains to be the resistance that separates the euro from continuing the weekly and monthly upward trend.

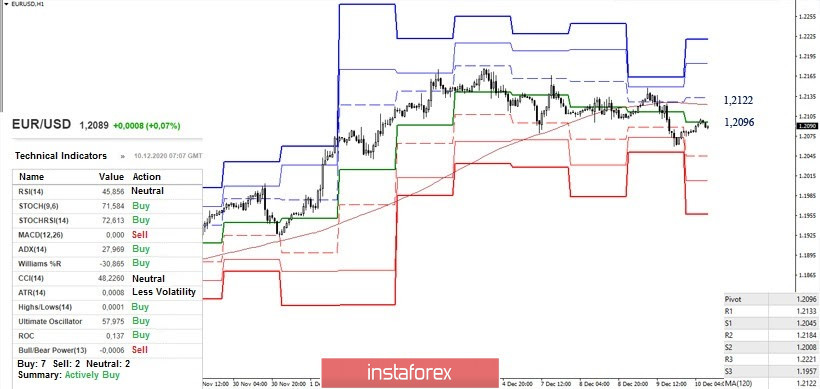

The scales in the smaller time frames swung towards the direction of the bears, who declined below the key levels the day before, turning them into resistances. Currently, the pair is retesting the level of 1.2096 (central pivot level of the day) and 1.2122 (weekly long-term trend). The bears ability to maintain their advantage and update yesterday's low (1.2059) will allow them to continue declining. In this regard, supports of the classic pivot levels are located at 1.2045 - 1.2008 - 1.1957 today. Now, if the key levels (1.2096 - 1.2122) in the hourly chart returns to the bulls' side, then the balance of forces will change again. In this case, the pivot points will be 1.2184 (R2) and 1.2221 (R3).

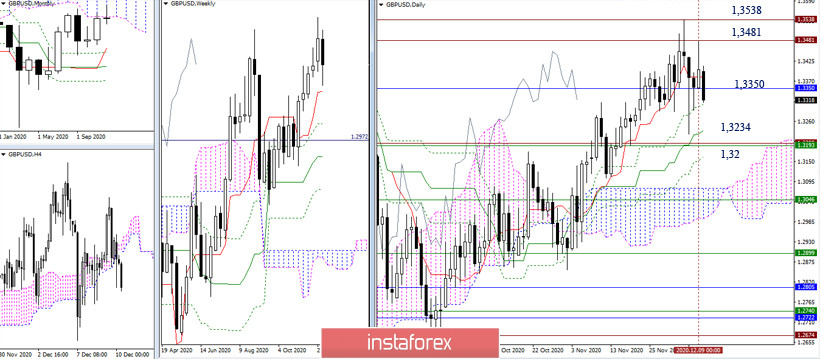

GBP/USD

Yesterday's testing of the resistance zone, indicated earlier in the range of 1.3481 - 1.3538, led to the formation of another rebound, which resumes its development. The levels of the daily cross (1.3381 - 1.3306) and the lower limit of the monthly cloud (1.3350) currently provides attraction. A consolidation below which will open the direction to the daily mid-term trend (1.3234) and the historical level of 1.32, strengthened by the weekly short-term trend (1.3196).

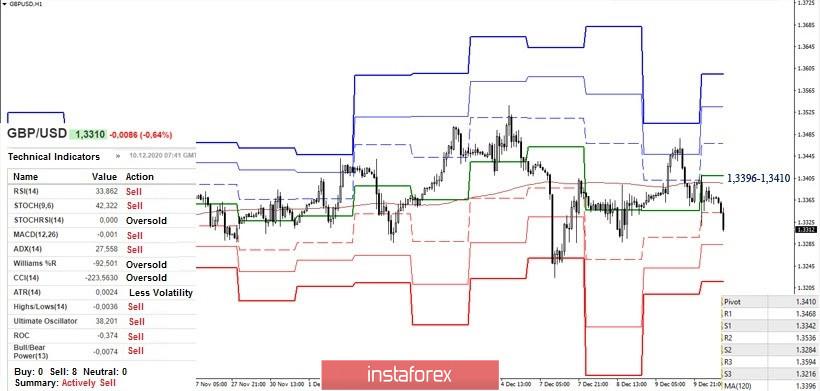

In the smaller time frame, the analyzed technical instruments give preference to the bearish traders. The weakening factor is the lack of directional movement and the long-term presence of the pair within the range of movement of the previous days. Therefore, it is important for players to update the low (1.3224) and securely settle below in the current situation. For the opponent, it will be necessary to go beyond last week's level (1.3538), after recovering the key levels of 1.3396-1.3410 (central pivot level + weekly long-term trend).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română