To open long positions on EUR/USD, you need:

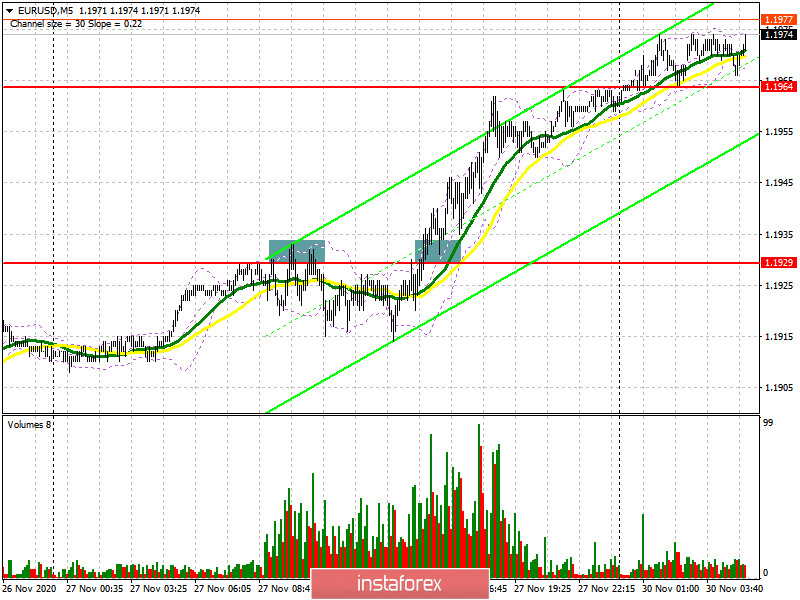

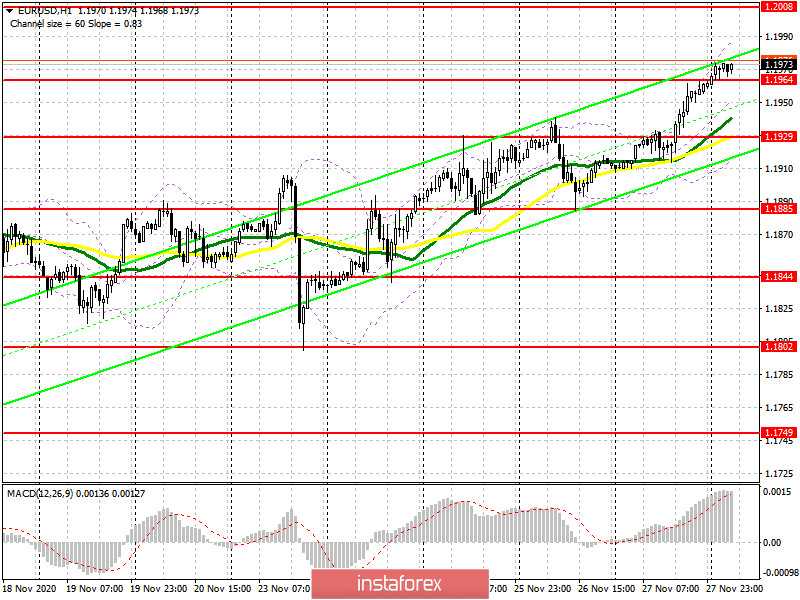

The euro's huge growth from last Friday can hardly be tied to something specific, since important fundamental statistics were not released and it was hardly possible to expect such optimism from the market. Nevertheless, selling after a false breakout at 1.1929 in the morning did not materialize to the extent that I expected. For my 5-minute forecast last Friday afternoon, I marked the short entry point after the bulls failed to go above 1.1929. However, the pair hit the 1.1915 level each time and returned to 1.1929. The bulls have already taken this range towards the middle of the US session, testing it from top to bottom, which led to producing an entry point into long positions. By the end of the day, buyers of the euro reached the resistance of 1.1964, and the movement was more than 35 points. The bulls managed to reach the 1.1964 level in today's Asian session.

We can expect the euro to continue rising as long as trading is above this range. Forming a false breakout at the 1.1964 level in the first half of the day will be an additional signal to open long positions. However, I have to reiterate that there is no real reason for the euro to grow in the short term and the market is filled with speculators whose main goal is to pull the euro to the resistance of 1.2008, which will trigger a number of stop orders. I recommend taking profits around 1.2008, because if we do not receive good news, for example, on the Brexit trade deal, one can hardly count on a real breakout of this area, slightly above which is where the 1.2057 level is located. If the euro is under pressure in the first half of the day, and the bears pull the pair under the 1.1964 level, then you should not rush to open long positions. The optimal scenario would be to wait until support at 1.1929 has been tested, where the moving averages play on the side of the bulls, and open long positions there for a rebound, counting on a correction of 15-20 points within the day. Larger buyers will focus on protecting the 1.1855 support.

To open short positions on EUR/USD, you need:

The sellers' initial task is to return the 1.1964 level to themselves, which they missed in today's Asian session. Despite all the negative data on the European economy, traders are in no hurry to sell the euro, hoping for the best. Getting the pair to settle below 1.1964 and testing it from the reverse side, from the bottom up, provides a more convenient entry point to short positions in hopes for a small downward correction to the support area at 1.1929, which is where the moving averages pass. However, updating this level will clearly not be enough to bring back the bear market. To be able to settle below 1.1929 will lead to a larger sale of the euro to the support area at 1.1885, where I recommend taking profits. If the bulls turn out to be stronger and continue to push the pair up after the inflation data from Germany and Italy, then it is best not to rush to sell, but wait until the high in the resistance area of 1.2008 has been updated, where you can open short positions immediately on a rebound. If bulls are not active at this level, and given how the market behaves, this cannot be ruled out, I recommend opening short positions immediately for a rebound, counting on a correction of 15-20 points within the day, I recommend doing so only from a high of 1.2057.

The Commitment of Traders (COT) report for November 17 showed an increase in long and short positions. Long non-commercial positions rose from 202,374 to 203,551, while short non-commercial positions increased from 67,087 to 69,591. The total non-commercial net position fell from 135,287 to 133,960 a week earlier. Take note that the delta has been declining for eight consecutive weeks, which confirms the euro buyers' reluctance to enter the market in the current conditions. We can talk about the euro's recovery only when European leaders have settled differences with Poland and Hungary, and also when the UK negotiates a new trade deal with Brussels. Otherwise, you will have to wait until restrictive measures have been lifted, which were implemented due to the second wave of coronavirus in many EU countries.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which indicates continued growth in the euro in the short term.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the upper border of the indicator around 1.1985 will lead to a new wave of euro growth. In case the pair falls, support will be provided by the lower border at 1.1915.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română