The AUD/USD pair edges higher as the Dollar Index dropped. The price jumped higher but it remains to see how it will react around the RBA policy meeting. Fundamentally, the Aussie received support from the Australian Retail Sales today. The indicator rose by 1.8% versus 0.3% expected.

As you already know, the USD was weakened also by the Chicago PMI which came in at 56.3 versus 62.1 expected. The pair is traded at 0.7264 level at the time of writing far above 0.7157 today's low.

Tomorrow, the Reserve Bank of Australia is to announce a decision on the cash rate. The RBA is expected to maintain its current monetary policy. Still, the RBA Rate Statement could really shake AUD/USD. Later in the day, the US ISM Manufacturing PMI could increase from 57.6 to 58.0 points.

AUD/USD Closed The Gap Down!

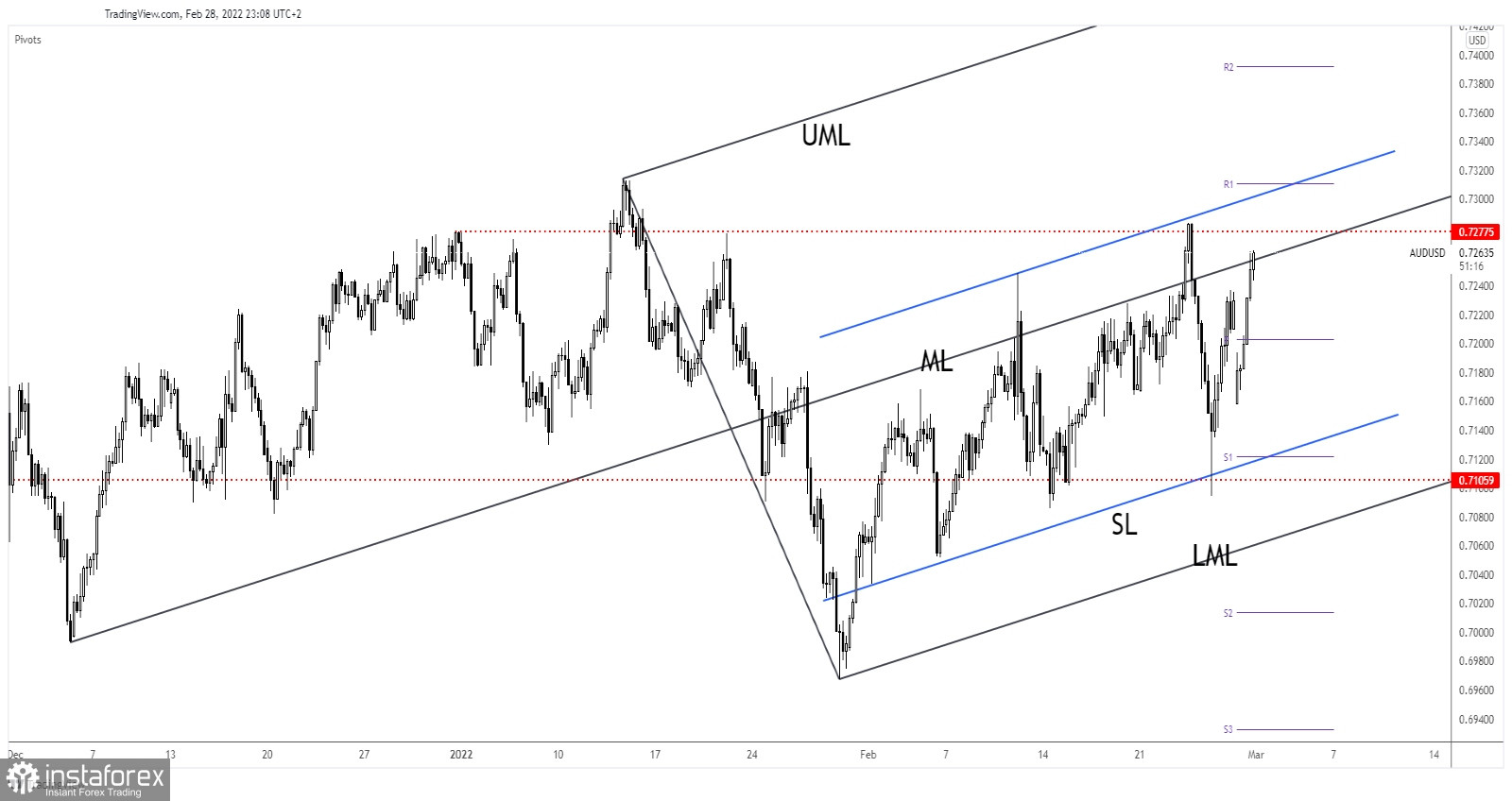

As you can see on the H4 chart, AUD/USD closed the gap down signaling potential further growth. Now, it's almost to hit the 0.7277 static resistance. Technically, after its previous massive drop, a rebound was somehow expected.

AUD/USD registered only a false breakdown with great separation below 0.7105 static support and through the inside sliding line (SL) signaling exhausted sellers.

AUD/USD Outlook!

A new higher high, a valid breakout above the 0.7277 could confirm further growth ahead. Still, after the current rally, you should be careful as a false breakout or a major bearish pattern could announce a new sell-off.

Staying below the ascending pitchfork's median line (ML) could bring short opportunities. This scenario could take shape if we'll have a dovish RBA.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română