An extremely busy week awaits the dollar. In addition to purely economic publications such as ISM, ADP and Nonfarms, a number of policy issues will be addressed that will slightly unfold the long-term plans of the Biden administration and the Fed.

The market considered that it is undoubtedly a positive step to appoint former Fed Chairman, Janet Yellen, as US Treasury Secretary, which will lead to the growth of stock indices and will contribute to the dollar's decline as it clearly indicates the intention of the Fed and the Treasury to work together on stimulus programs. On the other hand, Republicans who hold control of the Senate will not be able to survive significant political dividends in trade for the scale of the stimulus package, since the Fed will be able to make up for the lack of such incentives in agreement with the Treasury Department.

There are several rumors that the Fed and the ECB are preparing huge incentive measures next month to reverse the economic decline. Therefore, it is necessary to support the markets until mass vaccination gives results and allows countries to remove restrictive measures.

There is a slight increase in demand for protective assets today, while the USD will remain under pressure.

EUR/USD

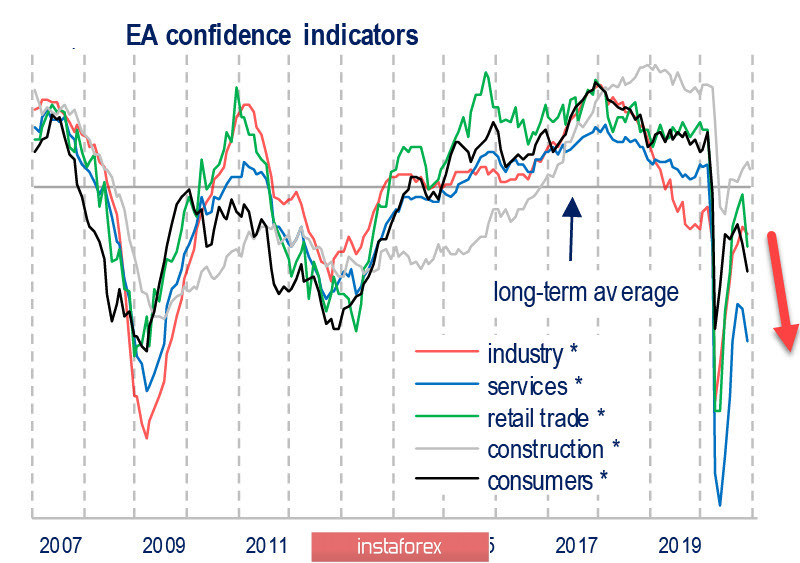

The negative mood in the eurozone remains. The V-shaped recovery, which was expected in spring and summer, is obviously not happening. Moreover, the pullback in the indices was not confident enough, and according to the European Commission, a second wave of decline began in all sectors of the eurozone in November, but from lower levels than before the pandemic.

The industry feels a little more bearable and there was a minimal drop. However, there was a strong decline in confidence in the retail trade, the service sector, and employment expectations.

On another note, the political crisis is also gaining impulse in the euro area. Hungary and Poland confirmed in a joint declaration that they are ready to veto the budget and the EU recovery fund if an attempt is made to link the rule of law to the money distribution. In fact, Hungary and Poland not only do not want to accept migrants, which EU authorities strongly imposed on them, but also raise the question quite differently – on what basis should the countries of Eastern Europe, which have never pursued a colonial policy, take responsibility for its consequences? Although it is not discussed from the stands, this issue is now the center of the developing crisis.

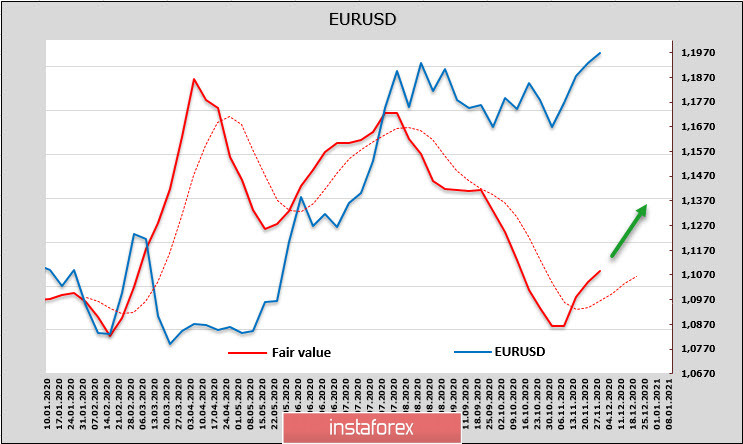

Without the CFTC data, stock and debt market analysis still gives the euro an advantage against the US dollar.

The resistance at 1.1900/20 has been broken, so it is possible to try breaking through the level of 1.20. But a stop and consolidation is likely before breaking another resistance level of 1.2090, which is currently the main target.

GBP/USD

Brexit talks resumed on Saturday, with the negotiators facing three unresolved issues again – fishing in disputed areas, a dispute resolution mechanism and a "level playing field", which means an equal requirements for trade and the rules for the movement of labor.

EU negotiator, Barnier, explained in the European Parliament that the negotiations will last all weekend and adding several days after it. Therefore, if there is no progress, it is necessary to prepare for a tough scenario. The deadline is on December 4, however, there was still no positive report from either side this morning.

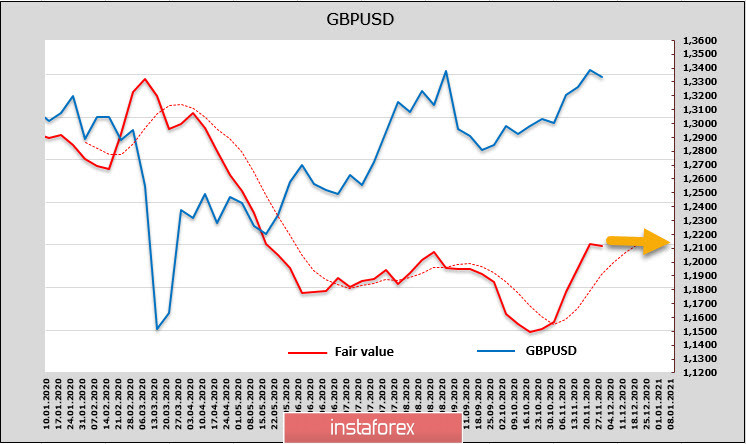

The pound has reduced its momentum in the absence of CFTC data. In addition, there is a low possibility of continuing growth, and the transition to a sideways range is clear in anticipation of news about the end of negotiations.

This morning, there is a slight growth in demand for protective assets and a decline in raw materials. The pound is more sensitive to such movements than the euro, which will experience a small stronger pressure.

Technically, the possibility of breaking through the resistance of 1.3380/3400 will directly depend on the negotiations results. Any positive news can let the pound rise to the next resistance level of 1.3479, since the topic of a weak US dollar will dominate regardless of the outcome of the Brexit negotiations.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română