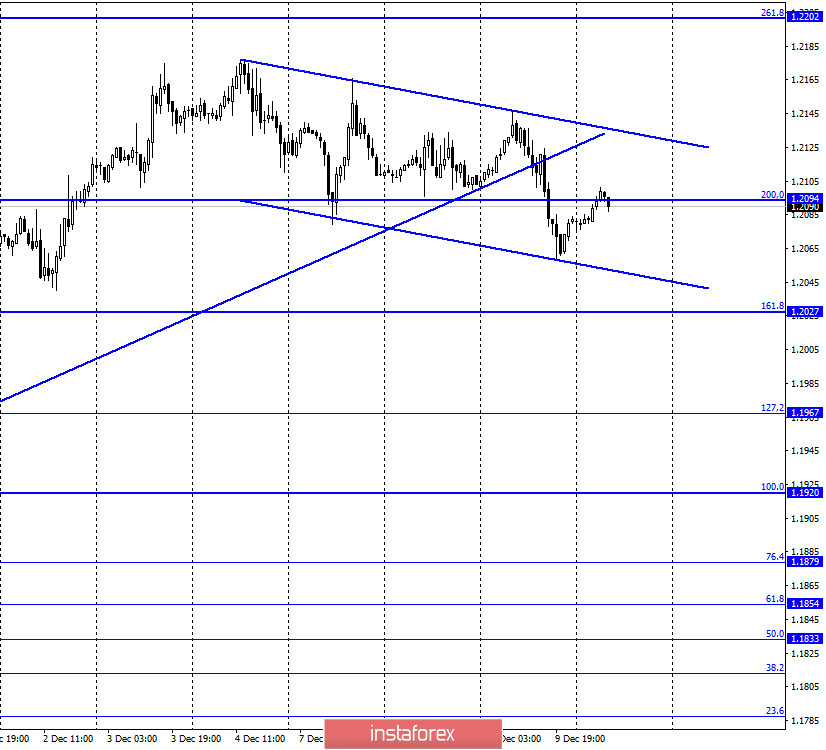

EUR/USD – 1H.

On December 9, the EUR/USD pair continued the process of falling under the Fibo level of 200.0% (1.2094) and performed a reversal in favor of the European currency, and began the growth process. These movements allowed us to build a downward trend corridor, which currently characterizes the mood of traders as "bearish". During the first three business days of the week, there was little news for the euro, and no news for the dollar at all. However, two important events will take place today. First, this is the ECB meeting, and second, the EU summit. However, the summit will be held for two days (at least), so its results will not be known until Friday. Thus, today, traders will fully focus on the results of the ECB meeting and the regulator's press conference. You can immediately note that the key rate (as well as the deposit and credit rates) will remain unchanged. The ECB has never changed rates in 2020. Thus, the regulator is likely to try to influence monetary policy by expanding the quantitative easing program or the program to counter the consequences of the pandemic. Both can be expanded by several hundred billion euros. And in each case, this will be a "bearish" factor for the euro. Also, ECB representatives (Christine Lagarde or Philippe Lane) may again talk about the overbought euro currency. They did this a couple of months ago when the euro was in the range of 1.17-1.19, but now the euro exchange rate is 1.2100. Thus, new talk about the too high value of the euro currency may frighten traders. Well, I don't expect optimistic statements from ECB representatives.

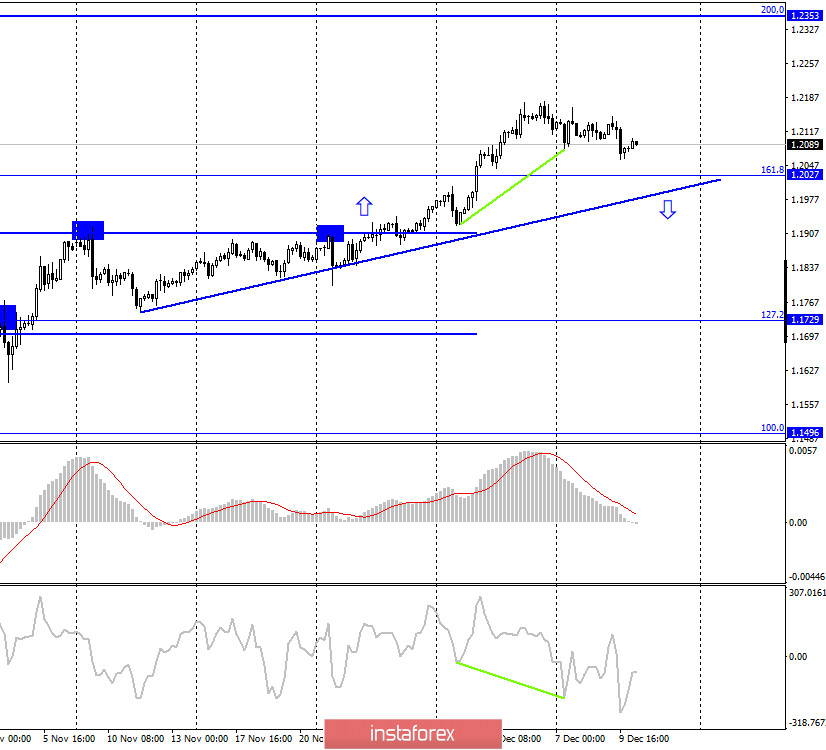

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes started a new process of falling in the direction of the corrective level of 161.8% (1.2027). Bullish divergence canceled. A rebound of the pair's rate from the upward trend line or the level of 161.8% will work in favor of the EU currency and resume growth in the direction of the corrective level of 200.0% (1.2353). Anchoring below the trend line will increase the likelihood of further falls.

