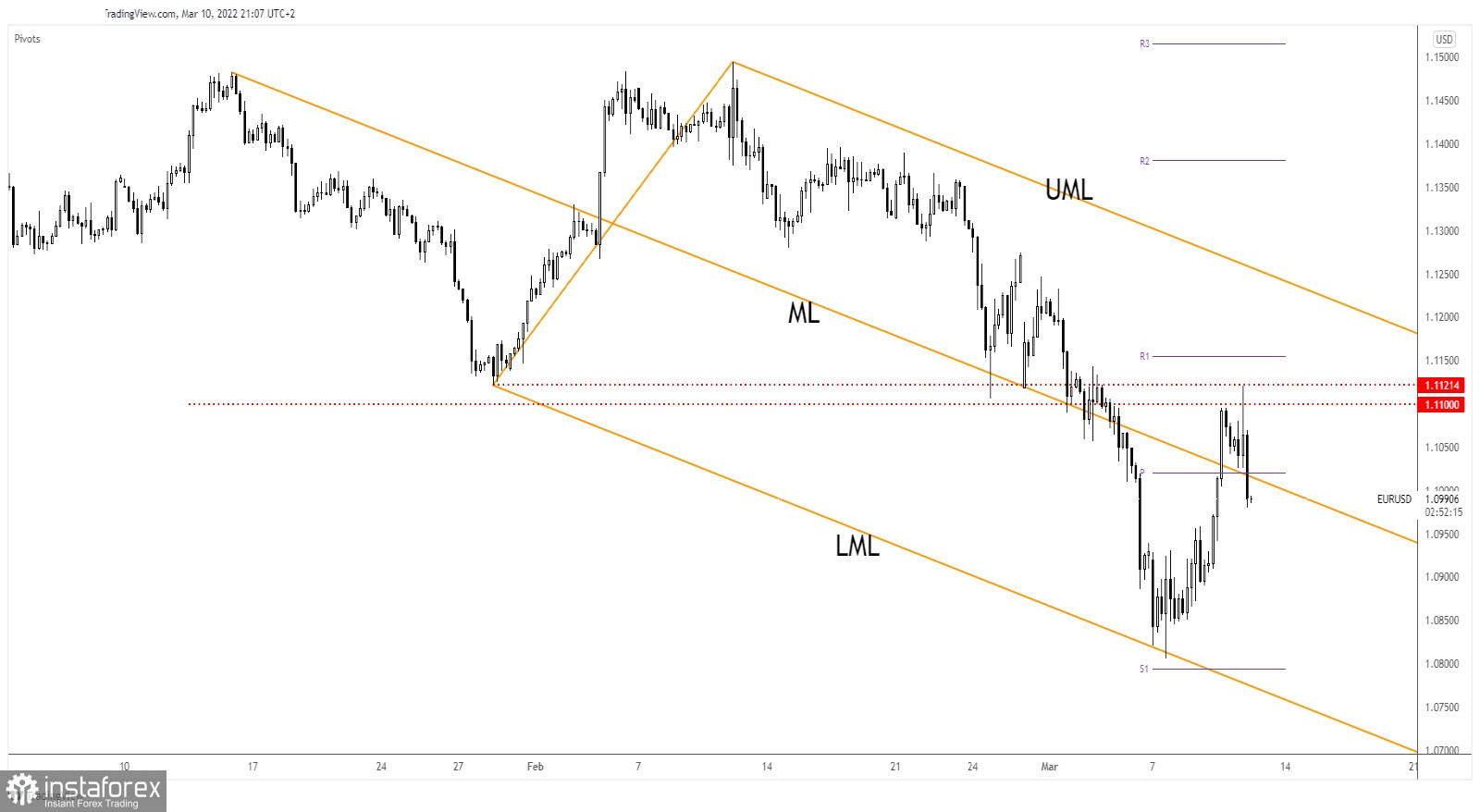

The EUR/USD pair plunges at the time of writing as the Dollar Index has managed to jump higher after the US inflation data publication. In the short term, the currency pair registered a rebound after its last massive drop. Now, the swing higher seems over. EUR/USD is trading at 1.0988 at the time of writing far below 1.1121 today's high.

As you already know, the ECB left its monetary policy unchanged in the March meeting. The Main Refinancing Rate was kept at 0.00% today. The USD rallied and dragged EUR/USD down as the US inflation data came in as expected. The CPI rose by 0.8% matching expectations, while the Core CPI registered a 0.5% in February as forecasted. The USD rallied not because that higher inflation is good but because the Federal Reserve is expected to take action and to hike rates.

EUR/USD Strong Sell-Off!

EUR/USD registered a strong growth after registering only false breakdowns below the lower median line (LML). It has jumped above the median line (ML) but it has found strong resisatnce at 1.1100 - 1.1121 area.

EUR/USD registered only a false breakout with great separation above the 1.11 psychological level signaling that the swing higher is over and that we may have a new sell-off.

EUR/USD Prediction!

The false breakout with great separation above 1.11 followed by the current sell-off below the weekly pivot point of 1.1020 and below the median line (ML) is seen as a short opportunity. Testing and retesting the median line (ML) could help the sellers to go short, to catch a new sell-off.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română