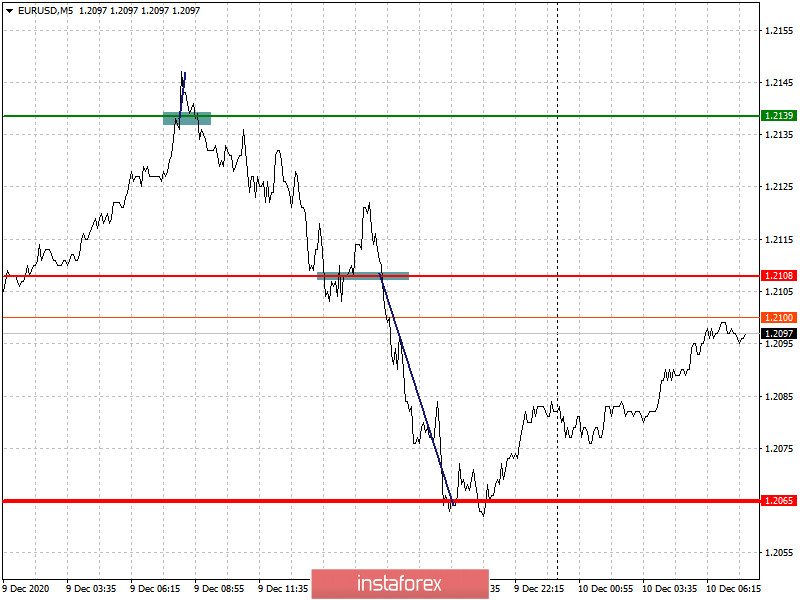

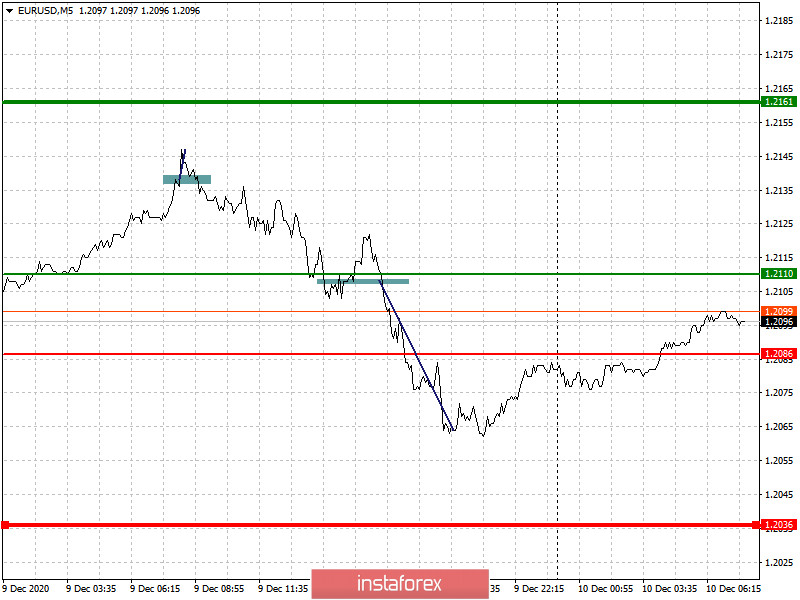

Analysis of transactions in the EUR / USD pair

Long positions from 1.2139 did not bring much profit, because after a slight increase from this area, the market stopped and then completely reversed. This indicates that pressure on the euro remains, especially ahead of the ECB meeting, during which significant adjustments to the economic stimulus program may be made. As for the short positions from 1.2108, they brought a rather tangible profit of about 40 pips, which completely covered the losses from the earlier transactions.

Trading recommendations for December 10

The European Central Bank will hold a meeting today, during which significant adjustments to the economic stimulus program may be made. There are also rumors that the ECB will resort to verbal intervention, and this will further weaken the position of the euro in the market. But if Christine Lagarde does not announce any of this in her statements, then the demand for the euro will quickly return, since the risk appetite in the market is quite high at the moment.

At the same time, reports on US inflation and labor market will be published, at which many expect that the number of jobless claims have continued growing due to the raging coronavirus pandemic. However, such weak performance will lead to a fall in the US dollar, and accordingly, an increase in the euro.

- Open a long position when the euro reaches a quote of 1.2110 (green line on the chart) and then take profit at the level of 1.2161. However, growth can only happen if the ECB does not make major changes in its monetary policy.

- Open a short position when the euro reaches a quote of 1.2086 (red line on the chart) and then take profit around the level of 1.2036. However, do this only if Christine Lagarde hints at the introduction of negative interest rates.

