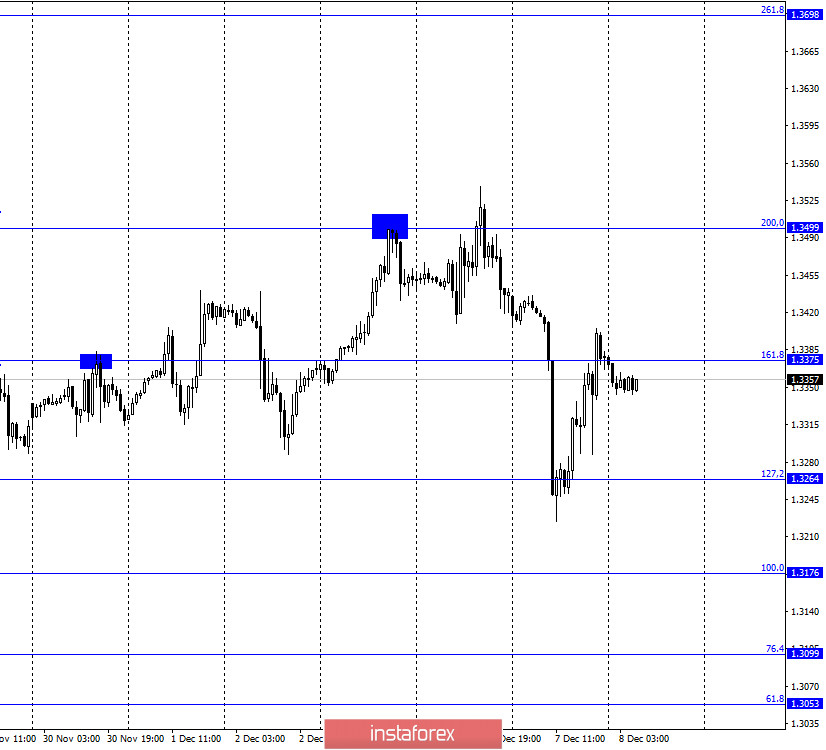

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair quotes performed a fall to the Fibo level of 127.2% (1.3264), a reversal near it in favor of the British and an increase to the corrective level of 161.8% (1.3375), near which there was also a reversal, but in favor of the US currency. Now the process of falling quotes can be resumed in the direction of 127.2% and 100.0% levels (1.3176). Fixing the pair's rate above the level of 161.8% will allow traders to expect further growth in the direction of the Fibo level of 200.0% (1.3499). The closer the date of the break between the UK and the EU approaches, the more information about how the bloc and the country will live after December 31, if a trade agreement cannot be reached. Contrary to popular belief that only the UK and its economy will suffer, Bloomberg journalists believe that this will also be a blow for the European Union. In terms of the economy, stability, and trust in the government. The fact is that in general, for the entire European Union, economic losses may not be large with an unordered Brexit. However, if we consider the EU countries separately, some of them may suffer serious losses and may later blame the EU authorities for allowing a "hard" Brexit. In the EU, for example, there is already a conflict over the rule of law and the allocation of the budget and the reconstruction fund. Claims to the EU may arise in Ireland, for which Britain is now the largest trading partner. Germany, as the strongest country in the EU and its President, is unlikely to make complaints, but its car industry will also lose enough billions of euros. France may be left without access to British waters. Thus, a "hard" Brexit will be a blow for everyone. For Britain - strong in economic terms, and for the EU - strong in terms of possible new splits.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a fall to the corrective level of 76.4% (1.3291), which was followed by a reversal in favor of the British. The consolidation of the quotes under this level will increase the chances of a further drop in prices. More important now is the hourly chart, which more clearly shows the nature of the current movement of the pair.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a rebound from the corrective level of 100.0% (1.3513). And this is the most important and clear signal on all charts. If the rebound is not false, then the Briton is waiting for a noticeable drop. But much now depends on the information background.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

There were no major economic reports in the UK and the US on Monday. However, they are now not particularly needed by traders who are fully focused on the topic of Brexit and trade negotiations.

