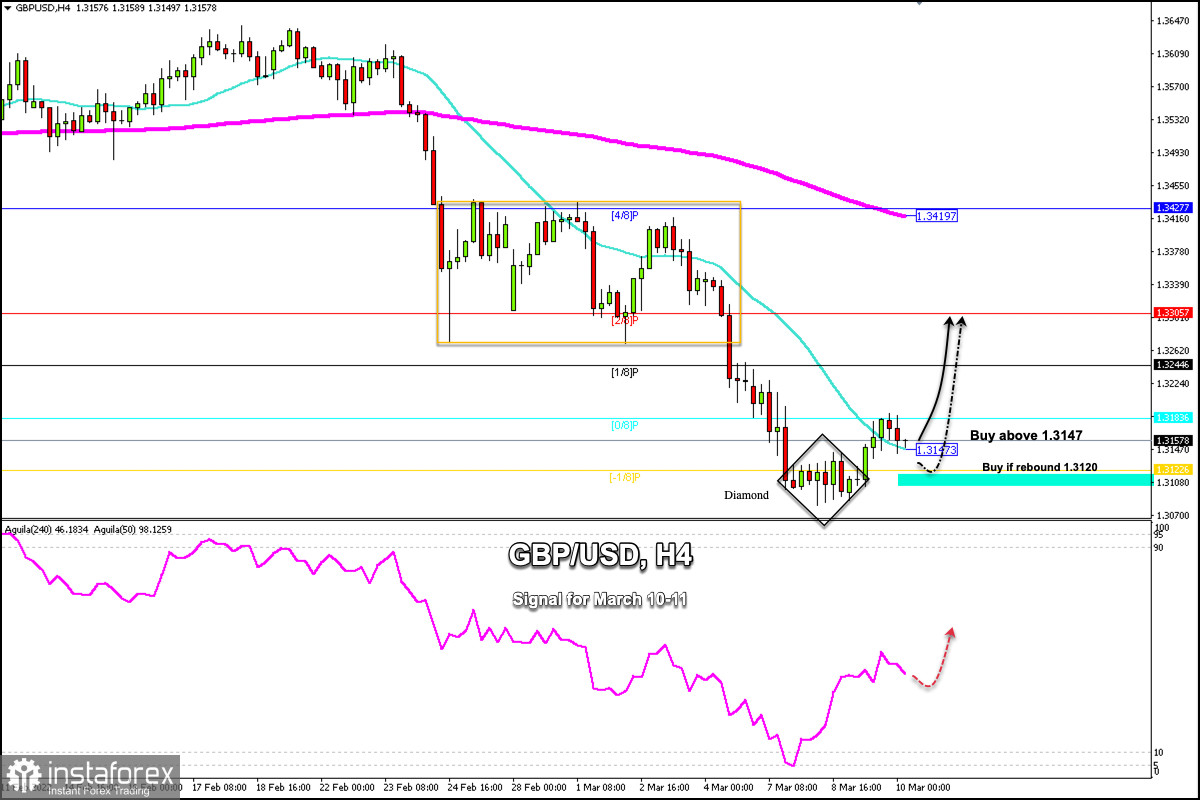

GBP/USD is consolidating above SMA 21 located at 1.3147 and above -1/8 Murray located at 1.3122.

On the 4-hour chart, we can see the formation of a diamond. This pattern could offer the pound an opportunity to recover and rally to the resistance zone of 2/8 Murray around 1.3305.

GBP/USD is trading above the 21 SMA but has a strong barrier at 0/8 Murray at 1.3183. Profit-taking by investors pushes major commodity prices back from recent highs, giving the pound the impetus to consolidate above 1.31.

In the European session, GBP/USD rose as high as 1.3187 but struggled to extend gains as a result of a solid resistance barrier in the area 0/8 Murray. A sharp break above this level on the 4-hour chart could accelerate the upside momentum and the price could reach 1.3244 and 1.3305.

US CPI consumer price index data will be released in the morning of the American session. Annual CPI inflation is projected to rise to a new multi-decade high of 8.0% from 6.0%. A stronger-than-expected CPI could strengthen the US dollar and the pound could tumble below 1.3100.

Investors are still not convinced that there will be a diplomatic solution to the conflict between Russia and Ukraine. Therefore, the closer the British pound gets towards the 200 EMA located at 1.3497, it will be an opportunity to sell in the coming days.

On March 7, the eagle indicator touched the extreme oversold zone around 5-points. This gave the pound a chance to rally above 1.3081. In the next few hours, the uptrend is likely to continue until the pair reaches the resistance zone 2/8 Murray at 1.3305.

Our trading plan for the next few hours is to buy the pound sterling as long as it settles above the 21 SMA with targets at 1.3200, 1.3244, and 1.3305. Besides, a technical bounce around -1/8 Murray and as long as it stays above this level will also be an opportunity to buy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română