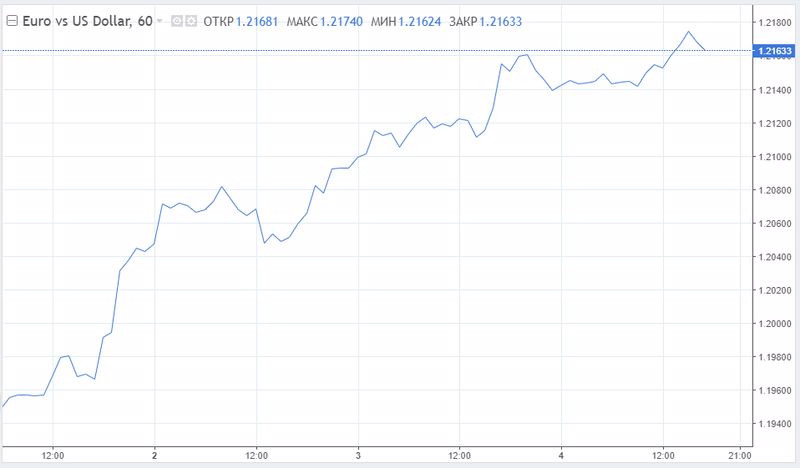

The euro has been one of the main beneficiaries of the dollar's current weakness, surpassing the $1.20 mark decisively this week.

On Thursday, the EUR/USD pair climbed to 1.2175, gaining 0.6% on the day, having strengthened 1.9% since the beginning of the week and rebounded by almost 15% from the March bottom.

Even the relatively good data on claims for unemployment benefits in the United States, published yesterday, did not support the US dollar.

"Statistics are clearly playing a secondary role after the positive news about COVID-19 vaccines and fiscal stimulus in the US. At the moment, the market remains optimistic about the latter, as bilateral negotiations have resumed in Washington. This provided additional support for risky assets and added arguments in favor of the bearish trend in USD," said ING specialists.

The greenback hit levels this week that have not been seen since April 2018.

The fall of the US dollar is accompanied by a rise in the stock market, as well as an increase in the yield of US government bonds.

"There is no doubt that since this spring, the Fed's actions have been extremely successful in weakening the dollar," strategists at Rabobank said.

From a technical point of view, the USD index has already corrected by almost 50% relative to its movement over the past ten years. It is currently trading near 91 pips (a year low) and a key support level at 88 pips, which could be an important turning point for the dollar.

"So far, the situation for dollar bears is developing well, however, the USD is only passively winning back global risk sentiment. Let's see what happens in the event of a significant increase in US yields. There is a possibility that the markets could then stumble severely. The nearest event risk is the Federal Reserve meeting on December 16," Saxo Bank said.

According to Citigroup, "Much will depend on the Fed's response to any surge in US yields, especially in light of the ongoing debate over the asset purchase program and amid expectations that it will allow the economy to overheat."

Currently, the US Central Bank buys about $120 billion in government bonds and mortgage-backed bonds every month, which is partly aimed at reducing the cost of borrowing for businesses and households.

Meanwhile, next week the next meeting of the ECB Governing Council will take place.

It is expected that following the December meeting, the financial institute will increase the volume of asset purchases by €500 billion. However, will this work if the QE program has not helped the ECB to prevent recession and deflation in the EU so far? The regulator is now also facing the problem of strengthening the euro.

It is clear that Europe is losing the devaluation race, which could aggravate the region's economy, which, according to IMF estimates, will contract by 8.3% this year.

The euro has broken out of the $1.16–1.20 trading range in which it has traded over the past four months, and does not see significant obstacles ahead of itself up to $1.25.

Deutsche Bank analysts predict that the EUR/USD pair could reach 1.30 by the end of 2021.

Strategists at ING, in turn, note that the strengthening of the single currency is largely due to the weakness of the dollar, and not fundamental factors. Therefore, the growth of the euro above $1.20 may turn out to be a short-term movement.

While the United States remains the leader in the number of people infected with COVID-19, the epidemiological situation in Europe remains challenging.

In France, the quarantine period is until December 15, after which it will be lifted gradually. In Germany, restrictive measures have been extended until early January.

Under such conditions, it is unlikely that Europe will show positive economic growth in the fourth quarter. At least, this is evidenced by the latest data on business activity in the euro area. The composite PMI index of the currency block in November dipped to 45.3 points, being in the zone of decline.

This week, the main currency pair is moving in tandem with the US stock indices, conquering new peaks.

"Investors see no reason to sell shares as long as there is reason to hope for future support in both the fiscal and monetary spheres," said MUFG Bank.

"In the event of a sudden external shock, a small (or even large) collapse may occur on the market, which will stop all attempts to weaken the USD for the near future. Such a blow could be the rejection of the stimulus agreement in the United States. Another option is to reassess expectations for vaccines. Other candidates are shock geopolitical events and a sharp rise in the yield of US bonds," Saxo Bank experts said.

"In this regard, you need to understand how confident a breakout of EUR/USD above 1.2000 is," they added.

Despite the willingness of American lawmakers to put an end to months of confrontation over the issue of stimulating the national economy, it is not yet clear how successful their negotiations will be.

This week, a bipartisan congressional group proposed another $908 billion stimulus package. However, experts say this will only be enough to maintain the neutrality of US fiscal policy in 2021.

Meanwhile, The Wall Street Journal reports, citing an informed source, that the pharmaceutical company Pfizer will be able to produce only 50 million doses of COVID-19 vaccine by the end of 2020 instead of the planned 100 million due to problems with the supply of necessary substances.

The source said, "Some batches of substances, as it turned out, did not meet our standards. We have solved this problem, but we will not have enough time to fulfill the supply plan for this year,"

Meanwhile, Joe Biden, who was tentatively elected president of the United States, said China must play by international rules.

Earlier, he announced that he would not immediately lift import tariffs on goods from China when he sits in January, giving investors a signal that trade relations between the two largest economies in the world are likely to remain tense even after Donald Trump leaves the White House.

Although the euro is generally set to grow, without a new dose of positive news, the EUR/USD bulls will most likely find it difficult to continue their march upward.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română