GBP/USD

Analysis:

The chart of the British pound sterling in the short term is dominated by the upward wave from September 10. Yesterday's price decline was completed by the hidden correction wave (B) that started a month ago. The price rise that started later has a reversal potential.

Forecast:

In the next trading sessions, there is a high probability that the price will move to the horizontal plane. In Europe, you can expect a flat decline, no further than the calculated support zone. By the end of the day, you can expect a resumption of activity, an increase in activity, and a return to the upward movement rate.

Potential reversal zones

Resistance:

- 1.3410/1.3440

Support:

- 1.3300/1.3270

Recommendations:

There are no conditions for sales in the pound market. In the area of settlement support, it is recommended to track the instrument purchase signals.

USD/JPY

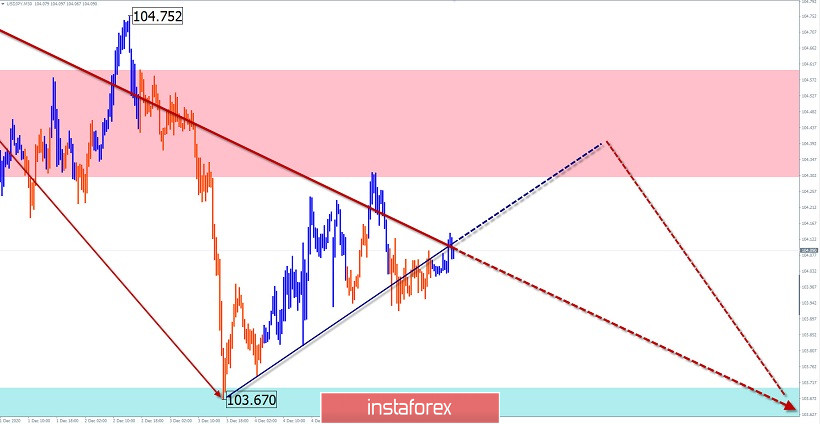

Analysis:

On the four-hour scale of the Japanese yen chart, the trend direction is set by the downward wave from November 9. In the structure of the wave, the formation of an intermediate correction began on December 3. Strong zones of a potential reversal of a large TF form a corridor that limits the range of movement of the pair's rate.

Forecast:

Today, the general flat mood of the price movement is expected. After an attempt to put pressure on the resistance zone, you should wait for a reversal and a return of the price to the support area.

Potential reversal zones

Resistance:

- 104.30/104.70

Support:

- 103.70/103.40

Recommendations:

Trading on the yen market today is only possible within the intraday. It is safer to reduce the lot. Purchases are risky. It is proposed to focus on the sale of the instrument.

USD/CHF

Analysis:

On the Swiss franc chart, the November price decline exceeded the wave level of correction, giving rise to a new wave along with the main trend. The pair's quotes reached the upper limit of the potential large-scale reversal zone. The need to form a bullish correction is mature.

Forecast:

In the next 24 hours, there is a high probability of an upward movement of the pair. The scope of the upcoming rise limits the calculated resistance. Previously, there may be short-term pressure on the support zone during the European session.

Potential reversal zones

Resistance:

- 0.8960/0.8990

Support:

- 0.8890/0.8860

Recommendations:

Today, trading the franc can be quite risky. The safest tactic is to refrain from trading during the upward correction and look for sell signals at the end of it.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română