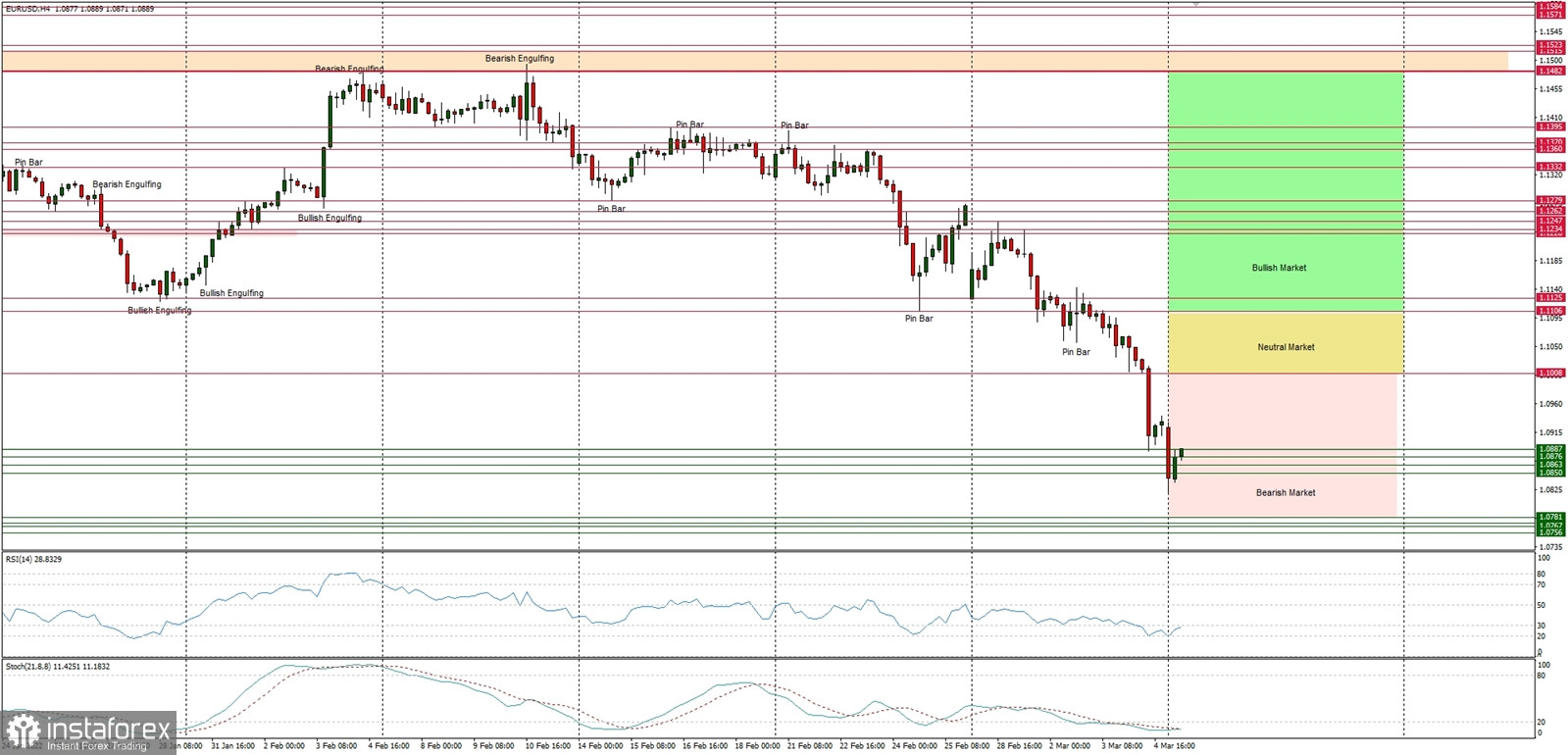

Technical Market Outlook

The EUR/USD pair keeps moving lower and lower in a search for a bottom. The next long term technical support for bulls is seen at the level of 1.0726 and 1.0639. The key technical resistance on the weekly time frame chart is located at 1.1245. The local demand zone seen between the levels of 1.0850 - 1.0888 might be good for a temporary bounce towards the level of 1.0935, but it will not hold the bearish pressure for long. The market keeps trading inside the bearish zone and only a sustained breakout above the level of 1.1008 would temporary change the outlook to neutral.

Weekly Pivot Points:

WR3 - 1.1463

WR2 - 1.1348

WR1 - 1.1096

Weekly Pivot - 1.0991

WS1 - 1.0737

WS2 - 1.0618

WS3 - 1.0318

Trading Outlook:

The market is still in control by bears that pushed the price way below the level of 1.1245, so a breakout above this level is a must for bulls for a trend reversal. The next long-term technical support is located at 1.0639. The up trend can be continued towards the next long-term target located at the level of 1.1494 (high from 06.02.2022) only if bullish cycle scenario is confirmed by breakout above the level of 1.1186 and 1.1245, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0639 or below.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română