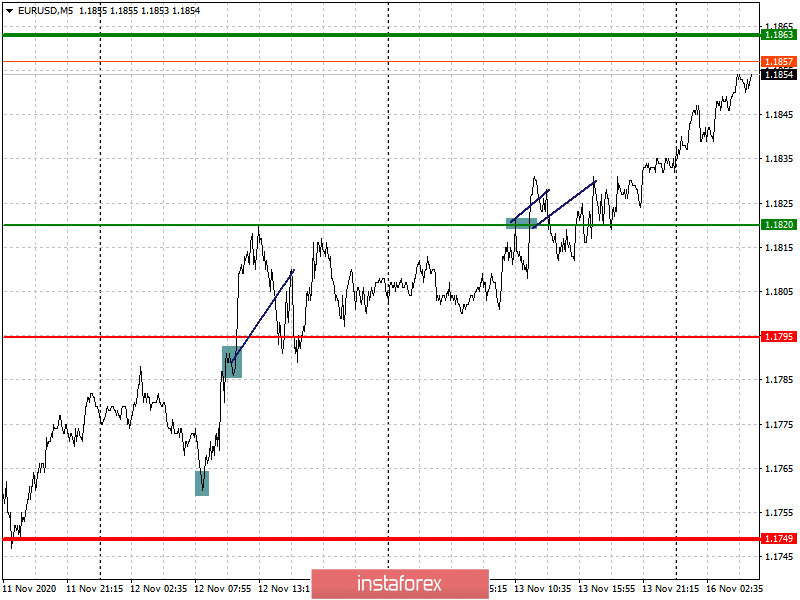

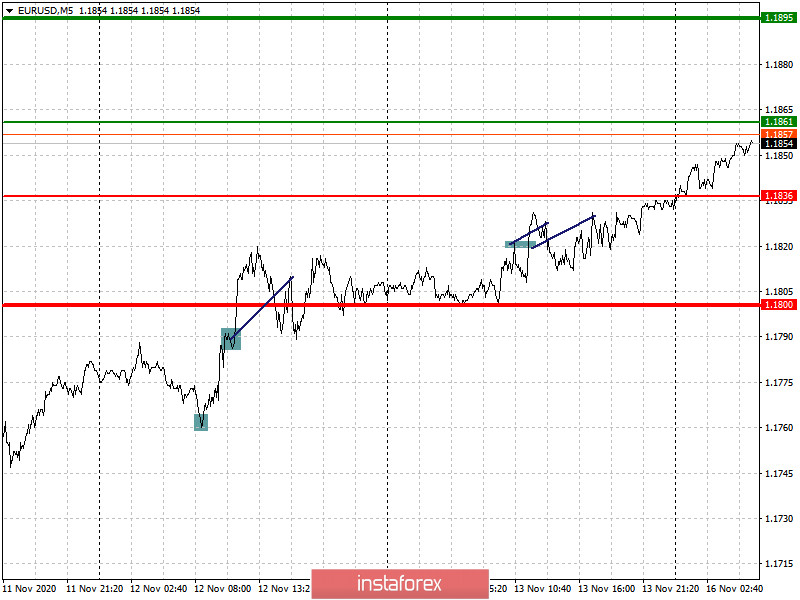

Analysis of transactions in the EUR / USD pair

The euro did not show active growth last Friday amid weak economic indicators from the euro area. According to reports, the final estimate of the EU GDP was worse than economists' forecasts, but thankfully was saved by improved activity in the labor market. Thus, the euro moved 15 pips up from 1.1820, and stopped there because of low growth incentives.

Then, in the afternoon, a disappointing report on US consumer sentiment was published, which decreased the positions of the US dollar in the market, thereby leading to the resumption of growth in risky assets.

Trading recommendations for November 16

At the moment, the bulls are aiming for a price of 1.1863, the success of which was their main task last Friday. Fortunately, there is a high chance that this movement will be met today, especially since consumer prices in Italy will be published, and the European Central Bank is scheduled to release a number of statements. But since the ECB President, Christine Lagarde, has already been speaking these past few weeks, there is a rather low chance of hearing any new changes. Thus, most likely, the demand for the euro will remain, and the bulls will continue their attempts on bringing the quote back to the monthly highs.

- Open a long position when the euro reaches a quote of 1.1861 (green line on the chart) and then take profit at the level of 1.1895. However, growth will occur only in the event that the ECB does not announce any plans to implement negative key rates.

