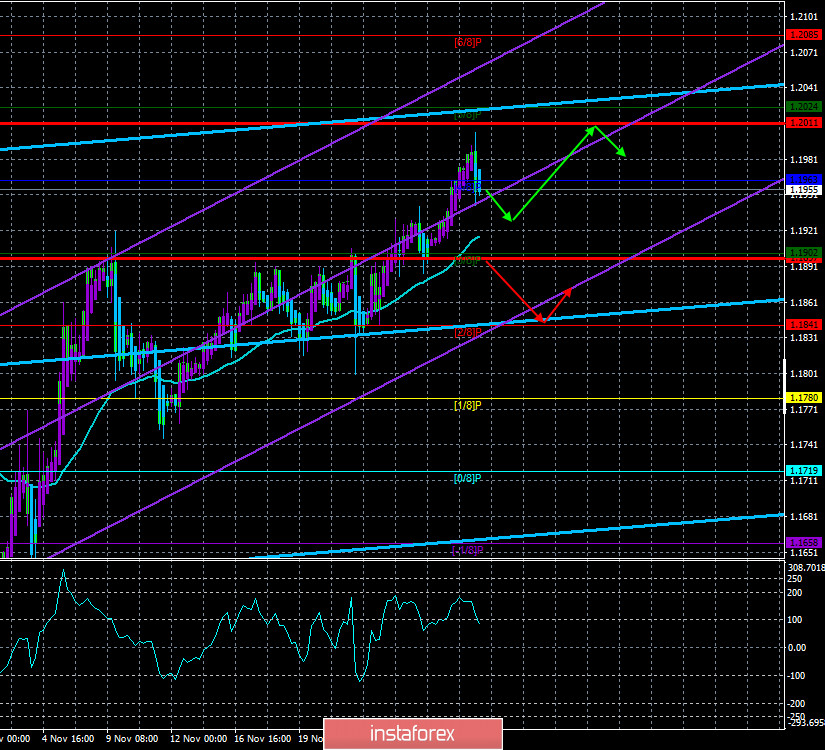

4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 84.9517

The first trading day of the new week for the EUR/USD pair was again in an upward movement. Even though no important macroeconomic publications were scheduled for Monday, and there was almost no news, market participants continued to buy the European currency. And from our point of view, this behavior of market participants is the best way to signal the unreasonableness of the current growth of the European currency. We are not saying that no currency can rise in price on any particular day of the week without news or statistics. No. However, the situation is completely different for the euro/dollar pair. Recall that the euro has been getting more expensive for 7-8 months and has grown by 1300 points during this time. Moreover, during all this time, there was not a single strong correction and not a single hint of the beginning of a downward trend formation. The United States and the US dollar have lost the fundamental foundations that allowed them to be in a better position than the EU and the euro currency. The Fed lowered rates to almost zero (which is closer to the ECB in terms of the "dovishness" of monetary policy). The US economy lost much more in the second quarter than the European one. And the losses from the "coronavirus" in America are much higher than in the European Union. Thus, we are not at all surprised by the strengthening of the euro in 2020. However, now that relative calm has reigned in the United States, it would still be more logical to see a correction, that is, a rise in the dollar. However, even on Monday, when nothing interesting is happening in the markets, traders continue to buy the European currency.

We have already mentioned in previous articles that Poland and Hungary blocked the adoption of the EU's seven-year budget and the economic recovery fund. Even though Germany, as the presiding country, should soon hold talks with the troublemaking countries, many experts note the fact that according to EU law, the budget and the fund can be approved without the participation of Warsaw and Budapest. Yes, the new legislation on the "rule of law mechanism" will not be adopted until all 27 EU member states vote for it, however, the fund and budget will be approved. And Poland and Hungary may suffer from this, as they rely on a lot of grants from these funds over the next years. So far, Warsaw and Budapest are not supported by any of the 25 other capitals of the alliance countries. According to official information. Unofficial support was found in Lisbon. From January 2021, it will be Portugal that will preside over the EU, which means that this country can hold talks with Poland and Hungary. Some experts believe that this is just another disagreement that occurs from time to time between EU countries. As in the situation with the "coronabonds" and the discussion of sources for the formation of the EU economic recovery fund after the pandemic. Then, we recall, the members of the alliance also could not come to a common denominator for a very long time, and there were a lot of talks that Italy was already preparing to leave the EU. Now the situation is similar. This is just a question that all 27 countries disagree on, and immediately many experts believe that this is the beginning of the end for the bloc. Most likely, vetoing the package of bills, including the fund, budget, and the "compliance principle", will only delay the approval of all three issues.

