The EUR/USD pair rebounded in the short term as the Dollar Index has slipped lower after its amazing rally. The currency pair has managed to recover a little which was natural after the last massive drop. It's traded at 1.0917 at the time of writing below 1.0958 yesterday's high.

Yesterday, the US and the Eurozone economic data came in mixed. EUR/USD increased a little only because the Dollar Index retreated. Earlier, the French Final Private Payrolls rose by 0.6% beating the 0.5% expected. Later, the Italian Industrial Production is expected to register a 0.6% drop.

JOLTS Job Openings indicator will be released later today and it's expected at 10.96M versus 10.93M in the previous reporting period.

EUR/USD Throwback!

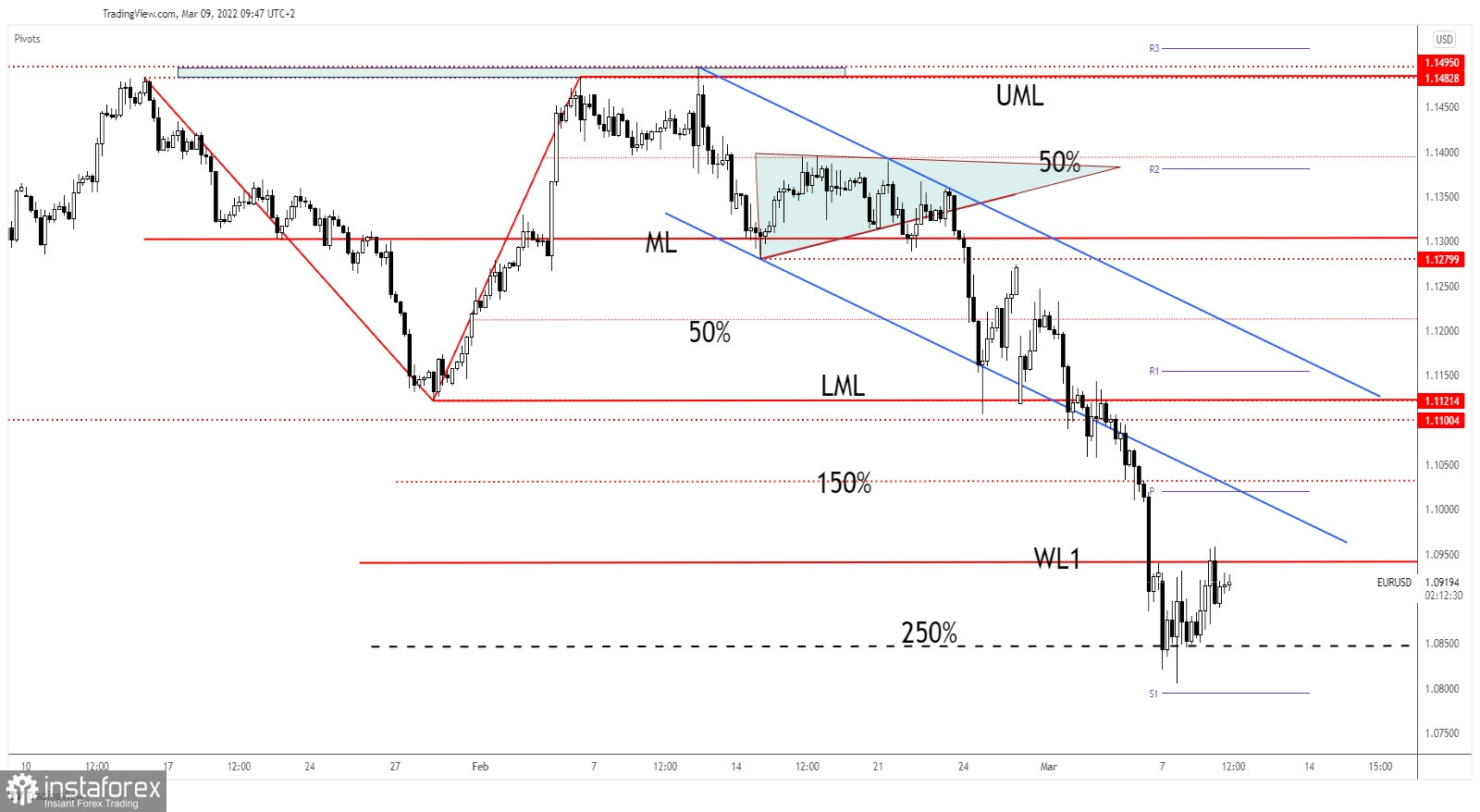

As you can see on the h4 chart, EUR/USD found support on the 250% Fibonacci line and now it challenges the warning line (WL1). Technically, after its amazing sell-off, a temporary rebound is natural.

The rebound could help the sellers to catch new short opportunities. EUR/USD could come back higher to test and retest the immediate resistance levels before dropping deeper. The 1.0 psychological level and the channel's downside line are seen as potential upside obstacles.

EUR/USD Outlook!

After its massive drop, a temporary growth is natural and it was expected. A new higher high, jumping and closing above the 1.0958 could activate further growth in the short term towards the 1.1020 weekly pivot point.

Failing to make a new higher high may signal that the sellers are very strong and that the rate could come back down.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română