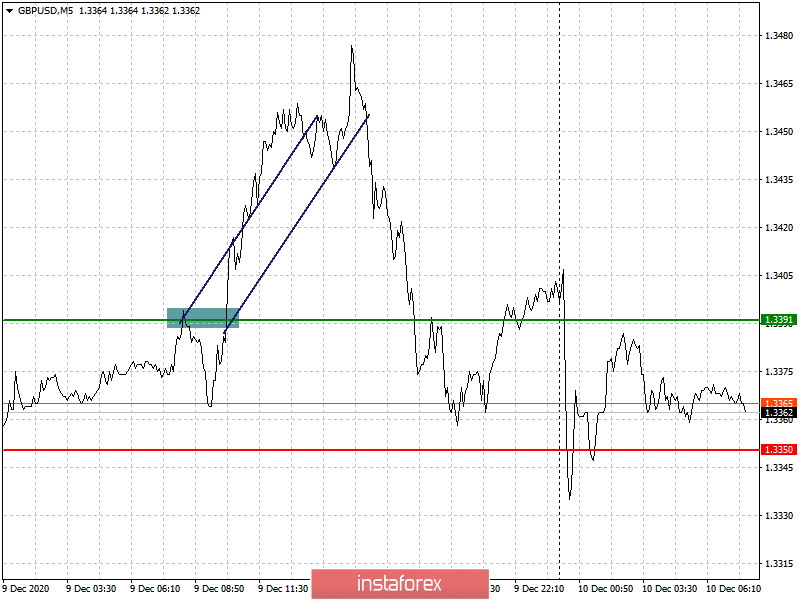

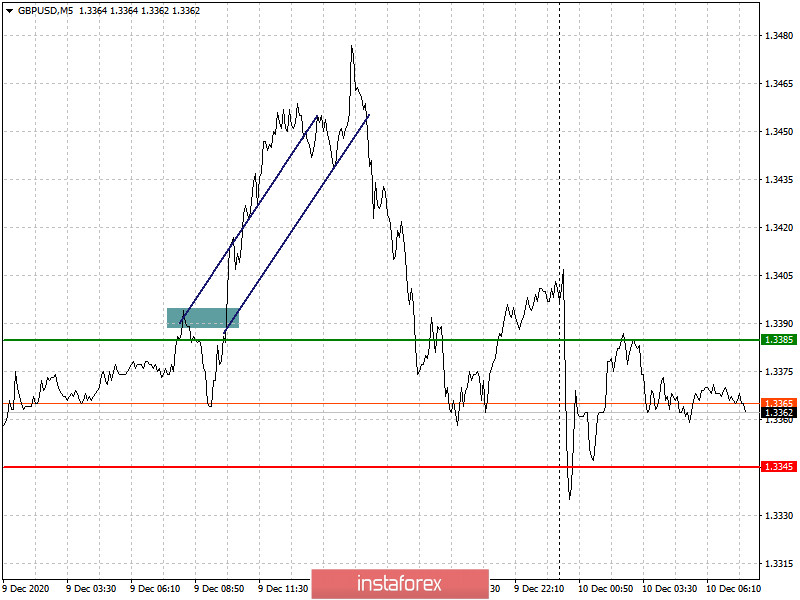

Analysis of transactions in the GBP / USD pair

Yesterday, the pound rose on optimism that Boris Johnson and Ursula von der Leyen will be able to conclude a deal. However, as it turned out, the hope did not come true. Nonetheless, the test of 1.3391 has led to a rather large increase by more than 70 pips, but until an agreement is signed, a larger upward move in the pound can hardly be expected.

Trading recommendations for December 10

The decision to continue negotiations until the end of this week was knocked down by volatility, which led to the GBP / USD pair hanging in a sideways channel. Although the meeting between Johnson and Leyen was unsuccessful, the market was not very upset and many traders are still betting on the further strengthening of the pound. If the issue on fishing is resolved, the currency will receive more support from major players, which will lead to a new wave of growth in the GBP / USD pair.

In the meantime, today, a report on UK GDP and industrial production will be published, the data of which may exert some pressure on the British pound, especially if the reports come out worse than the forecasts.

- Open a long position when the quote reaches the level of 1.3385 (green line on the chart) and then take profit around the level of 1.3544 (thicker green line on the chart). Good news on Brexit, as well as good data on UK GDP, may strengthen the position of the British pound.

- Open a short position when the quote reaches the level of 1.3345 (red line on the chart) and then take profit around the level of 1.3227. Bad news on Brexit will resume the downward trend in the GBP/USD pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română