At the same time, we do not want to say that this problem is not a problem for the EU. No one knows how it will end. And in any case, this is not positive news for the European Union, most of whose countries are now in lockdown, which means they will suffer financial losses in the fourth quarter. In any case, this is not positive news for the EU economy, which will shrink due to a drop in business activity in the service sector. In any case, this is not positive news for the ECB, which is going to allocate additional funds to stimulate the economy in December. Thus, we still believe that the euro is growing quite unreasonably. But if up to the 20th figure its growth can still be "tolerated", then if the quotes go above the 20th figure, it will be quite strange. Recall that the latest COT reports clearly show that it is the "bearish" mood that is growing among the major players. Fundamental factors, all as one, do not speak in favor of the euro. And in the US, there is generally silence.

There is silence in the United States, which does not mean that everything is all right in America. However, the "coronavirus" for the United States is no longer a problem, at least for the current government. The number of diseases continues to grow, but all American media believe that if there is a second American "lockdown", it will only be under President Joe Biden. In the meantime, another anti-record has been broken in America. On November 27, more than 200,000 cases were recorded per day. The total number of deaths from the virus is approaching 270 thousand. Thus, if mass vaccination does not begin in the next few months, America will not avoid a "lockdown". Also, the United States has not approved and provided a new package of assistance to the American economy. It was supposed to be $ 2 trillion, but Republicans and Democrats never agreed on it. On the one hand, this is good for the US currency exchange rate, since the Fed will not print hundreds of billions of dollars. For now. On the other hand, the economy is not being helped, and it is not recovering as fast as previously expected. Thus, the situation in America may worsen in the next month or two, and then a new fall in the US currency would be logical. But for now, new deterioration is closer to the Eurozone, but it is the euro that is growing, which continues to force us to conclude the strong overbought of this currency. The higher the euro gets now, the lower it will fall later. From a technical point of view, the upward trend continues, so it is recommended to trade for an increase. We have already said that any fundamental hypothesis must be supported by specific technical factors. Currently, no indicator indicates the end of the upward trend. Therefore, to expect a fall in the euro currency quotes, you need to wait for at least a consolidation of the price below the moving average.

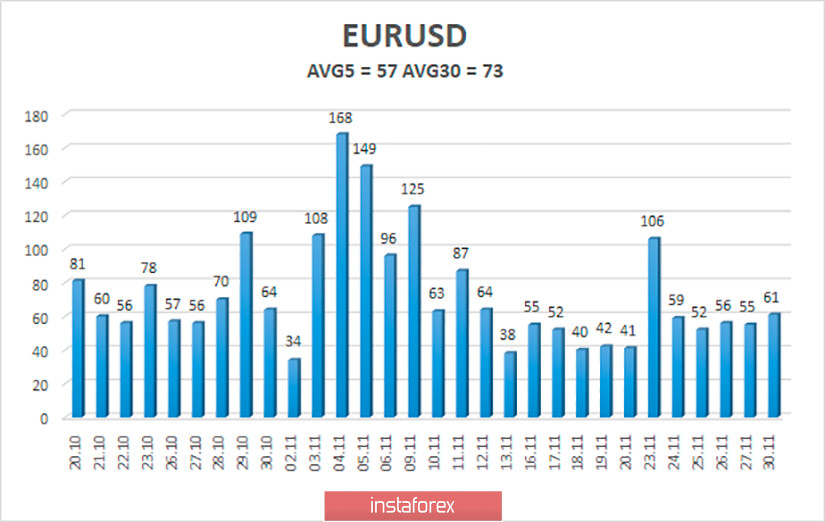

The volatility of the euro/dollar currency pair as of December 1 is 57 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1897 and 1.2011. The reversal of the Heiken Ashi indicator back to the top signals a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.1902

S2 – 1.1841

S3 – 1.1780

Nearest resistance levels:

R1 – 1.1963

R2 – 1.2024

R3 – 1.2085

Trading recommendations:

The EUR/USD pair has started to adjust. Thus, today it is recommended to open new buy orders with the target level of 1.2011 after the Heiken Ashi indicator turns up or after the price rebounds from the moving average. It is recommended to consider sell orders if the pair is fixed below the moving average with a target of 1.1841.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română