In theory, yesterday should have been completely quiet and calm, but everything went wrong when the US session was about to end, and the dollar began to noticeably lose its positions. The reason was the transfer of power from the Donald Trump administration to the representatives of Joseph Biden. The fact is that the United States Treasury Department had transferred $455 billion from the stabilization fund to the general Treasury fund. The beauty of the situation lies in the fact that funds from the stabilization fund can be spent at any time and without prior approval. that is, the ministry can use these funds as needed, for example, on measures to stimulate the economy and the like. But the funds in the common fund will no longer work. Any spending of these funds must receive prior approval from Congress, and formalized in the form of law. In other words, the transfer of funds from the stabilization fund to the general fund makes it difficult to use them. And this decision was instantly criticized by the Democratic Party. Democrats saw this move as an attempt to tie the hands of the future administration of Biden so that he did not have the opportunity to fight the coronavirus epidemic and stimulate economic growth. The point is that after this decision, only $80 billion remained in the Treasury's stabilization fund. At the same time, purely formally, the Ministry of Finance did everything right. After all, we are talking about the funds that were provided by the Federal Reserve in the fight against the coronavirus epidemic. And there is no specific indication of how the unused funds can be used in the corresponding document regulating the use of these funds. The law only talks about certain restrictions that are imposed from January 1, 2021. But without any specifics. The law does indeed require that all unspent funds be transferred to the general Treasury fund to cover the current deficit. However, this must be done no later than January 1, 2026. In general, there are a lot of questions. But the decision to transfer funds from the stabilization fund to the general one creates certain difficulties for the future administration and will clearly limit its possibilities. So the implementation of Biden's plans, which he spoke about only after the presidential elections, will clearly stall. The political mess in the United States is reaching a new level. This is the reason why the dollar weakened.

However, the most interesting thing in all this is that if the market clearly reacted to the US reports on Monday, it is not clear how it will behave today in the light of the new circumstances. But today will be extremely busy. The data on orders for durable goods may increase by 0.8%. So it is quite possible to count on further growth in industry and consumer activity, which in itself is an extremely positive factor. Besides, the second estimate of GDP for the third quarter may be slightly better than the first. If the previous estimate showed a slowdown in economic growth from -9.0% to -2.9%, today this result can be revised to -2.8%. So it turns out that the American economy is recovering quite well. In addition, the data on claims for unemployment benefits will be released today due to the fact that tomorrow is a Thanksgiving holiday in the United States. The number of initial applications may decrease from 742,000 to 730,000. The number of repeated applications may decrease from 6,372,000 to 6,000,000. In other words, the labor market also continues to recover. It turns out that from the point of view of basic macroeconomics, things in the United States are doing quite well. But will such optimistic news be able to outweigh the entire political farce that is not going to end?

GDP Growth Rate (United States):

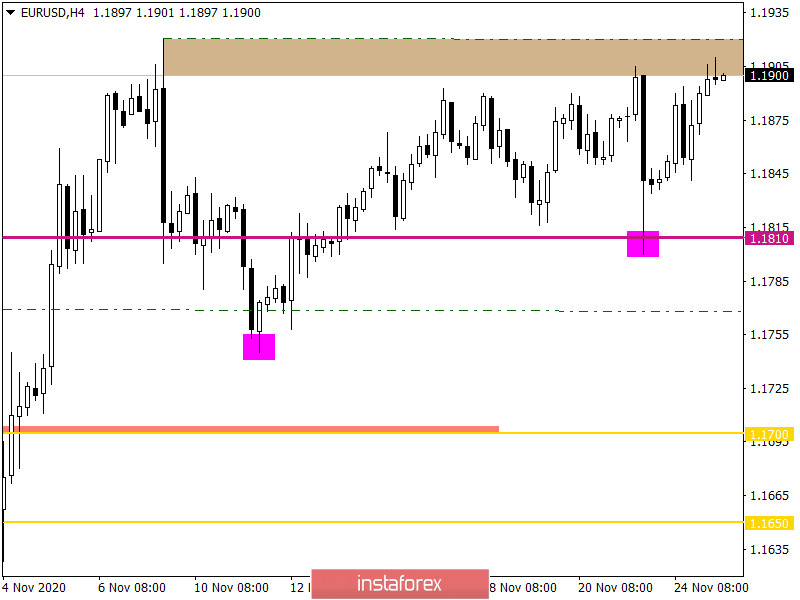

The EUR/USD pair, in the wake of an upward move from the support level of 1.1810, returned to the resistance level of 1.1900/1.1920, where it slowed down locally, but left a trail of long positions.

As for volatility, there is a consistent acceleration process, which has a positive effect on the speculative ratio.

If we proceed from the quote's current location, then we can see that the fluctuation is within the range level of 1.1900/1.1920, where the price has already broken this week's local high.

Considering the trading chart in general terms (daily period), we can see that there has been an upward movement in the market since the beginning of November, but it only led us to the upper border of the medium-term horizontal channel.

We can assume that the resistance level (1.1900/1.1920) is still putting pressure on buyers, which may affect the volume of long positions in the form of their reduction. In case of a repetition of the regular basis of a rebound from the 1.1900/1.1920 area, the price could move towards 1.1810.

An alternative scenario of market development will be considered if the price stays above 1.1930 for a four-hour period. In this case, we can consider the local price moving towards 1.2000.

From the point of view of a complex indicator analysis, we see that the indicators of technical instruments on the hourly and daily timeframes signal a buy due to price fluctuations within the week's high.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română