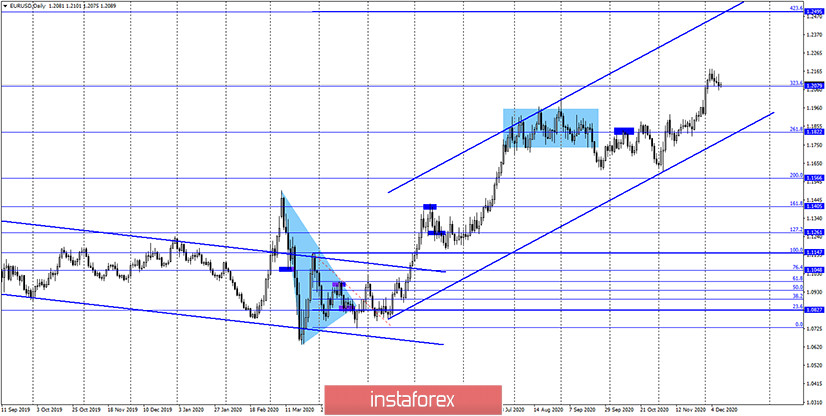

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a consolidation above the Fibo level of 323.6% (1.2079). Thus, the probability of continuing growth in the direction of the next corrective level of 423.6% (1.2495) remains. And until the pair completes the consolidation below the level of 323.6%, there are still high chances of resuming growth.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 9, there were no economic reports or other interesting events in the European Union and the United States. Thus, the information background was very weak.

The news calendar for the United States and the European Union:

EU - publication of the ECB's decision on the main interest rate (12:45 GMT).

EU - ECB press conference (13:30 GMT).

US - consumer price index (13:30 GMT).

US - number of initial and repeated applications for unemployment benefits (13:30 GMT).

On December 10, there will be more interesting events than the day before. The results of the ECB meeting and the US inflation report are something not to be overlooked on Thursday.

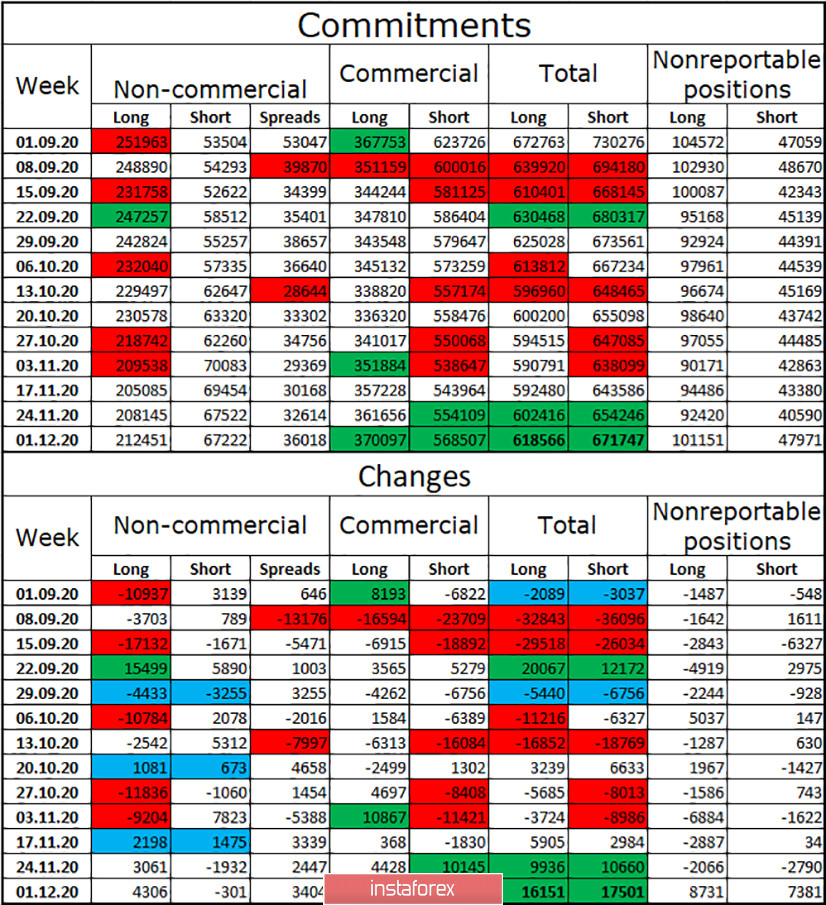

COT (Commitments of Traders) report:

For the third week in a row, the mood of the "Non-commercial" category of traders has become more "bullish". This is indicated by COT reports and it coincides with what is happening now for the euro/dollar pair. During the reporting week, speculators opened 4306 new long contracts and closed 301 short contracts. However, I would like to draw your attention to the fact that in the last two weeks, traders of the "Commercial" category have become very active, who have opened a total of 35 thousand contracts, most of which are short. But I still pay more attention to speculators. Their activity has been low in recent weeks, and purchases of the euro currency are extremely cautious as if forced. I still believe that the upward trend in the euro is nearing its end.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with the target of the Fibo level of 161.8% (1.2027), if a rebound is made from the upper limit of the corridor or the level of 200.0% (1.2094) on the hourly chart. It is recommended to open purchases of the pair with the targets of 1.2175 and 1.2202 if the upward corridor is fixed on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română