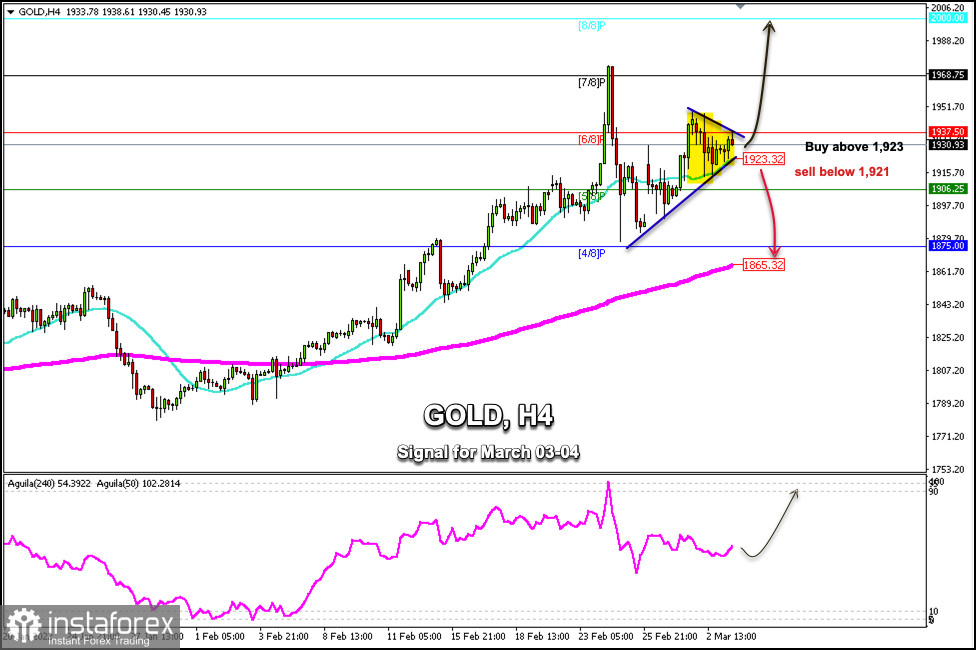

Gold price is trading above an uptrend channel formed from the low at 1,877 on February 24.

Currently, we can see the formation of a symmetrical triangle. This means that a break above the upper line around 1,937 could cause a strong bullish movement for gold and the price could reach the zone of 7/8 Murray located at 1,964 and eventually reach the psychological level of $2,000.

Conversely, a sharp break below the symmetrical triangle around the 21 SMA located at 1,923 could accelerate gold's strong bearish move and it will fall towards the 5/8 Murray at 1,906 and towards the 200 EMA around 1,865.

In his presentation to Congress, Jerome Powell, the Chairman of the Federal Reserve, expressed his support for a 25-basis point hike in the interest rate at the March meeting, and gave no indication of a stronger rate of adjustment. The market reacted to this news and for now we see the increase in risk appetite.

However, gold will continue to be the final winner and will be the one that will benfit the most in the Russia - Ukraine crisis because investors, in the face of any fear, will continue to return to refuge. So, gold is likely to conquer new highs.

As long as gold continues to trade above 1,923, it is likely to reach the area from 1,937 to 1,964. Conversely, a close on the 4-hour chart below 1,923 could trigger a move down towards the psychological level of 1,900.

Support and Resistance Levels for March 03- 04, 2022

Resistance (3) 1,964

Resistance (2) 1,937

Resistance (1) 1,929

----------------------------

Support (1) 1,913

Support (2) 1,895

Support (3) 1,877

***********************************************************

Scenario

Timeframe H4

Recommendation: buy above

Entry Point 1,923

Take Profit 1,937; 1,968

Stop Loss 1,917

Murray Levels 2,000(8/8), 1,968(7/8) 1,937(6/8), 1,906(5/8)

***************************************************************************

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română