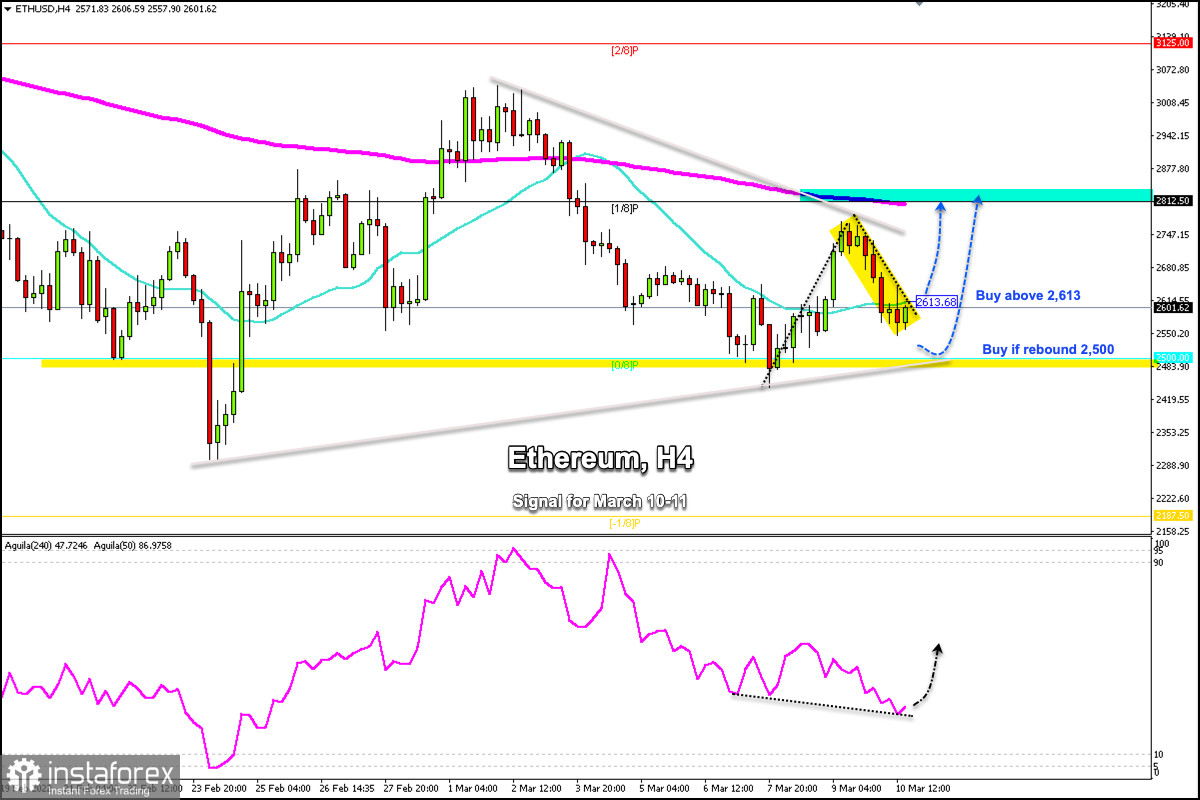

Ethereum (ETH/USD) has formed a symmetrical triangle pattern. This shows a possibility of a massive move in both directions. However, considering the technical side, the probability of a move lower seems more likely for ETH.

There is a probability that in the next few hours Ether will continue to consolidate above 0/8 Murray located at 2,500 and below the EMA 200 and below 1/8 Murray located at 2,812.

A break above 2/8 Murray (3,125) puts the target on the pivot point 4/8 Murray at 3,750, but a move below 2,400 reveals the target at 1,875 (-2/8 Murray).

However, a bullish move is less likely due to the presence of the 200 EMA on the daily chart at 3,040 and the strong resistance of 2/8 Murray at 3,125. Besides, since the beginning of January, Ether has been consolidating below the 200 EMA.

Therefore, a close on 4-hour chart below 2,400 would signal a break and forecast a drop to strong support at 1,875.

In the short term, ETH is expected to bounce around the key level of 2,500, giving us the opportunity to buy with targets at 2,613 and 2,1812. On the other hand, a close on 4-hour chart above the 21 SMA located at 2,613 will be a signal to buy with targets at 2,812 (200 EMA).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română