Some data came out a little worse than forecasts yesterday, while others a little better. But in general, macroeconomic reports show a confident recovery of the American economy. And although the number of initial applications for unemployment benefits increased from 748,000 to 778,000, the number of repeated applications fell from 6,370,000 to 6,071,000. So, as a whole, the labor market is gradually recovering from the blow of this spring, and in general, the data are positive. In addition, the volume of orders for durable goods increased by 1.3%, so that consumer activity will clearly grow, and with it industrial production. But the second estimate of GDP for the third quarter completely coincided with the first estimate. So the rate of economic decline is slowing down from -9.0% to -2.9%. In any case, the nature of the data is moderately optimistic. Nevertheless, the market ignored all this remarkable data altogether. Investors are still hesitant because of the ongoing political instability in the United States. It is a holiday today in the United States, so the market will continue to stand still.

GDP Growth Rate (United States):

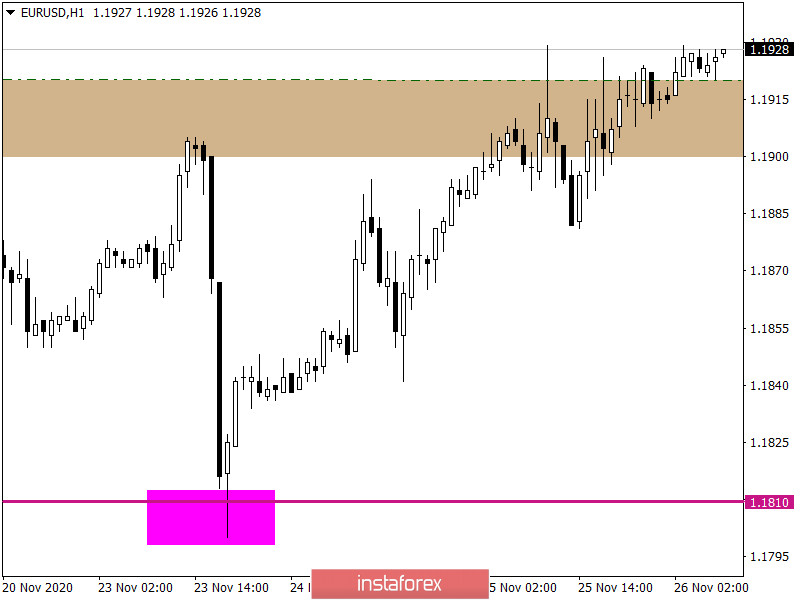

The EURUSD pair is slowly but surely moving along an upward trajectory, where once again the resistance level of 1.1900/1.1920 was reached. In fact, this is the third attempt to bring back the upward trend in November.

With regard to volatility, here you can see a slowdown process, while an inertial move takes place.

If we proceed from quote's the current location, we can see that traders managed to settle slightly above the 1.1900/1.1920 level, but after that it naturally stopped.

Considering the trading chart in general terms (daily period), we can see that the euro has strengthened in value by about 300 points since the beginning of November, and the quote has returned to the area of the upper border of the medium-term side channel.

We can assume that the quote will temporarily focus on the level, which will lead to stagnation and price fluctuations in the range of 1.1900/1.1930.

The subsequent upward move can be considered, but if the price stays above 1.1940, activity will decrease.

From the point of view of a complex indicator analysis, we see that the indicators of technical instruments on the hourly and daily timeframes signal a purchase by getting the price to settle above the range level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română