In times of market turmoil, investors turn to gold as a haven asset. When Russian troops invaded Ukraine on February 24, the yellow metal hit 1,974. Today, on March 8, it reached a new high at the level of 2,020.40

Before the current crisis, the price of gold hovered around 1,800 without having made significant gains since the end of 2020.

Without a doubt, gold as a safe-haven asset will continue an upward trend and could reach 2,250 in the coming months. This is the level +1/8 Murray on weekly charts.

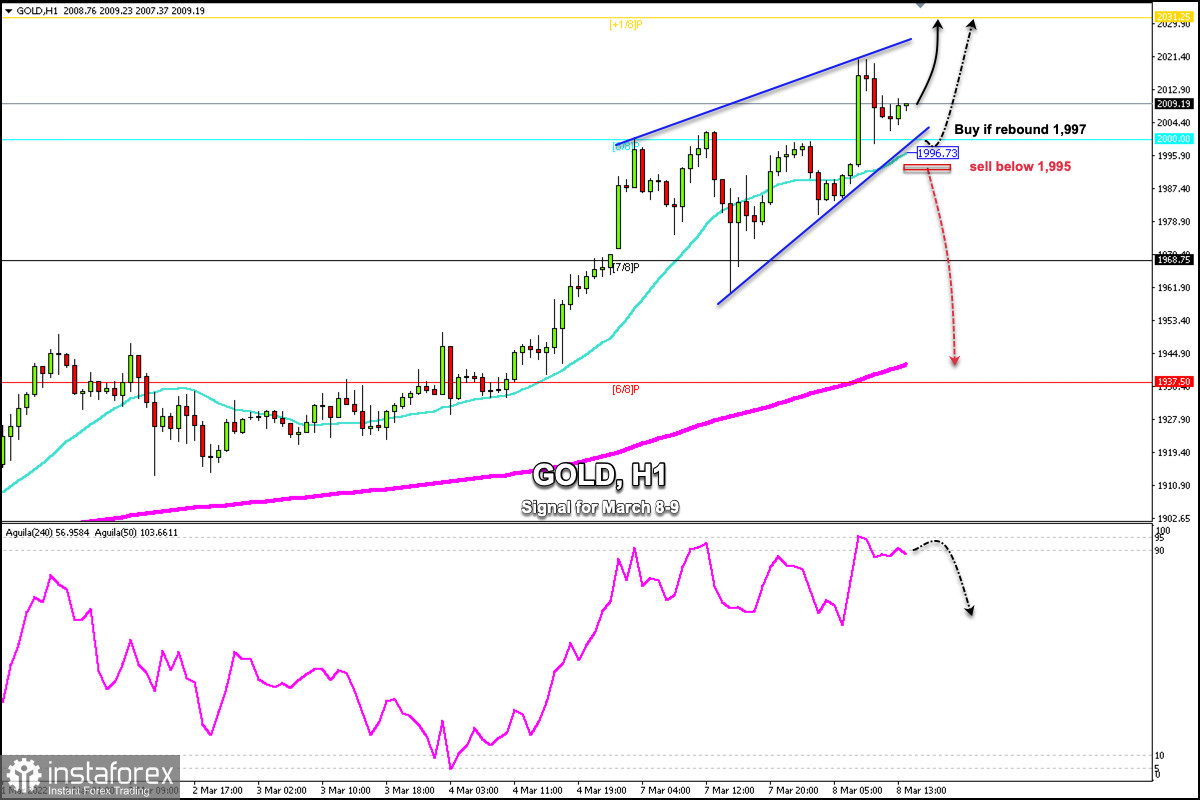

Earlier in the European session, gold reached the 2020.40 level, the highest level since August 2020. Then, it experienced a downward correction to the psychological level of 2,000.

Currently, it is bouncing above 8/8 Murray with a bullish bias. The bullish trend towards the resistance zone +1/8 Murray around 2,031 is likely to continue in the coming hours.

On the 1-hour chart, we can see the formation of a rising wedge pattern. The break below the 21 SMA and below this pattern could accelerate the move down towards 200 EMA located at 6/8 Murray around 1,940.

Our trading plan for the next few hours is to buy gold only if it remains trading above the psychological level of $2,000. Conversely, a break below 1,996 will be a clear signal to sell with targets at 1,968 (7/8) and 1,937(6/8).

The eagle indicator is giving an overbought signal and a technical correction is imminent in the next few hours.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română