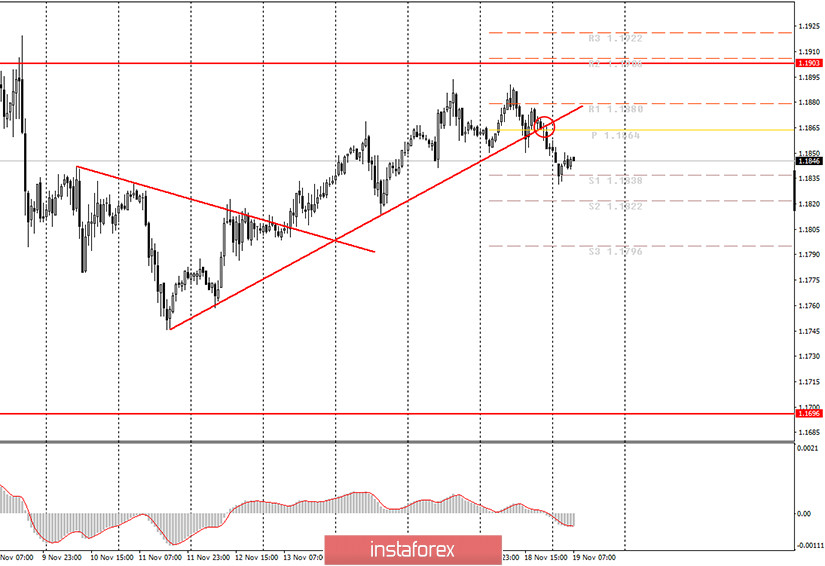

Hourly chart of the EUR/USD pair

The EUR/USD pair has settled below the upward trend line last night, as we predicted. And so novice traders received a sell signal on the breakout of the trend line, and those who did not sleep when it appeared could open short positions and gain a small profit. Yes, this is the foreign exchange market, signals can appear even at night, when many in our respective time zones are asleep. Therefore, the support level of 1.1838 has been reached, from which the pair rebounded and can now start an upward correction. At the same time, do not jump to conclusions. The European trading session is just beginning, and the sell signal is strong enough. Therefore, we believe that we might see a downward movement in the next hour or two. In any case, novice traders will have reasons to close short positions if the MACD indicator turns to the upside. However, even in this case, it is better to move Stop Loss to breakeven and try to wait for a stronger fall in the euro's quotes.

European Central Bank President Christine Lagarde will speak on Thursday, November 19. Most likely, there is one event, but the ECB chairman has three speeches. However, as we said, Lagarde has been speaking almost every day and does not mention anything new and fundamentally important. Therefore, traders have nothing to react to: Lagarde simply does not touch on the topic of monetary policy and the EU economy. No important events are planned for the day. Data on applications for unemployment benefits will be released in the US, this report was quite significant at the very beginning of the epidemic, but not right now. Although, if the number of applications starts to grow, this will mean that the strengthening of quarantine measures in many states is starting to negatively affect the economy and we can expect a new rise in unemployment and a decrease in GDP. Recall that the coronavirus is not only present in America right now, it is raging and has become a hotbed of COVID-19, with more than 150,000 cases of the disease recorded there every day. Although it is difficult for the dollar to find support in such conditions, one should not forget that the pair has been trading in the 1.1700-1.1900 horizontal channel for three months already and it has a priority value now. Quotes have reached its upper border and will now tend to the lower one.

Possible scenarios for November 19:

1) Long positions are no longer relevant, since the price has settled below the upward trend line, therefore, the trend has changed to a downward trend. So now you can only return to buying the euro when the current downward trend has ended. Under current conditions, the only option is to overcome the 1.1903 level, which will mean that the pair will leave the 1.1700-1.1900 horizontal channel.

2) Trading for a fall has become relevant at this time, since the trend has changed to a downward one. Novice traders could open short positions when the price has settled below the trend line and you can aim for 1.1838 and 1.1822. At the moment, you can keep sell orders open with targets at 1.1822 and 1.1796 until the MACD indicator turns to the upside. Or move Stop Loss to breakeven and wait for a stronger fall.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română