- Open a short position when the euro reaches a quote of 1.1836 (red line on the chart) and then take profit around the level of 1.1800. Sell the euro only if the economic reports from Italy come out worse than economists' forecasts.

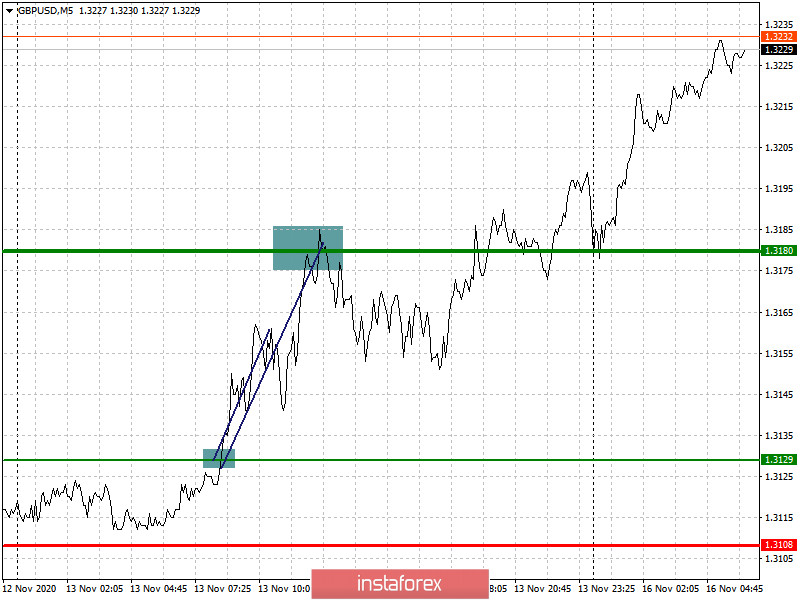

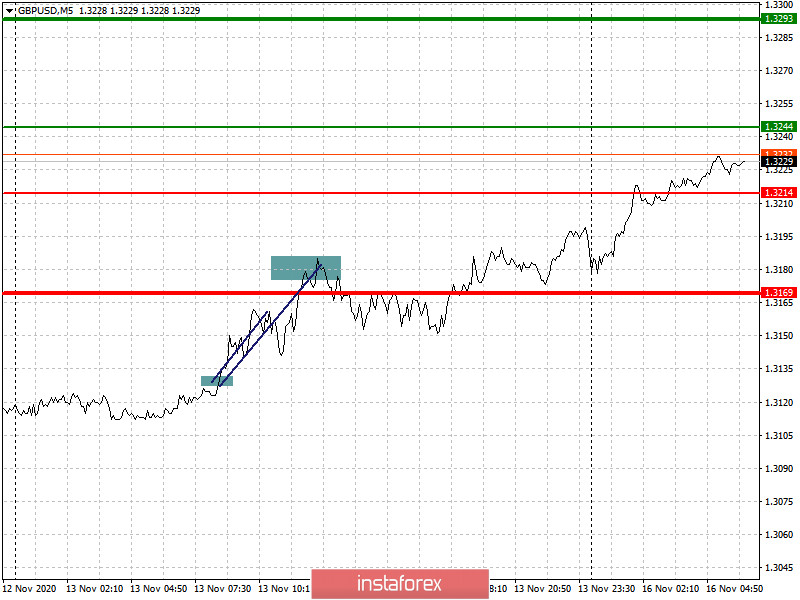

Analysis of transactions in the GBP / USD pair

The British pound moved 60 pips up from 1.3129 last Friday, reaching a quote of 1.3180 as forecasted. It seems that the market is all right even if the Bank of England resorts to negative interest rates.

Trading recommendations for November 16

The position of the pound shall rely today on the statements from the Bank of England and Federal Reserve, which are unlikely to be negative and cause serious decline in the quotes. There is a high chance that the bullish momentum from the Asian session will continue.

- Open a long position when the quote reaches the level of 1.3244 (green line on the chart) and then take profit around the level of 1.3293 (thicker green line on the chart). If the Bank of England leaves key rates unchanged, demand for the British pound may increase.

- Open a short position when the quote reaches the level of 1.3214 (red line on the chart). A breakout of this range will bring pressure back to the pair, which will push the pound towards the level of 1.3169.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română