To open long positions on EUR/USD, you need:

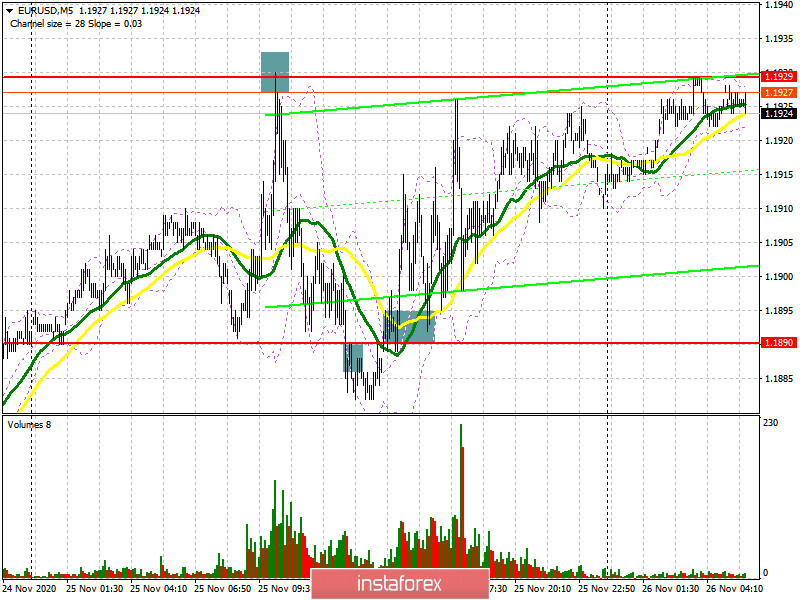

We dealt with transactions for buying and selling euros in the first half of the day in yesterday's afternoon forecast. Let's take a look at the 5-minute chart and talk about what happened in the US session. If testing the 1.1890 level in the first half of the day resulted in producing a buy signal, then the bears managed to gain a foothold below this range in the afternoon and made an entry point into short positions, which was never realized due to weak fundamental data on the US economy. Returning to the 1.1890 level and testing it from top to bottom produced a new signal to buy the euro, which quickly brought the pair back to the weekly high of 1.1929, which is where buyers are now focused. All entry points are marked on the chart.

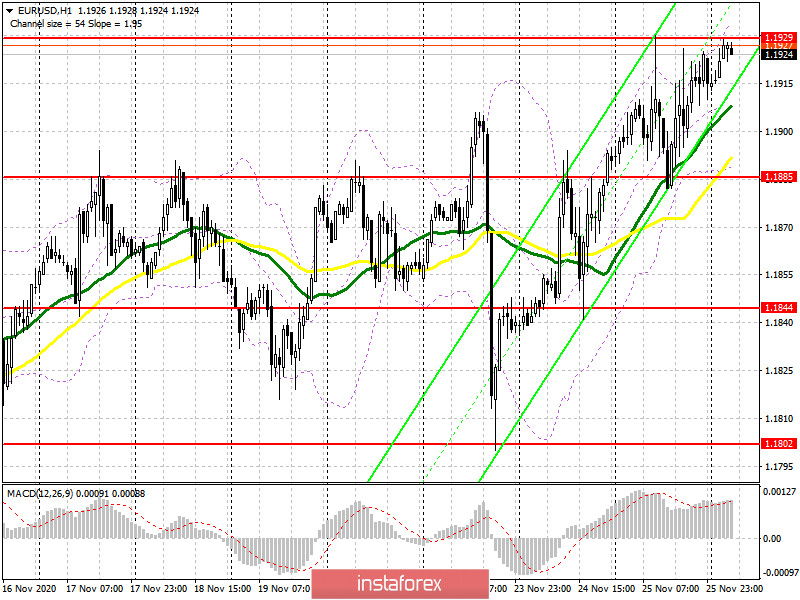

No important fundamental reports scheduled for release today, and only the European Central Bank's report from its monetary policy meeting will be able to return volatility to the market. The bulls' initial goal is to break out and settle at the 1.1929 high, testing it from top to bottom produces a fairly convenient entry point into long positions, in hopes for the euro to rise and reach a new level at 1.1964, where I recommend taking profit. The bulls will still aim for the resistance of 1.2008, which is also psychological in nature. In case EUR/USD falls to the 1.1890 area in the first half of the day, a false breakout in that area will be a signal to open long positions. In case bulls are not active at this level, I recommend not to rush to buy, but to wait for a downward correction to the support area of 1.1844, from where you can buy the euro immediately on a rebound, counting on an upward correction of 15-20 points. A larger support level is seen at this week's low in the 1.1802 area, where you can also buy the euro immediately on its initial test.

To open short positions on EUR/USD, you need:

The sellers' initial task is to return to the 1.1885 level, which they failed to recapture yesterday afternoon due to weak reports on the American economy. This report showed an increase in the number of applications for unemployment benefits, as well as a decrease in income and expenses of Americans compared to last month. Settling below 1.1885 and testing it from the bottom up forms a more convenient entry point to short positions in hopes to bring back the downward trend. In this case, the nearest target will be the low of 1.1844, which is where you could observe the pair's active growth quite recently. However, an update of this level will only be an indication that the trade remains in a horizontal channel. A breakdown and settling below this range will lead EUR/USD to the area of weekly lows at 1.1802, where I recommend taking profits. If the bulls turn out to be stronger and continue to push the pair after the minutes of the ECB on monetary policy, then it is best not to rush to sell, but wait until a false breakout forms in the resistance area of 1.1929, which will be a signal to open short positions in the euro. I recommend selling EUR/USD immediately on a rebound but only from a high of 1.1964, counting on a correction of 15-20 points within the day.

The COT report for November 17 showed an increase in long and short positions. Despite this, buyers of risky assets believe that the bull market will continue since the delta is on their side. Long non-commercial positions rose from 202,374 to 203,551, while short non-commercial positions increased from 67,087 to 69,591. The total non-commercial net position fell from 135,287 to 133,960 a week earlier. Take note that the delta has been declining for eight consecutive weeks, which confirms the euro buyers' reluctance to enter the market in the current conditions. We can talk about the euro's recovery only when European leaders have settled differences with Poland and Hungary, and also when the UK negotiates a new trade deal with Brussels. Otherwise, you will have to wait until restrictive measures have been lifted, which were implemented due to the second wave of coronavirus in many EU countries.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which indicates that the euro will continue to rise in the short term.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

A breakout of the upper border of the indicator around 1.1930 will lead to a new wave of euro growth. In case the pair falls, support will be provided by the lower border at 1.1885.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română