Ethereum (ETH) in the American session fell to a low of 2,443. The support at $2,500 continued to be the key to avoiding heavier losses.

Concerns over Russia circumventing sanctions via the crypto market continues to deliver market uncertainty.

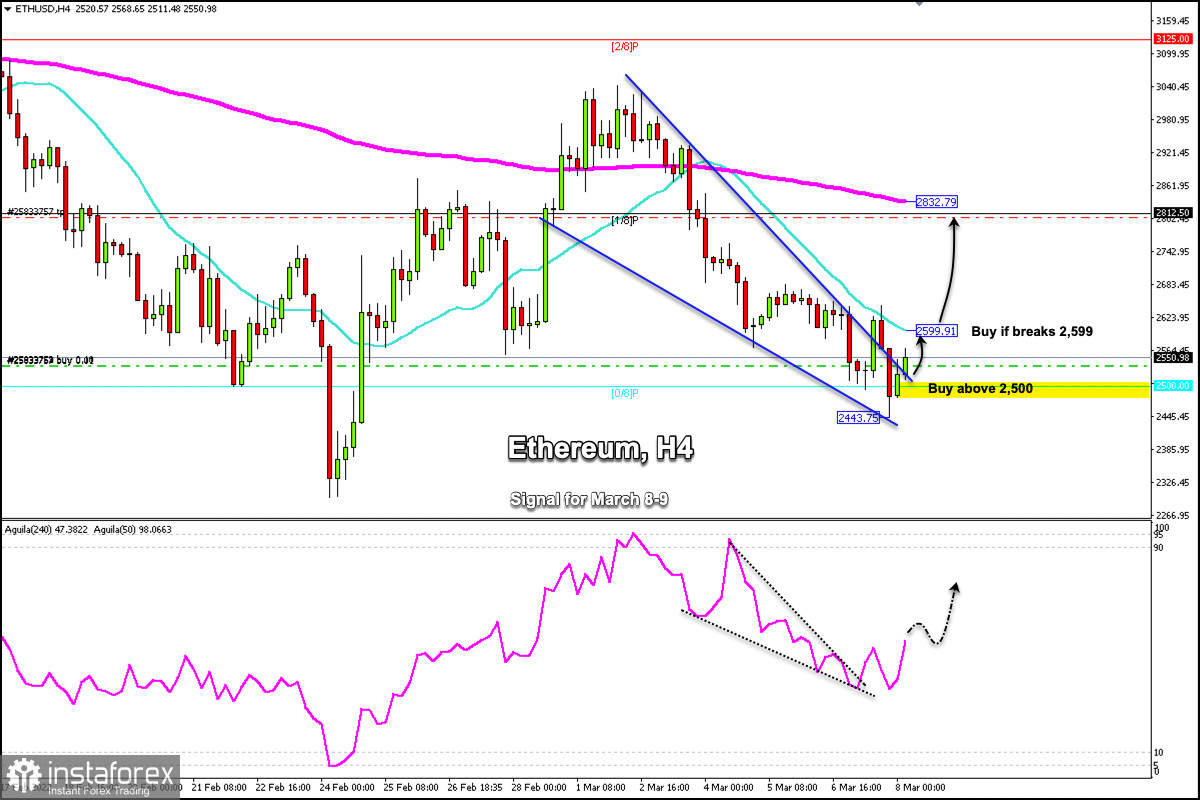

After reaching the psychological level of $3000 on March 1, ETH started a technical correction towards 4/8 Murray around 2,500.

This represents a loss of more than 20% in less than a week. A technical correction could follow in the next few hours if the price consolidates above $2,500.

Since March 1, ETH has been forming a falling wedge pattern. A sharp break of this technical pattern could confirm the technical bounce above 4/8 Murray.

A breakout and consolidation on the 4-hour chart above the 21 SMA will be the start of a bullish rally towards the 200 EMA at 2,832.

Ethereum is likely to consolidate above 2,500 in the next few hours, giving us an opportunity to buy, with targets at 2,599 and 2,832.

The short-term outlook for Ether remains bearish, due to the fact that it is located below the moving averages of 200 and 21. This means that as long as it remains below these moving averages, Ether could continue its decline and reach the support level of February 24 at 2,300.

Our trading plan for the next few hours is to buy above 4/8 Murray located at 2,500. If there is a break above 2,600, it will be a clear signal to buy with targets at 2,844 and towards the psychological level of $3,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română