Crypto Industry News:

China's tough policy on cryptocurrencies made itself felt once again today when the country's Supreme Court changed its judicial interpretation of illegal fundraising to include cryptocurrency transactions.

The Chinese Supreme Court has issued a revised version of its "decision to change the interpretation of the Supreme People's Court on several issues relating to the specific application of the law in criminal cases relating to illegal fundraising."

The amendment also changes the convictions and penalties for offenses related to illegal fundraising. While retaining the four original features of the law, crime, online loans, cryptocurrency transactions, financial leasing and a few more have been added to the revised list, local media reported.

The inclusion of cryptocurrency transactions in the new revised judicial ruling means that people found to be illegally raising funds from the public using digital currencies will be punished under the revised law. The new act comes into force on March 1, 2022.

China's strict cryptocurrency policy is nothing new as the country has announced over a dozen bans on various cryptocurrency-related activities over the past decade. One of the biggest repression took place in 2021, when a commission made up of some of the top regulators issued a complete ban on all cryptocurrency-related activities.

Technical Market Outlook

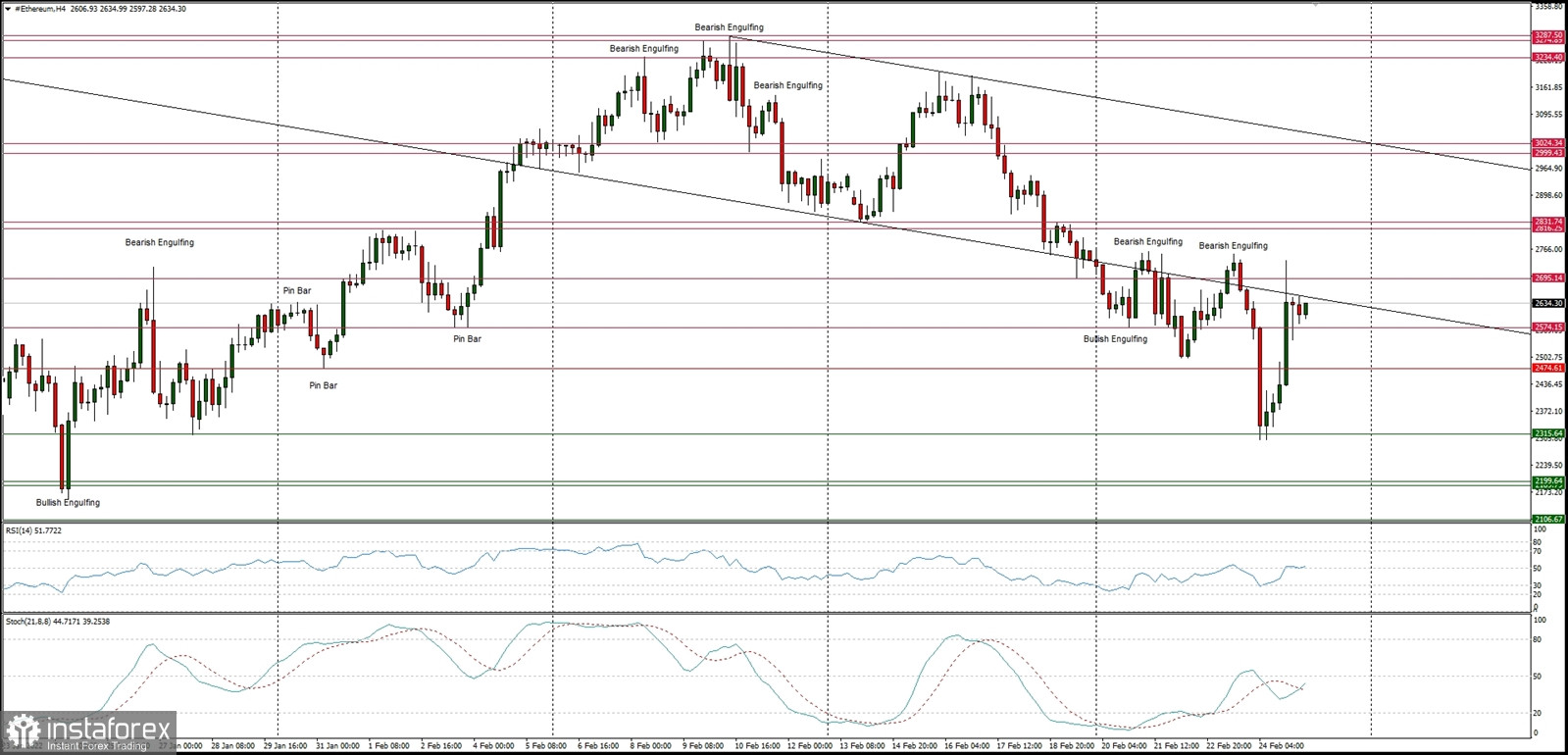

The ETH/USD pair has made a V-shape reversal from the level of $2,315 and is testing the lower descending channel line around the level of $2,650. The local high was made at the level of $2,738, but the bulls are having problem to continue to up move as the momentum remains neutral. The immediate technical support is seen at the level of $2,574. Only a sustained breakout above the level of $2,831 would change the temporary outlook to more bullish.

Weekly Pivot Points:

WR3 - $3,521

WR2 - $3,347

WR1 - $2,888

Weekly Pivot - $2,742

WS1 - $2,272

WS2 - $2,129

WS3 - $1,665

Trading Outlook:

The market is bouncing after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,436 is the next key technical resistance for bulls. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română