News calendar for the United States and the United Kingdom:

On December 8, in the United Kingdom and America, news calendars are empty, so the background information may not be available today. Unless there is new news about the progress of negotiations between London and Brussels.

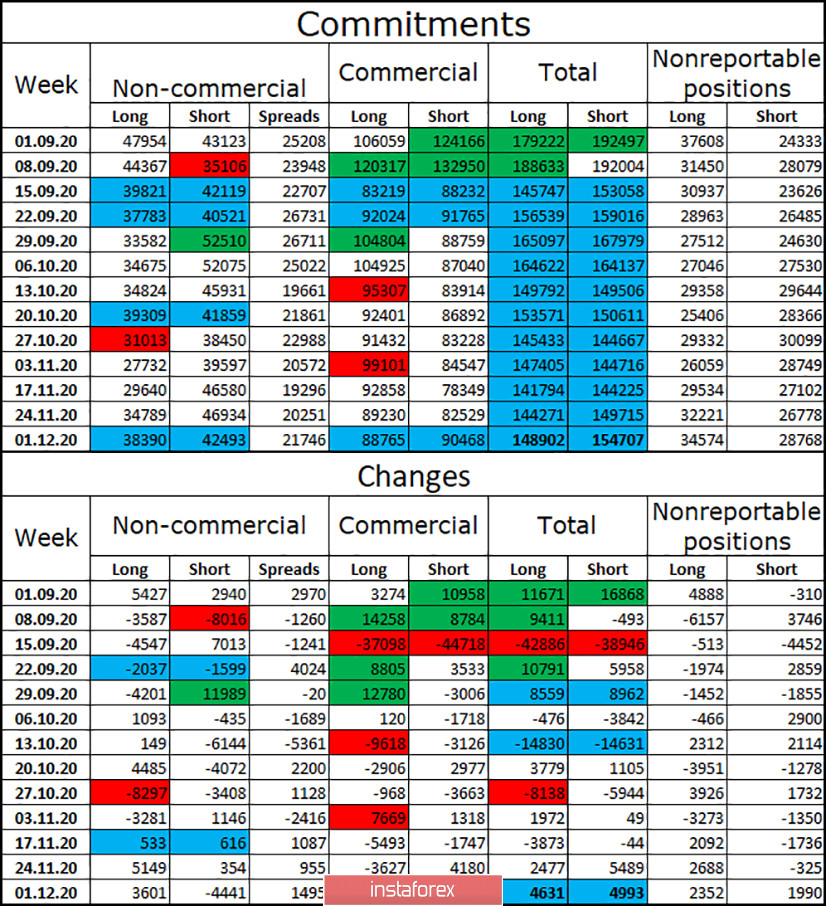

COT (Commitments of Traders) report:

The latest COT report showed a new increase in the number of long contracts held by speculators. This time, their total number increased by 3,601 contracts, and the number of short-contracts decreased by 4,441 units. Thus, the mood of speculators has become much more "bullish". At the same time, this is a very rare situation. The number of long and short contracts focused on the hands of the "Non-commercial" and "Commercial" categories is almost equal. The same applies to data for all categories of major players. Thus, the market is now in balance, however, the future of the British is still more dependent on the outcome of trade negotiations between London and Brussels. Major traders will also adjust to these results. Thus, their mood may change very dramatically, based on the results of the negotiations.

GBP/USD forecast and recommendations for traders:

At this time, I recommend that you be extremely careful when opening any deals on the British. First, it is extremely difficult to find signals now. Second, the pair continues to move very raggedly and often changes direction. I recommend making new purchases of the British dollar if the closing above the level of 161.8% (1.3375) is completed on the hourly chart with the target of 1.3499. I recommend selling the British dollar now with a target of 127.2% (1.3264), as the closing was made at the level of 161.8%.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română