Past review of GBP/USD pair

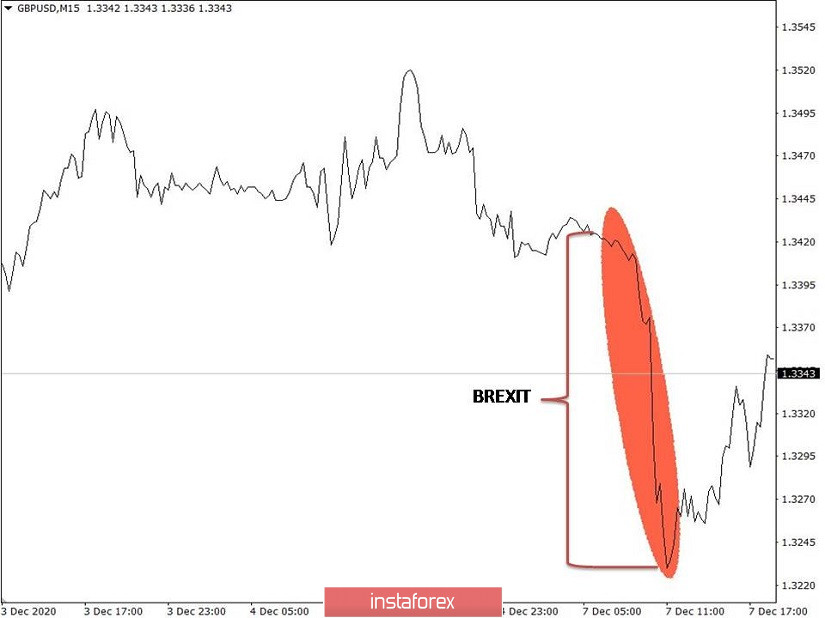

The pound showed very high activity yesterday. As a result, the quotes initially collapsed, and then recovered to previous levels.

What was published on the economic calendar?

Nothing interesting was published in the UK in terms of statistics, similarly in the United States.

What caused such high activity in the market?

This is due to the prolonged Brexit process, where England and Brussels cannot agree on a trade agreement in any way. The tight deadlines for negotiations lead to the fact that speculators begin to panic buy and sell the pound, depending on the incoming information.

Yesterday, there was information about the lack of progress in the negotiations, which led to the pound's rapid decline by more than 200 points.

Many traders expected the reaction of the market, so it was easy to earn 100-150 points in just a few hours.

What happened on the trading chart?

The pound sharply fell at the beginning of the European session, which resulted in the quotes' decline to the level of 1.3225 even before noon, where a stop occurred followed by a recovery.

Such a sharp decline in the pound's value in a short period of time was noticed. Thus, the recovery process began almost immediately, where the quote returned to the level of 1.3400 at the end of the day, where it started almost from this point.

Past review of EUR/USD pair

The euro showed less activity yesterday compared to the pound, but there was still a characteristic downward interest.

What was published on the economic calendar?

Statistics from Europe were not published and so, the market was sharply driven by the information noise flow, particularly news on the Brexit trade negotiations.

What happened on the trading chart?

The quote followed the pound at first, dropping the euro rate to the level of 1.2080. After that, a stop occurred with the price concentration near the level of 1.2100.

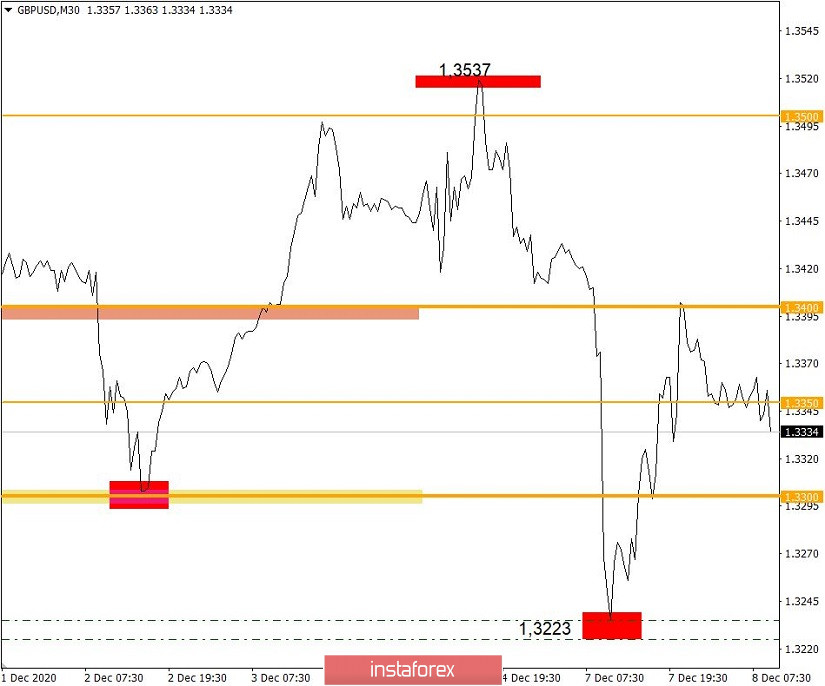

Trading recommendation for GBP/USD on December 8

There are no statistics from the UK and the US today in terms of economic calendar. Therefore, market participants will continue to track information on Brexit trade negotiations.

It should be recalled that positive information on trade negotiations leads to the pound's strengthening, while negative news about the lack of progress or the threat of Britain leaving the EU without a deal leads to the pound's weakening.

Technically, a stagnation within the coordinate 1.3350 can be seen, as if market participants are waiting for a new batch of Brexit information. A speculative surge in the market can be expected, depending on the nature of the information (positive/negative).

Local surges can occur outside the limits of the current stagnation 1.3335/1.3370.

- Buying a pair at a price above 1.3370, with the prospect of moving to the level of 1.3400 is recommended.

- Selling a pair at a price below 1.3330, with the prospect of moving to the level of 1.3300 is recommended.

Trading recommendation for EUR/USD on December 8

Considering the economic calendar, we are waiting for the third estimate of Europe's GDP for the third quarter to be published today, where a decline in the economic slowdown is predicted from -14.8% to -4.4%. Investors do not expect any sharp price changes in the euro at the time of publication of the news, due to the fact that the data repeats the result of the first assessment.

In terms of analysis, you can see that the quote continues to move within the level of 1.2100, trying to consolidate below it.

If the quote continues to move below the level of 1.2100, and then remains below the previous day's low - 1.2078, then the most significant correctional movement towards 1.2000 will be possible.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română