To open long positions on EURUSD, you need:

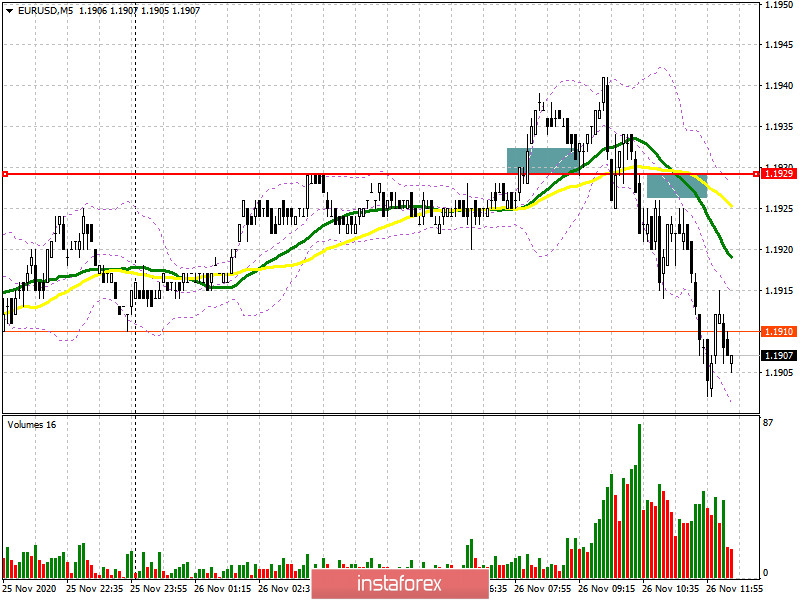

In my morning forecast, I paid attention to purchases from the level of 1.1929 after the breakdown and consolidation above this range, which happened. On the 5-minute chart, I marked the entry point to long positions after testing the level of 1.1929 from top to bottom. However, the bullish momentum failed to find support among the major players, which eventually led to a change in market sentiment. The upward movement ended before it started and amounted to no more than 12 points. A return and consolidation below 1.1929 could have formed a good entry point for short positions, however, my trading strategy did not test this level from the bottom up, so I was forced to skip this signal.

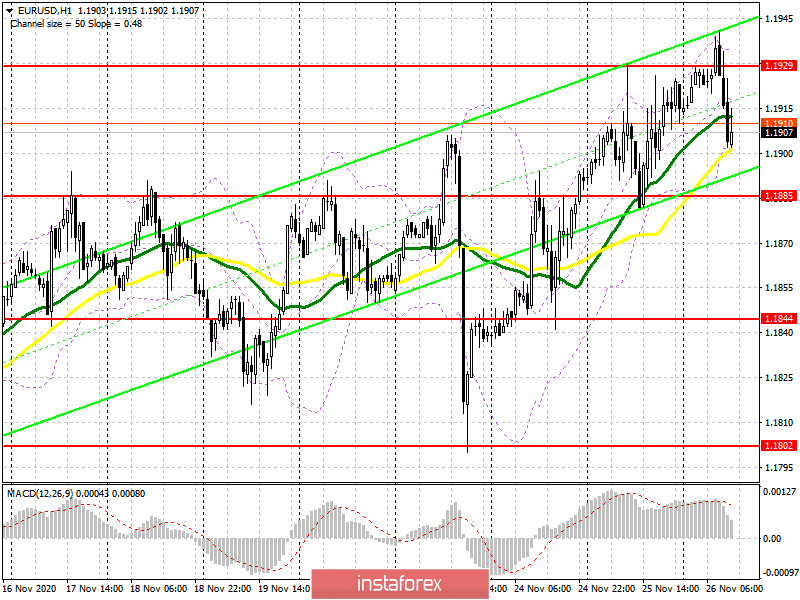

As a result of all the movements, the technical picture remained completely unchanged. In the second half of the day, after the report of the European Central Bank from the meeting on monetary policy, the release of other fundamental statistics is not planned, and the US market will be completely closed due to the Thanksgiving holiday. The initial goal of the bulls is to break through and consolidate at the maximum of 1.1929, the top-down test of which, similar to the morning purchase, forms a convenient entry point into long positions in the expectation of continuing the upward movement of EUR/USD and reaching a new level of 1.1964, where I recommend fixing the profits. The longer-term goal of the bulls is still the resistance of 1.2008, which is also psychological. In the scenario of EUR/USD falling back to 1.1885 in the first half of the day, only the formation of a false breakout there will be a signal to open long positions. If there is no bull activity at this level, I recommend that you do not rush to buy, but wait for a downward correction to the support area of 1.1844, from where you can buy the euro today immediately for a rebound based on an upward correction of 15-20 points. A larger support level is seen only at this week's low in the area of 1.1802, where you can also buy euros immediately on the first test.

To open short positions on EURUSD, you need:

With the first morning task, the bears coped perfectly and did not allow the bulls to take control of the resistance of 1.1929. The next task for sellers, even against the background of low trading volume, is to return to the level of 1.1885, which they failed to recapture yesterday in the first half of the day. Only a consolidation below 1.1885 and its test on the reverse side from the bottom up form a more convenient entry point for short positions in the expectation of a resumption of the downward trend. In this case, the nearest target of the bears will be a new low of 1.1844. But only a breakdown and consolidation below this range will lead EUR/USD to the weekly support area of 1.1802, where I recommend taking the profit. If the bulls are stronger in the second half of the day, then it is best not to rush to sell. I recommend waiting for the next update of the resistance at 1.1929, where only the formation of a false breakout will be a signal to open short positions in the euro. I recommend selling EUR/USD immediately for a rebound only from the maximum of 1.1964, based on a correction of 15-20 points within the day.

Let me remind you that the COT report (Commitment of Traders) for November 17 recorded an increase in long and short positions. So, long non-commercial positions increased from the level of 202,374 to the level of 203 551, while non-commercial short positions increased to 69,591 to the level of 67,087. The total non-commercial net position fell to 133,960, down from 135,287 weeks earlier. It is worth noting that the delta has been declining for 8 consecutive weeks, which confirms the lack of desire of euro buyers to go to the market in the current conditions. It will be possible to talk about a further recovery of the euro only after European leaders "settle" their differences with Poland and Hungary, and the UK agrees with Brussels on a new trade agreement. Otherwise, we will have to wait for the lifting of restrictive measures imposed due to the second wave of coronavirus in many EU countries.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates the sideways nature of the market before a period of low trading volume at the end of the week.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the upper limit of the indicator around 1.1935 will lead to new growth of the pair. A break in the lower limit of the indicator at 1.1900 will increase the pressure on the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română