The AUD/USD pair continues to gain momentum, approaching the level of 0.75. At the moment, the Australian dollar is testing the resistance level of 0.7480 (upper line of the Bollinger Bands indicator on the daily chart). The breakdown of which will open the way to the next price resistances – 0.7500 and 0.7550 (upper line of the Bollinger Bands on the monthly chart, coinciding with the lower limit of Kumo clouds).

The upward trend of the indicated pair is still strong, so it is very likely that the Australian currency will reach higher peaks in the near future. It should be recalled that the pair is growing not only due to the US dollar's general weakness, but also due to the Australian dollar's strengthening. On the other hand, RBA's rhetoric is pushing up the AUD, with the USD bulls' approval, which failed to reverse the trend.

During last Friday's Asian session, there was a publication of Reserve Bank of Australia's quarterly report, which turned out to be quite good, despite the listed risks and concerns about a slow recovery of the labor market. The central bank focused on the high level of underemployment once again, predicting that the unemployment rate would be above 6% for another one and a half to two years. According to the indicator, this fact will be reflected in the dynamics of wages growth. At the same time, economists calculated that wages are expected to grow by less than 2% in the coming year and 2022; whereas, inflation growth in basic terms will only be 1% next year and 1.5% in 2022, which is significantly lower than the RBA's inflation target.

It was shown that the above arguments are pessimistic. However, the following conclusions of the regulator in the context of the RBA's monetary policy prospects allow traders to ignore this pessimism, especially amid the latest published data on the growth of the Australian labor market. It should be recalled that the growth rate in the number of employed soared, reaching 178 thousand (against the forecasted decline of 29 thousand). This is the strongest growth rate since June this year, when Australia began to lift the lockdown, and this despite the fact that the latest data cover in that period is when Victoria, largest state in the country, observed strict quarantine – in particular, curfew was in effect in Melbourne with almost 5 million population. Given this fact, we can assume that the next Australian Non Farms will show a stronger result.

Moreover, RBA members admitted in a report released today that the Australian economy is recovering at a faster pace than earlier forecasts, despite the voiced risks and concerns. A good argument in this case is the released data on the country's economic growth in Q3. Here, the key indicators appeared in the "green zone", significantly exceeding the forecast values. As one of the RBA's representatives recently noted, the coronavirus crisis affected the Australian economy very much, but the worst-case scenario did not happen in the country. The regulator made it clear that it will maintain a wait-and-see attitude in the coming months.

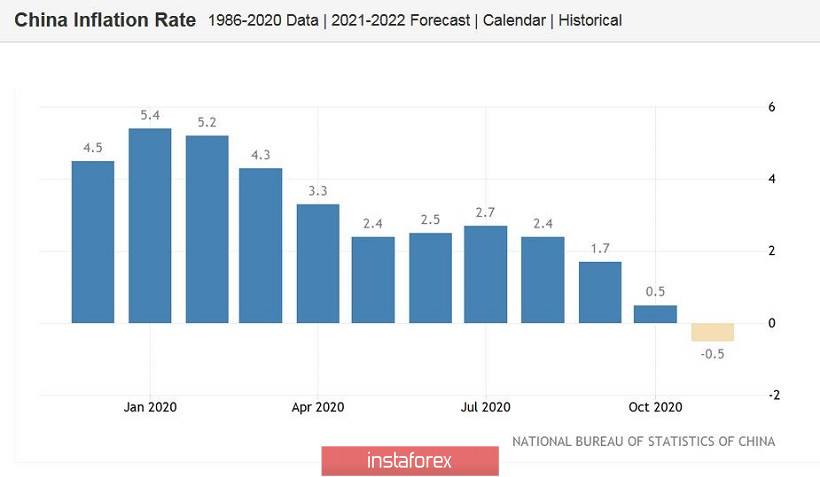

As a result, AUD/USD traders did not focus on the pessimistic ideas of the document. In general, buyers of the pair have recently shown an amazing "stress tolerance": for example, they ignored China's weak data yesterday. China's deflation was recorded for the first time in the past 11 years. The November CPI came out at -0.5%, last time such dynamics was at such lows was during the global economic crisis of 2008-2009. As a rule, the Australian dollar reacts quite sharply to the declines of the Chinese indicators, especially since we are talking about a multi-year anti-record. However, it only showed a slight correction, and resumed its growth just a few hours later. This suggests that AUD/USD buyers use corrective pullbacks to open longs, thereby pushing the pair to new price levels.

The US dollar, in turn, enjoys occasional demand only during periods of uncertainty and/or amid rising anti-risk sentiments. Yesterday, USD bulls tried to take the lead, taking advantage of the situation in the US Congress. The fact is that Congressmen continue to argue over the scale of the stimulus package. Democratic representatives believe that the amount of support should exceed $ 2 trillion, while the Republicans insist on the amount of no more than one billion. The debate around this issue has been going on for months, so the reaction of traders has somewhat dulled. For this reason, the dollar bulls were unable to develop a large-scale offensive yesterday, limiting themselves to a modest correction. Nevertheless, the AUD/USD pair continued upwards.

Today, all the attention of the pair's traders will be focused on the data about US inflation growth. According to forecasts, the general consumer price index on monthly terms in November should reach 0.1% (after falling to zero), and rise to 1.3% in annual terms. At the same time, core inflation should show similar dynamics: + 0.2% in monthly terms and growth to 1.6% in annual terms. The forecasts are relatively good, but there is also a downside. If traders' expectations on inflation are not met, the US dollar might be under significant pressure again. This fact will allow AUD/USD buyers not only to break through the resistance level of 0.7480, but also enter the area of 0.75 level.

Thus, if we talk about the medium-term period, we can consider longs from the current position, with the first target of 0.7480 and the main target of 0.7550. The technical prospect of AUD/USD pair also talks about the priority of buy: the pair is located between the middle and upper lines of the Bollinger Bands indicator, as well as above all the lines of the Ichimoku indicator on the H4, D1 and W1 time frames.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română