Crypto Industry News:

MicroStrategy CEO Michael Saylor believes that BTC could be the solution to the growing number of cyber attacks. Moreover, according to Saylor, it could become one of the most important uses of cryptocurrency over time.

MicroStrategy CEO's arguments are based on the assumption that the nature of Bitcoin is related to energy.

In addition to using BTC as a security against cyber attacks, Saylor also points to two other areas where the use of cryptocurrency makes the most sense. The first is fundraising, i.e. raising funds. The second area is what MicroStrategy is famous for: a speculative tool for companies looking to put cryptocurrency on their balance sheets.

As an example of how BTC can help reduce cyber attacks, Michael Saylor gives the following example: each user would have to spend $ 10 in BTC to obtain verified status in the form of an orange marker. This would allow him to access content on the internet. Such a fee would be payable once in a lifetime as regular users are not criminals. The latter, on the other hand, would have to regularly deposit money due to the use of bots.

Considering Saylor is seen as one of the biggest proponents of BTC, his opinion on the use of cryptocurrency as a currency may come as a surprise. MicroStrategy's CEO believes that this asset class will never be real currency. Instead, it should be treated as property.

Technical Market Outlook

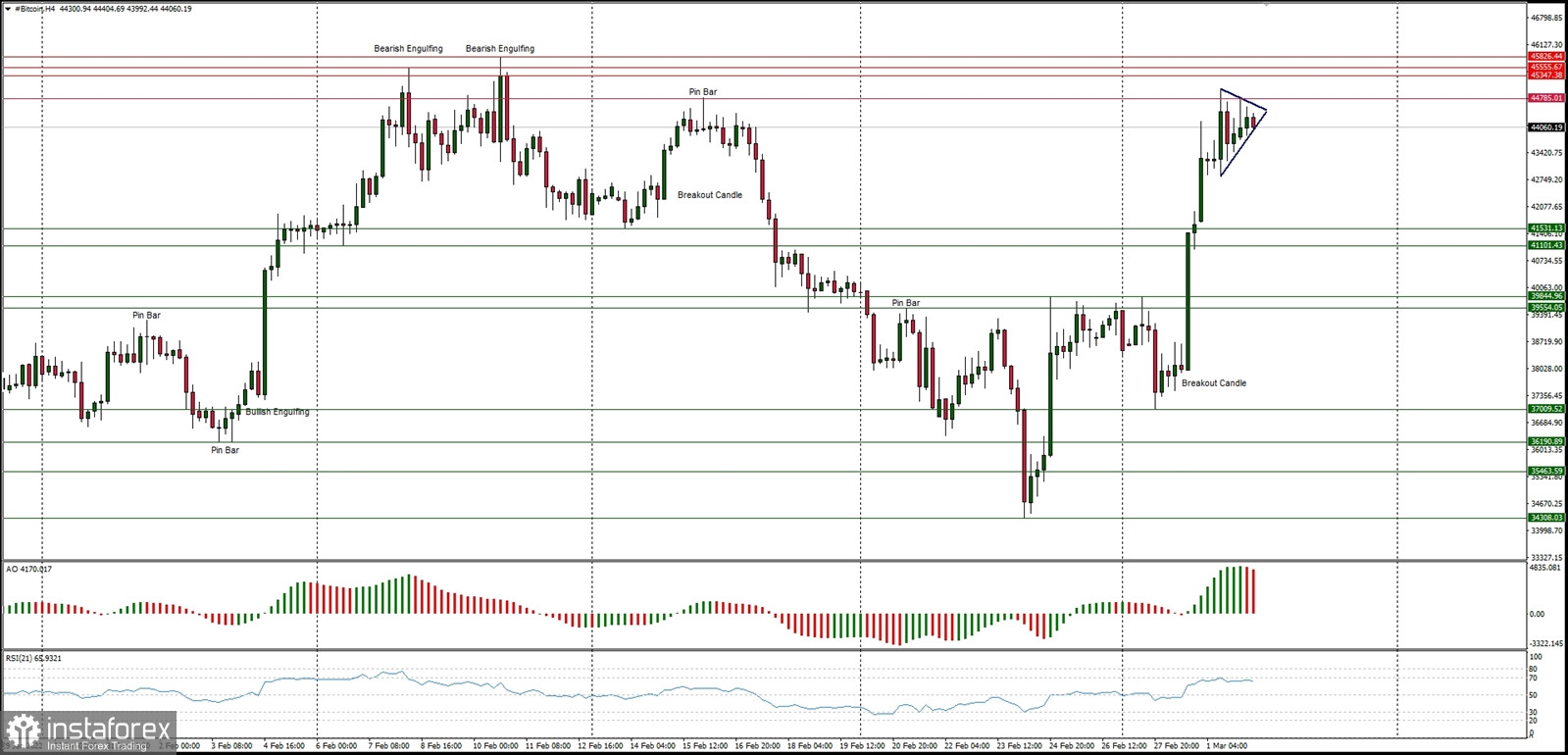

The BTC/USD pair has been rallying above the level of $40k and made a local high at the level of $44,997. The next target for bulls is seen at the level of $45,347 and at the swing high located at $45,826. Currently, the bulls are consolidating the recent gains in the Triangle formation around the level of $44k. The immediate technical support is seen at $41,531. The strong and positive momentum supports the short-term bullish outlook on BTC.

Weekly Pivot Points:

WR3 - $49,623

WR2 - $42,432

WR1 - $40,007

Weekly Pivot - $37,159

WS1 - $34,592

WS2 - $31,509

WS3 - $29,166

Trading Outlook:

The market is bouncing after over the 80% retracement made since the ATH at the level of $68,998 was made. The level of $44,442 is the next key technical resistance for bulls, but the game changing technical supply zone is seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română