Outlook on December 9:

Analytical overview of major pairs on the H1 TF:

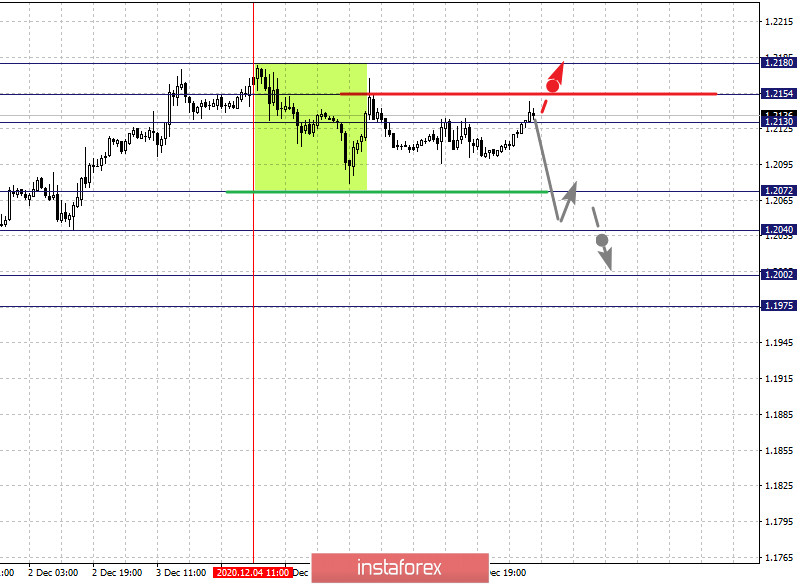

The key levels for the euro/dollar pair are 1.2180, 1.2154, 1.2130, 1.2072, 1.2040, 1.2002 and 1.1975. The price is in the correction from the upward trend and forms the potential trend for the low from December 4. Therefore, the downward trend is expected to resume after breaking through the level of 1.2072. In this case, the first target is 1.2040. There is consolidation near this level. Now, if the first target breaks down, it will lead to the development of a strong decline. The next target is 1.2002. For the potential target at the bottom, we consider the level of 1.1975. Price consolidation and upward pullback are expected upon reaching this level.

Short-term growth, in turn, is possible in the range of 1.2130 - 1.2154. In case that the last value breaks down, it will encourage the formation of a local upward trend. The first potential target here is 1.2180.

The main trend is the local upward trend of November 23, correction stage

Trading recommendations:

