To open long positions on EUR/USD, you need:

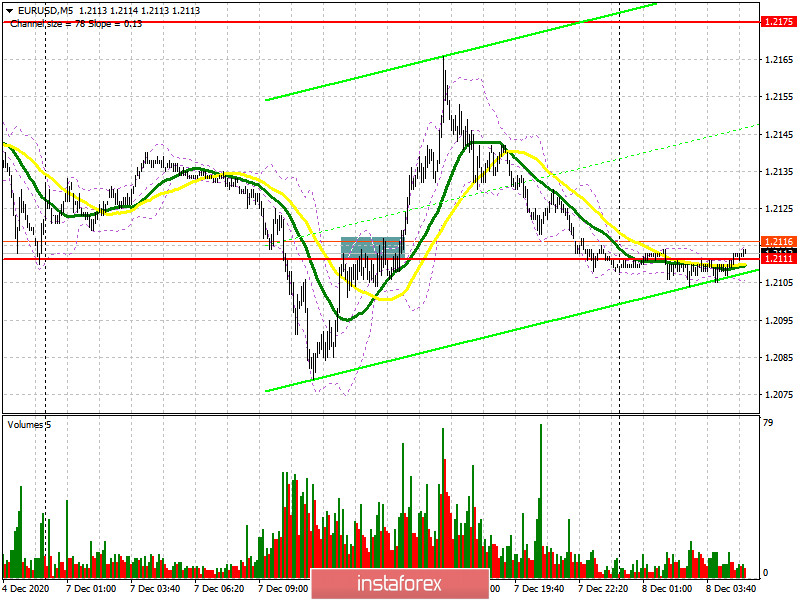

In yesterday's forecast, I drew attention to the 1.2111 level and said that as long as trading is conducted below this range, we can expect the euro to continue falling. I marked an area on the 5-minute chart where bears were actively defending their positions, forming false breakouts from the resistance at 1.2111, but this did not lead to anything good. As a result, the breakout and consolidation at 1.2111 caused EUR/USD to rise in the afternoon. Unfortunately, I did not wait until the 1.2111 level has been tested from top to bottom in order to produce a convenient entry point, so I missed this, as well as being able to sell in the morning.

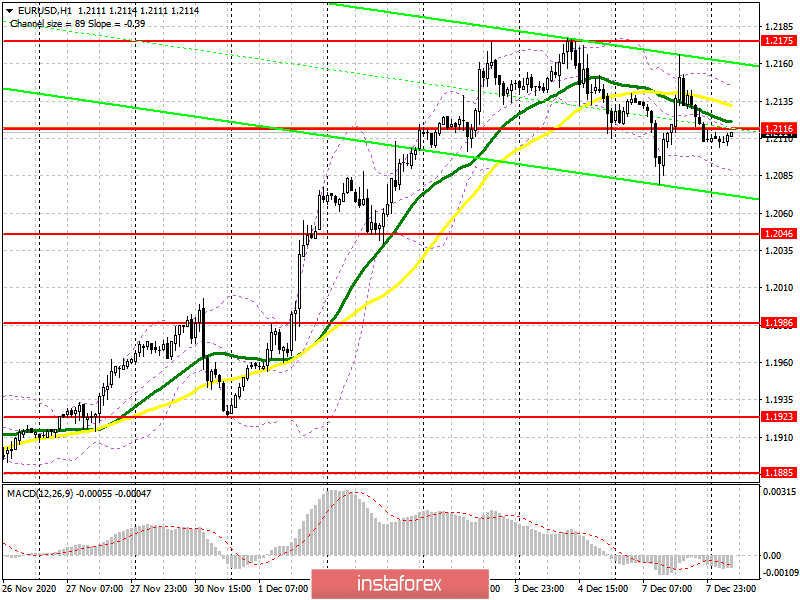

I didn't really review much at the moment. The 1.2111 level has slightly changed, which became 1.2116. I will focus on it in the morning. Buyers of the euro need to do their best to regain resistance at 1.2116, and they know how to do it. Yesterday's breakdown of 1.2111 was proof of this. Testing this level from the bottom up after the breakout produces a good signal to open long positions. The main goal is to return to last week's highs in the 1.2175 area, which has already been tested for strength twice. The fact that the bulls did not update this level yesterday jeopardizes the upward trend. Therefore, testing 1.2175 for the third time will lead to its breakout and EUR/USD will rise to highs of 1.2255 and 1.2339, where I recommend taking profit. In the absence of bullish activity in the 1.2116 area and we receive weak fundamental data from the ZEW institute for Germany and the eurozone, it is best not to rush into long deals, but wait until the 1.2046 low has been updated. You can buy the euro on a rebound from this level, counting on a correction of 20-25 points within the day. A larger support level is seen around 1.1986. Testing this low will lead to a reversal of the upward trend in the short term.

To open short positions on EUR/USD, you need:

News that there is still a chance for a Brexit trade deal has made it possible for the bulls to regain their positions following a huge drop earlier in the day. At the moment, the pound sellers are focused on the 1.2116 level, which they need to protect. Forming a false breakout there in the first half of the day after receiving weak data on the index of business sentiment in Germany and the eurozone from the ZEW institute and the index of the current situation from the ZEW institute will be a signal to open short positions in sustaining the downward correction to the area of a low of 1.2046, where I recommend taking profit... Getting the pair to settle below this level and testing it from the bottom up will be a good signal to sell EUR/USD to the area of a large low at 1.1986, and the bears hope to be close to the support area of 1.1923, which will seriously affect the upward trend. If EUR/USD rises above the resistance of 1.2116, it is better not to rush to sell. In this scenario, you can only rely on short positions from the resistance of 1.2175, or sell EUR/USD from a new high of 1.2255, counting on a downward correction of 15-20 points within the day.

The Commitment of Traders (COT) report for December 1 showed an increase in long positions and a reduction in short positions. Buyers of risky assets believe that the bull market will continue and they also anticipate the euro's growth, after going beyond the psychological mark in the area of the 20th figure. Thus, long non-commercial positions rose from 206,354 to 207,302, while short non-commercial positions fell to 67,407 from 68,104. The total non-commercial net position rose to 139,894 from 138,250 a week earlier. Take note of the delta's growth after its 8-week decline, which indicates a clear advantage of buyers and a possible resumption of the medium-term upward trend for the euro. We can only talk about an even bigger recovery when European leaders have negotiated a new trade deal with Britain. However, we did not receive good news last week, and we have an EU summit ahead of us, which could put the final point in this story. News that restrictive measures will be lifted for the Christmas holidays can provide support to the euro, as well as the absence of major changes in the ECB's monetary policy.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates the struggle of euro buyers to maintain control over the market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the upper border of the indicator in the 1.2150 area will lead to a new wave of euro growth. A breakout of the lower boundary at 1.2080 will increase pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română