To open long positions on GBPUSD, you need:

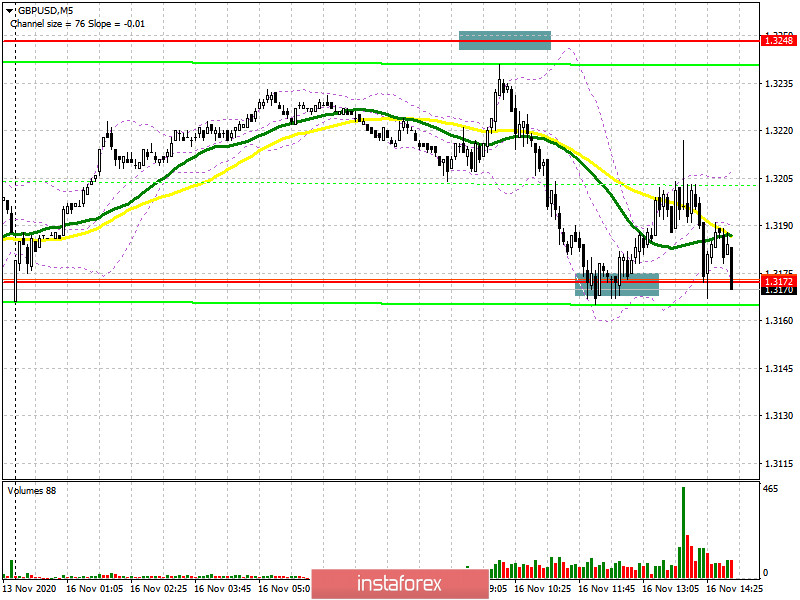

In the first half of the day, I paid attention to two levels from which I recommended making trading decisions. If you look at the 5-minute chart, you will see how the test of the 1.3248 level, from which I recommended selling the pound, did not take place. As a result, all attention turned to the support of 1.3172, where the situation was more interesting. The formation of a false breakout there with the return of GBP/USD to this range led to the formation of a buy signal and an upward trend of the pair. However, it did not reach a major increase, although the upward movement was about 30 points.

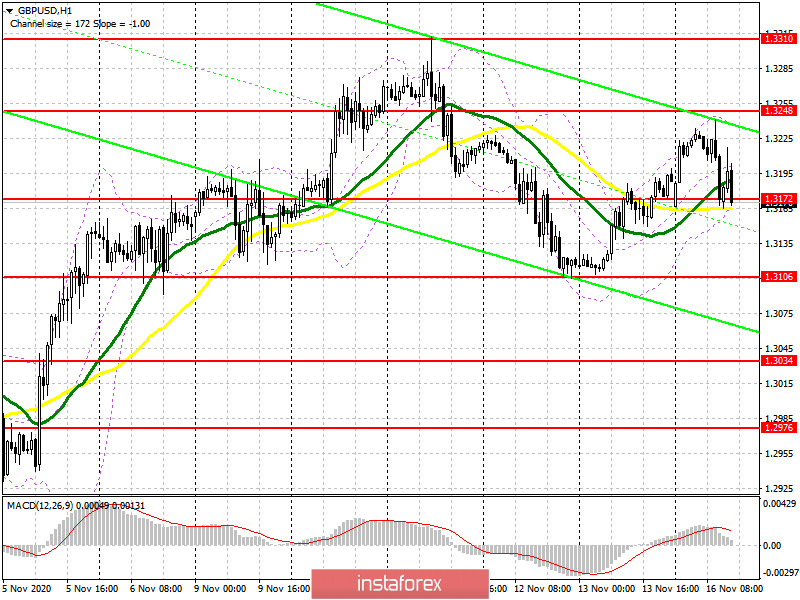

At the moment, nothing has changed from a technical point of view. The initial task for the second half of the day remains to protect the support of 1.3172, which was tested today during the European session. Only the next formation of a false breakout there after an unsuccessful attempt by the bears to take the market under their control will give confidence to buyers and return GBP/USD to the resistance area of 1.3248, where I recommend fixing the profits, since it is unlikely to count on a larger surge in volatility today. Fixing the bulls above the resistance of 1.3248 forms a new entry point for long positions in the expectation of continued growth of GBP/USD and reaching the maximum of 1.3310, where I recommend fixing the profits. The longer-term target will be the resistance of 1.3378, however, it will require a good reason to update it. In the scenario of no bull activity in the area of 1.3172, it is best to take your time and postpone long positions until the test of a new low of 1.3106, where you can buy the pound immediately on the rebound in the expectation of a correction of 20-30 points within the day.

To open short positions on GBPUSD, you need:

Bears are still fighting to regain control of the level of 1.3172, however, it will be quite difficult to do this without fundamental data on the US economy. I recommend opening short positions in the area of 1.3172 only after the GBP/USD returns to this level and consolidates under it. Testing it from the bottom up will be a good sell signal. In this scenario, you can count on a downward trend in the area of 1.3106, with the first test of which you can observe a slight rebound of the euro up. A longer-term goal is the support of 1.3034, where I recommend taking the profit. If all the bears' attempts are unsuccessful, and the pair again falls back to the middle of today's side channel, it is best to postpone selling the pound until a false breakout is formed in the resistance area of 1.3248 or sell GBP/USD for a rebound from the monthly maximum in the area of 1.3310, based on a correction of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily averages, which indicates an active struggle between buyers and sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Only a break of the lower border of the indicator in the area of 1.3170 will lead to a new downward wave of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română