Buy: 1.2130 Take profit: 1.2153

Buy: 1.2155 Take profit: 1.2180

Sell: 1.2072 Take profit: 1.2042

Sell: 1.2038 Take profit: 1.2002

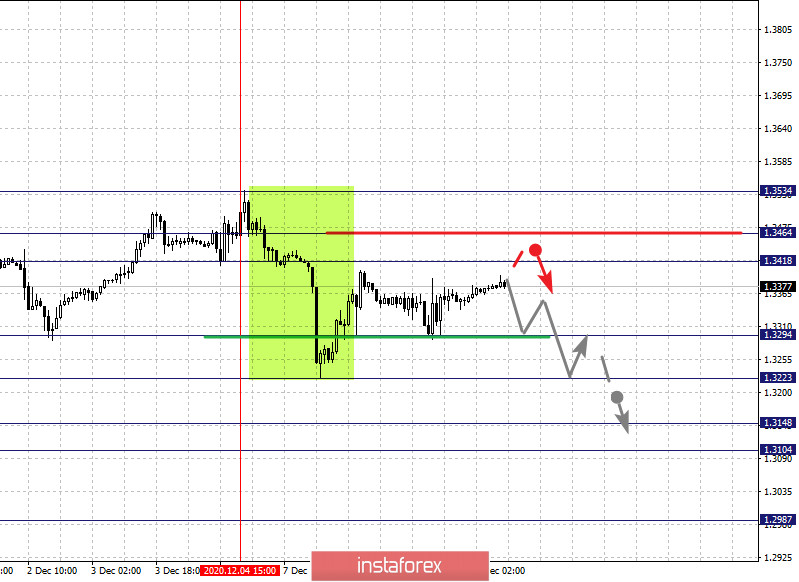

The key levels for the pound/dollar pair are 1.3534, 1.3464, 1.3418, 1.3294, 1.3223, 1.3148, 1.3104 and 1.2987. Here, the price of the pair is forming potential initial conditions for the December 4th downward trend. Now, we expect the decline to continue after the level of 1.3294 breaks down. In this case, the target is 1.3223 and price consolidation is around this level. If the indicated target breaks down, it will lead to a strong decline. In this case, the next target is 1.3148. On the other hand, there is a short-term decline and consolidation in the range of 1.3148 - 1.3104. For the further potential downward target, the level of 1.2987 is considered. Upon reaching this level, upward pullback is expected.

Meanwhile, the key support for the downward trend is the range of 1.3418 - 1.3464. The price overcoming this level will encourage the development of an upward trend. In this case, the first potential target is 1.3534.

The main trend is building capacity for the downward trend of December 4

Trading recommendations:

Buy: 1.3418 Take profit: 1.3463

Buy: 1.3465 Take profit: 1.3534

Sell: 1.3294 Take profit: 1.3225

Sell: 1.3221 Take profit: 1.3150

The key levels for the dollar/franc pair are 0.8963, 0.8928, 0.8901, 0.8868, 0.8849, 0.8804 and 0.8772. The development of the downward cycle from November 30 is monitored here. In this regard, we expect the decline to continue after the price overcomes the noise range of 0.8868 - 0.8849. In this case, the target is 0.8804. For the potential target on the downside, we consider the level of 0.8772. Upon reaching which, price consolidation and upward pullback can be expected.

On the other hand, short-term increase is possible in the range of 0.8901 - 0.8928. If the last value breaks down, a deep correction will occur. Here, the target is 0.8963, which is the key support level for the local downward trend from November 30.

The main trend is the local downward trend of November 30

Trading recommendations:

Buy : 0.8901 Take profit: 0.8927

Buy : 0.8929 Take profit: 0.8961

Sell: 0.8848 Take profit: 0.8805

Sell: 0.8803 Take profit: 0.8773

The key levels for the dollar/yen are 104.77, 104.52, 104.27, 104.11, 103.89, 103.64, 103.44, 103.30, 102.89 and 102.59. The price here is forming a potential downward trend from December 2. Therefore, the downward movement is expected to continue after breaking through the level of 103.89. In this case, the first target is 103.64. Breaking through which will allow us to move to the next target of 103.44. There is consolidation near this level. Meanwhile, the price overcoming the noise range of 103.44 - 130.30 will lead to the development of a strong decline. In this case, the target is 102.89. As a potential target below, the level of 102.59 is considered. Price consolidation and upward pullback is likely after reaching this level.

In turn, a consolidated upward movement is possible in the range of 104.11 - 104.27. If the last value breaks down, it will lead to a deep correction. The target here is 104.52, which is the key support level for the downward trend from December 2.

The main trend is the downward trend from December 2

Trading recommendations:

