EUR / USD

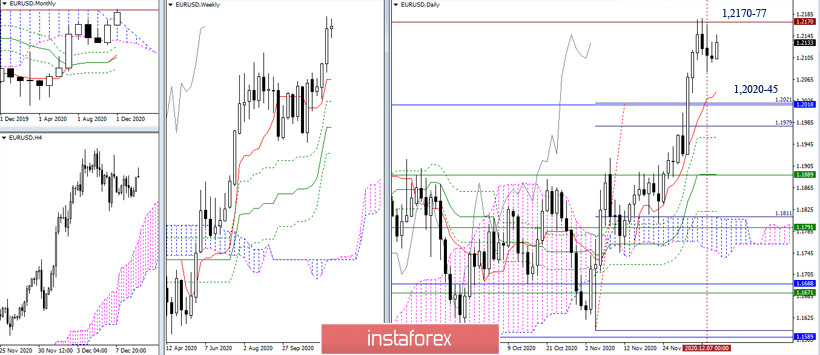

The pair is not in a rush to develop a corrective decline. The daily short-term trend has slightly moved forward today, so the support zone has been expanded to 1.2020-45 (daily Tenkan + monthly Senkou Span B + 100% of the daily target). If the bulls find the strength to complete the correction (highest extremum of the correction is 1.2177) and manage to securely consolidate above, continuing the upward trend, then new prospects will be considered. The nearest pivot point will be the level of 1.2555.

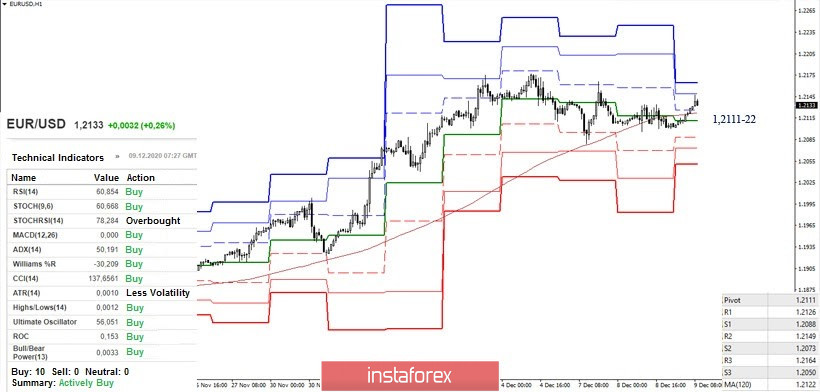

The uncertainty in the higher time frame has led to the fact that the pair works in the attraction zone of key levels in the smaller time frames, alternately moving away from them only for insignificant distances. The key levels in the smaller time frames are currently located in the area of 1.2111-22 (central pivot level + weekly long-term trend). The intervals of intraday support and resistance, formed by classic pivot levels, are narrowed today. The resistance levels can be noted at 1.2149 (R2) - 1.2164 (R3), while support levels are at 1.2088 (S1) - 1.2073 (S2) - 1.2050 (S3).

GBP / USD

The attempt of the bears failed again and so they had to return to the monthly cloud (above 1.3350) by the close of the day. As a result, the situation has not changed dramatically. The main conclusions and expectations remain the same. On the other hand, the zone of 1.3381 - 1.3350 (daily Tenkan + monthly Senkou Span A) is now the center of attraction and influence. The nearest resistances are located within 1.3481 - 1.3538 (maximum extremes), while the most significant supports are combined around 1.32 (historical level + weekly Tenkan). Today's closest support levels are found at 1.3299 (daily Fibo Kijun) and 1.3225 (daily Kijun).

The pair spends most of its time near the key levels of the smaller time frame, which are joining forces today around 1.3345 -89 (central pivot level + weekly long-term trend) and have support from the larger time frames (1.3350-81). Moving above this attraction zone will lead to the strengthening of the bullish moods. In view of this, the resistance levels of 1.3449 (R2) - 1.3505 (R3) can serve as pivots within the day.

On the contrary, a decline to the levels (1.3345-89) and a reliable consolidation below will give bears the advantage. Their supports, in the form of classic pivot levels, are located today at 1.3297 - 1.3241 - 1.3193.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română