4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: -15.8310

The second trading day of the week for the EUR/USD pair was spent in the same futile attempts to correct normally against the upward trend. However, the moving average line failed to work out again during the day. As you can see, the bears remain extremely weak, as well as the demand for the US currency. Thus, now in the truest sense of the word, everything depends on the buyers. How long are they willing to keep long positions open and increase them? The final duration of the upward trend depends on the answer to this question. So far, we see that the bulls do not even take profits on open positions, so it is extremely difficult for the euro/dollar pair to even correct. At the same time, the fundamental background for the pair practically does not change from day to day. Therefore, it is impossible to draw a conclusion about the growth of the euro currency based on the deteriorating fundamental background for the dollar. Recently, some analysts have begun to link the current fall in the US dollar to the saturation of the Fed and Congress of the US economy with freshly printed dollars. However, we would like to remind you that it is not only the American economy that is flooded with cash. The same path is followed by the governments of the United Kingdom and the European Union. Perhaps the amount is less, however, the economy of the Alliance and the Kingdom is less.

The most interesting thing (and we have already focused the attention of traders on this) is that there are absolutely no important messages or news coming from America right now. Traders continue to ignore macroeconomic statistics. They also continue to ignore the general macroeconomic background (the fact that the European economy is beginning to show signs of slowing down in the fourth quarter, in contrast to the US). But the general fundamental background is now zero. Donald Trump is making last-ditch attempts to seize power from Joe Biden or rather not give it to him. Several US media outlets reported that the US President even called personally high-ranking officials of the States of Pennsylvania and Michigan to find out how to cancel or change the election results. However, in both cases, he received a response that state law does not have the ability to change the results of the popular vote. In total, Donald Trump and his team made 30 attempts to challenge the election results through the courts, and all lost thirty times. Meanwhile, in America, the process of transferring power to the Joe Biden team is in full swing, and this is probably why there is a certain information void.

More interesting events are currently unfolding in the European Union. They are not only interesting but also dangerous for the entire Alliance and its economy. We have already mentioned that Poland and Hungary vetoed a package of legislative projects that includes a 750 billion euro economic recovery fund after the pandemic, a seven-year EU budget of 1.1 trillion euros, and a new "rule of law mechanism" that allows the European Commission to cut funding for states whose authorities do not adhere to the principle of democracy and exceed their powers. As of today, the veto has not been lifted, and negotiations with the troublemaking countries are continuing. Many political analysts believe that Hungary and Poland will eventually succumb to the onslaught of the European authorities. The problem is that the budget and the recovery fund can be approved and adopted without Poland and Hungary. But funding for these countries will definitely not be available without their approval. Given that both countries should receive only a few tens of billions of euros in grants from the recovery fund, it is unlikely that the leaders of these countries are ready to go all the way. Most likely, some decisions will be made during the negotiations. At the same time, it is still very difficult to understand how the "rule of law mechanism" can be changed to suit Warsaw and Budapest.

Polish and Hungarian diplomats believe that the European Union faces collapse if Brussels continues to impose its will on individual countries while violating treaties and rules. According to other information, EU countries will only be able to accept the recovery fund, and the budget for 2021-2027 will remain blocked due to the vetoes of Poland and Hungary. If this is true, then Warsaw and Budapest have a more serious bargaining chip in their hands. The fact is that if the EU authorities do not find a way to circumvent the veto on the EU budget, then funding will not start for all countries. Of course, there is a reserve fund for this case, from which 25 countries will be financed for the first time. But it will not last long, so you can't do without the approval of Poland and Hungary. Earlier this week, the foreign ministers of the troublemaking countries held a personal meeting, during which they decided not to withdraw the veto and support each other. Thus, the situation in the European Union is heating up, and we can only watch its development.

Meanwhile, the euro/dollar pair has excellent chances to continue its upward movement. Despite the fact that COT reports have been signaling a new downward trend for several months. Despite the fact that it is still very difficult to find fundamental or macroeconomic factors that would continue to force traders to buy the euro and sell the dollar. The technical picture remains unchanged. Well, based on the movement of the pair in the last couple of days, we can conclude that sellers are not eager to fight at all, and buyers are not retreating from the market. So, given the current upward trend, it's hard to imagine what would happen for markets to suddenly change their mindset. Therefore, we continue to recommend trading higher, as there are no signs of the beginning of a downward movement now. And trying to guess a downward turn on such a strong upward trend is a thankless task.

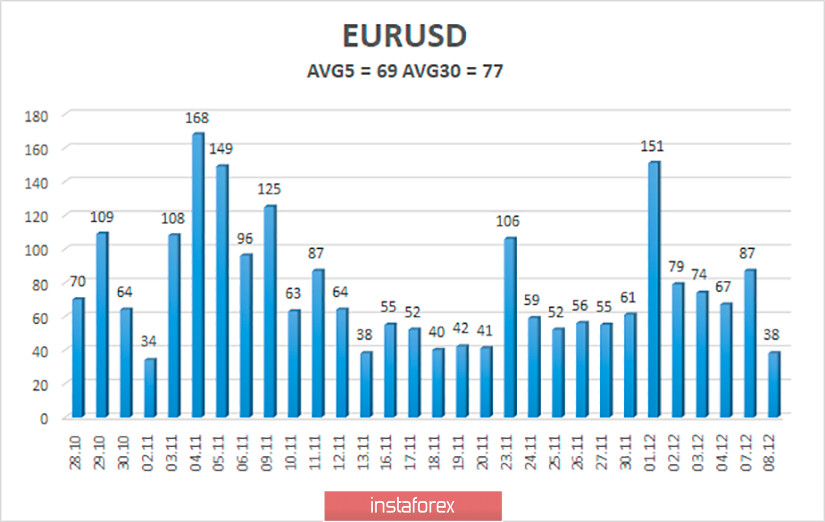

The volatility of the euro/dollar currency pair as of December 8 is 69 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.2042 and 1.2180. A reversal of the Heiken Ashi indicator to the top signals a new round of upward movement.

Nearest support levels:

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading recommendations:

The EUR/USD pair continues to be adjusted. Thus, today it is recommended to open new buy orders with a target of 1.2180 and 1.2207 if the Heiken Ashi indicator turns up again. It is recommended to consider sell orders if the pair is fixed below the moving average with targets of 1.2042 and 1.1963.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română