Buy: 104.11 Take profit: 104.26

Buy : 104.28 Take profit: 104.50

Sell: 103.64 Take profit: 103.45

Sell: 103.30 Take profit: 102.90

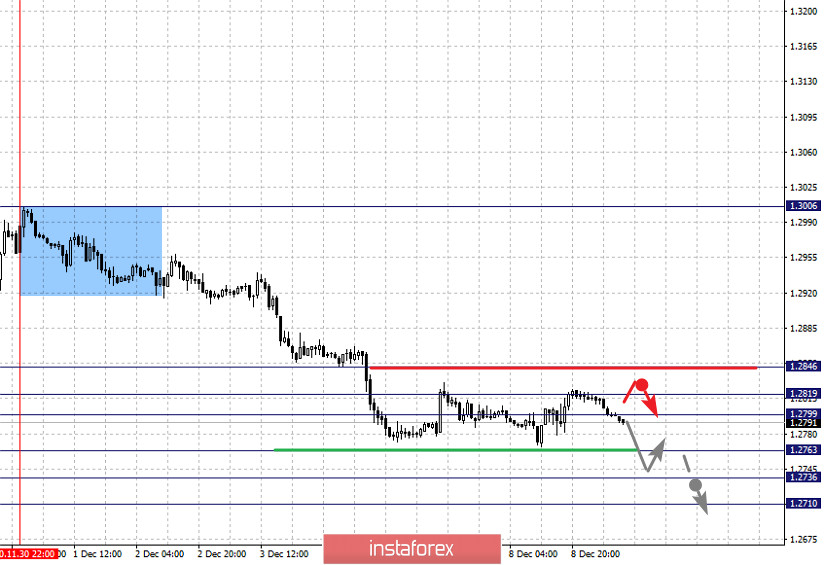

The key levels for the USD/CAD pair are 1.2846, 1.2819, 1.2799, 1.2763, 1.2736 and 1.2710. Here, the continuation of the downward trend from November 30 is being followed. In this regard, a short-term decline is expected in the range of 1.2763 - 1.2736. Given that the last value breaks down, it will lead to the potential target of 1.2710. Upon reaching this level, an upward pullback can be expected.

Meanwhile, short-term growth is possible in the range of 1.2800 - 1.2819. In case that the last value breaks down, a deep correction will further develop. Here, the target is 1.2846, which is the key support level for the downward trend from November 30.

The main trend is the formation of a local downward trend from November 30

Trading recommendations:

Buy: 1.2800 Take profit: 1.2818

Buy : 1.2821 Take profit: 1.2846

Sell: 1.2763 Take profit: 1.2737

Sell: 1.2735 Take profit: 1.2710

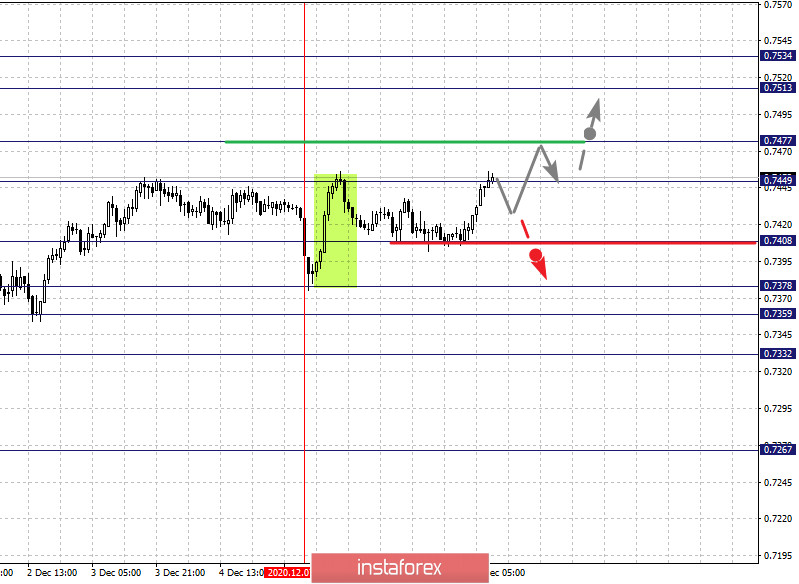

The key levels for the AUD/USD pair are 0.7534, 0.7513, 0.7477, 0.7449, 0.7408, 0.7378, 0.7359 and 0.7332. The local bullish trend from November 23 is pursued here. Thus, short-term growth is expected in the range of 0.7449 - 0.7477. In case that the last value breaks down, it will lead to a strong growth. The target here is 0.7513. For the upward potential value, we consider the level of 0.7534. Price consolidation and downward pullback is expected after this level is reached.

Leaving into a correction, in turn, is expected after the level of 0.7408 breaks down. The next target is 0.7378. On the other hand, the range of 0.7378 - 0.7359 is the key upward support and the price passing this level will encourage the formation of initial conditions for a downward trend. In this case, the potential target is 0.7332.

The main trend is the upward trend from November 23, local potential upward trend from December 7

Trading recommendations:

Buy: 0.7450 Take profit: 0.7475

Buy: 0.7478 Take profit: 0.7513

Sell : 0.7406 Take profit : 0.7380

Sell: 0.7357 Take profit: 0.7332

The key levels for the euro/yen pair are 127.14, 126.80, 126.44, 126.19, 125.75, 125.36 and 125.17. Here, the price is in the correction from the upward trend and forms the potential downward trend from December 4. In view of this, we expect decline to continue after breaking through the level of 125.75. In this case, the target is 125.36. At the moment, we consider the level of 125.17 as a potential target below, near which price consolidation is expected.

On the other hand, a consolidated movement is expected in the range of 126.26 - 126.04. The breakdown of the last value will encourage the formation of a local upward trend. Here, the first target is 126.80. For the potential upward target, we consider the level of 127.14. Upon reaching which, consolidation as well as downward pullback are expected.

The main trend is the formation of potential downward trend from December 4

Trading recommendations:

Buy: Take profit:

Buy: 126.82 Take profit: 127.14

Sell: 125.75 Take profit: 125.37

Sell: 125.35 Take profit: 125.18

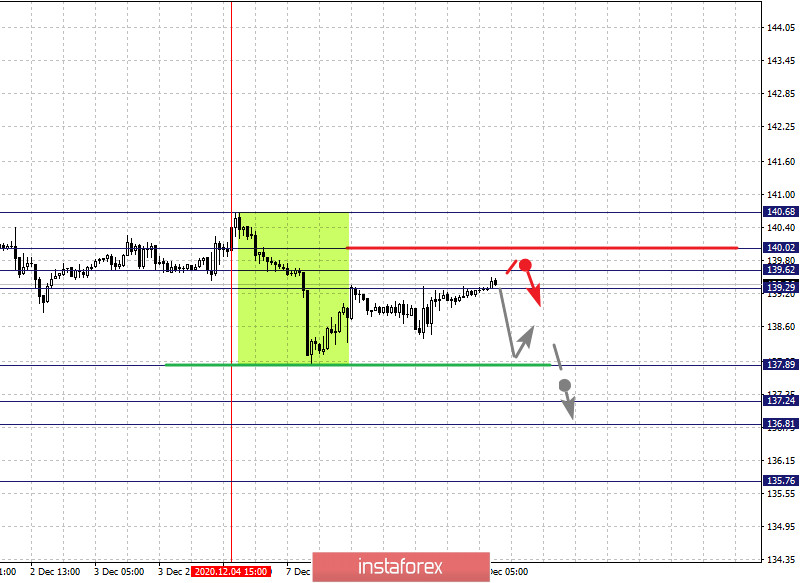

The key levels for the pound/yen pair are 140.02, 139.62, 139.29, 137.89, 137.24, 136.81 and 135.76. The price forms the strong initial conditions of the downward trend of December 4. Against this background, the downward trend is expected to continue after breaking through the level of 137.89. In this case, the target is 137.24. On the other hand, short-term decline and consolidation are considered in the range of 137.24 - 136.81. If the last level breaks down, it should be accompanied by a strong decline towards the potential target - 135.76, from which an upward pullback can be expected upon reaching it.

Short-term growth is possible in the range of 139.29 - 139.62. In case that the last value breaks down, a deep correction will occur. The target here is 140.02, which is the key support level for the downward trend.

The main trend is the formation of initial conditions for the downward trend from December 4

Trading recommendations:

Buy: 139.40 Take profit: 139.60

Buy: 139.63 Take profit: 140.01

Sell: 137.89 Take profit: 137.25

Sell: 137.23 Take profit: 136.83

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română